1/ @solana, known for its low transaction costs and quick confirmation times, has found its strength in consumer products with lower-value transactions.

@0xallyzach dives into some key insights and trends shaping Solana's ecosystem and user activity. 🧵

@0xallyzach dives into some key insights and trends shaping Solana's ecosystem and user activity. 🧵

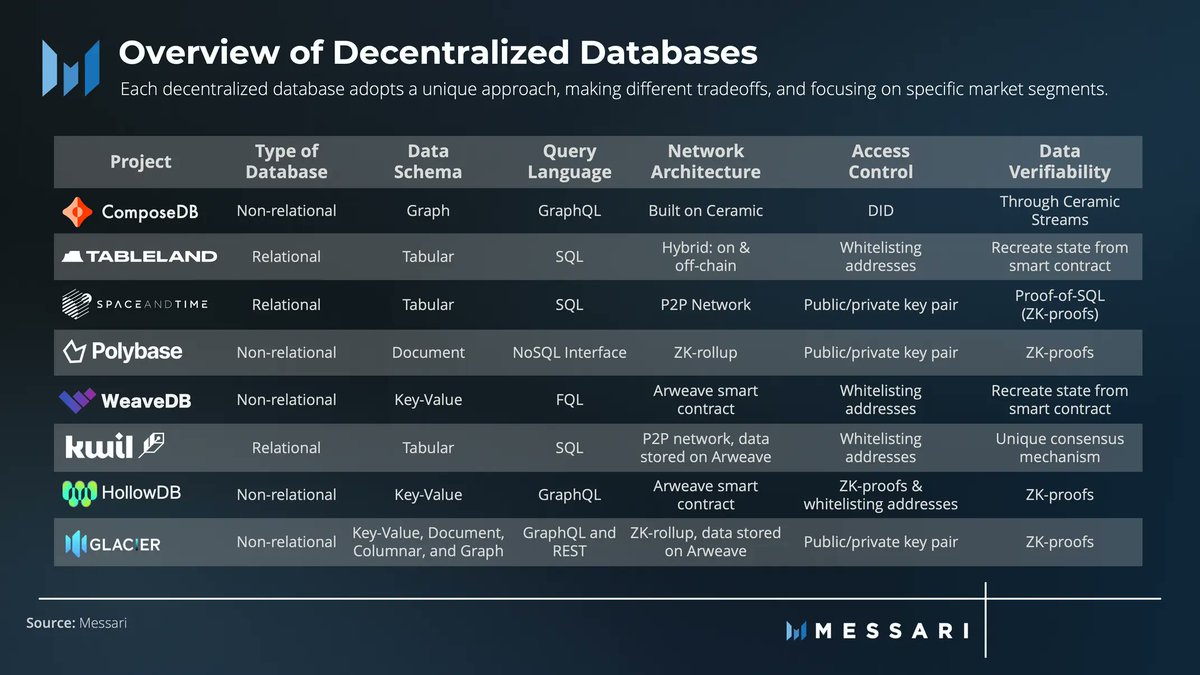

2/ Despite the decline in on-chain liquidity, @solana's developer ecosystem has shown resilience.

They have been actively building new functionalities, especially in the consumer sector, including programmable #NFTs and compressed NFTs.

They have been actively building new functionalities, especially in the consumer sector, including programmable #NFTs and compressed NFTs.

3/ While @solana's TVL has depreciated since the beginning of 2022, it's important to note that TVL is primarily a measure for #DeFi protocols.

