An interesting (and hopeful) angle in today's 🇨🇦 GDP release. Economy-wide inflation (measured by the GDP deflator) has largely abated: up just 1.3% in last 12 mos. This corresponds to a moderation of the excess profits corporations racked up in post-lockdown period. #cdnecon /2

Gross corporate operating surpluses are down 6% over the last yr. That's largely because of lower fossil fuel energy prices (& profits), but also due to easing supply constraints & lower profit-taking in other key sectors (like building products, autos, primary metals, M&E). /3