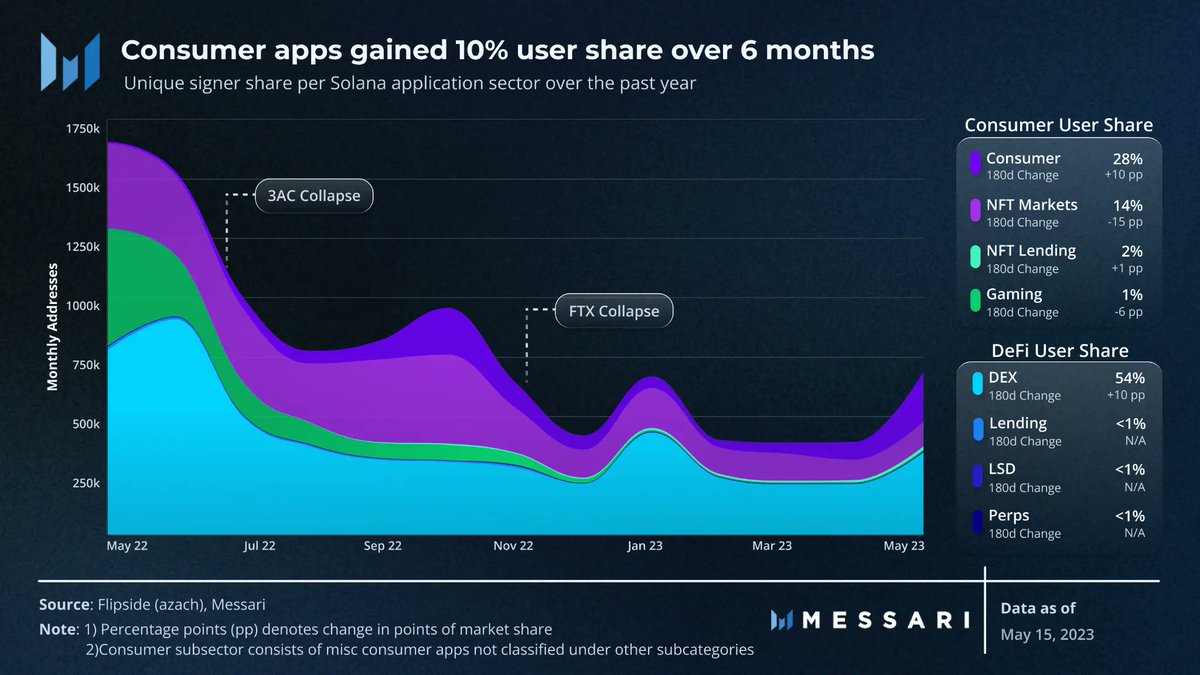

Solana's focus on consumer applications has led to a shift in user activity away from DeFi and toward consumer protocols.

Solana's focus on consumer applications has led to a shift in user activity away from DeFi and toward consumer protocols.

4/ The @solana landscape continues to evolve, with a transition from DEXs and NFT markets to emerging consumer applications.

The rise of gateway interactions from gaming applications and the introduction of new consumer platforms indicate a changing user preference.

The rise of gateway interactions from gaming applications and the introduction of new consumer platforms indicate a changing user preference.

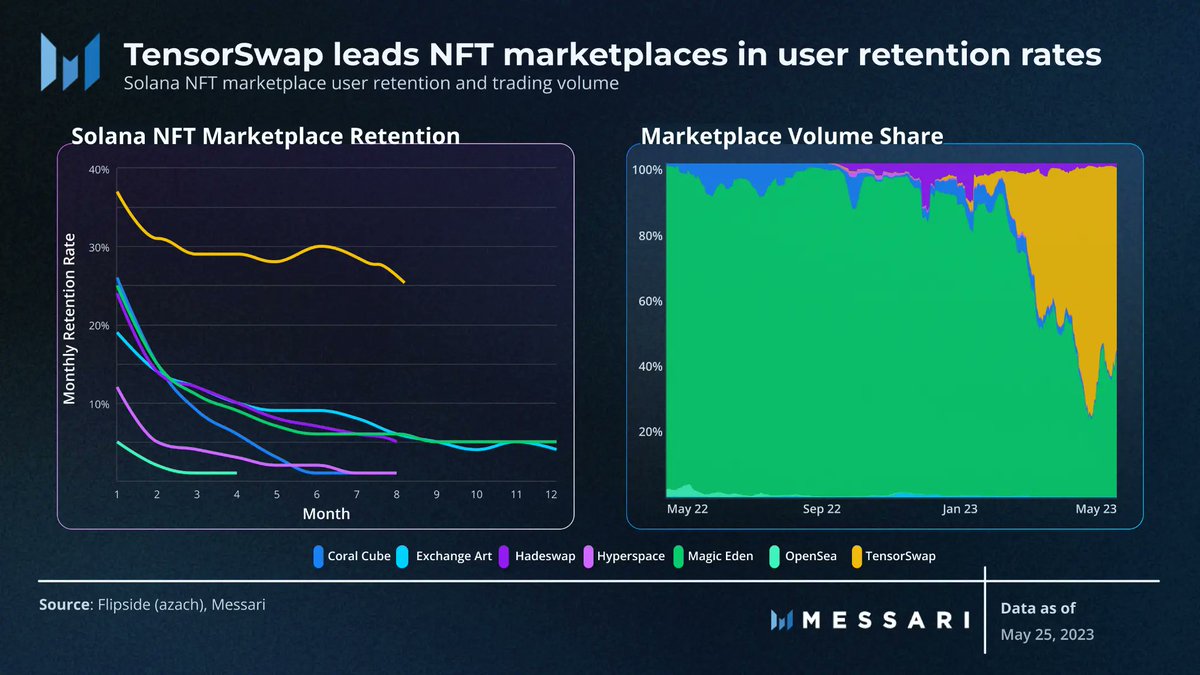

5/ @solana has successfully attracted new users, but long-term user retention remains a challenge.

To sustain growth, Solana needs more compelling and distinctive applications that provide a captivating user experience.

To sustain growth, Solana needs more compelling and distinctive applications that provide a captivating user experience.

6/ Examining historical usage by sector, protocol ecosystem connections, and gateway applications provides insights into the types of applications driving @solana's usage.

This analysis can help identify new application specializations that could revive the network.

This analysis can help identify new application specializations that could revive the network.

7/ @solana's user activity has seen a decline in #DeFi applications but a surge in consumer protocols.

The ecosystem's growth, even during the bear market, offers users a wide variety of activities. Let's explore the key players contributing to Solana's short-term retention.

The ecosystem's growth, even during the bear market, offers users a wide variety of activities. Let's explore the key players contributing to Solana's short-term retention.

8/ @tensor_hq, the leading NFT trading platform, has made waves on @solana.

With its innovative features, feeless trading, and airdrop mechanism, TensorSwap has attracted significant attention from the NFT community.

With its innovative features, feeless trading, and airdrop mechanism, TensorSwap has attracted significant attention from the NFT community.

9/ #NFT lending platforms, like @SharkyFi, have experienced a surge in transaction activity on @solana.

These platforms demonstrate impressive retention rates, bringing changes to the financial dynamics surrounding NFTs.

These platforms demonstrate impressive retention rates, bringing changes to the financial dynamics surrounding NFTs.

10/ @saydialect, a messaging platform on @solana, has quickly gained popularity by leveraging the platform's #NFT compression capabilities.

With a high retention rate and new partnerships, Dialect showcases the potential for consumer applications within the Solana ecosystem.

With a high retention rate and new partnerships, Dialect showcases the potential for consumer applications within the Solana ecosystem.

11/ The @solana application ecosystem has undergone a significant transformation, shifting from #DeFi to consumer-centric applications.

Solana's infrastructure advantages and low unit costs position it favorably for consumer apps. Differentiation and user retention remain key.

Solana's infrastructure advantages and low unit costs position it favorably for consumer apps. Differentiation and user retention remain key.

12/ Solana's journey reflects both challenges and opportunities.

Despite liquidity market share decline, Solana's resilience and evolving ecosystem present immense potential.

By fostering unique applications and enhancing user experiences, Solana can continue to thrive.

Despite liquidity market share decline, Solana's resilience and evolving ecosystem present immense potential.

By fostering unique applications and enhancing user experiences, Solana can continue to thrive.

13/ Get an in-depth look at @solana's Shifting Landscape: From DeFi to Consumer Applications, in the full Enterprise Report from @0xallyzach.

messari.io/article/solana…

messari.io/article/solana…

Subscribe to the Unqualified Opinions newsletter for world-class research from the Messari analysts, straight to your inbox!

messari.io/newsletter?utm…

messari.io/newsletter?utm…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter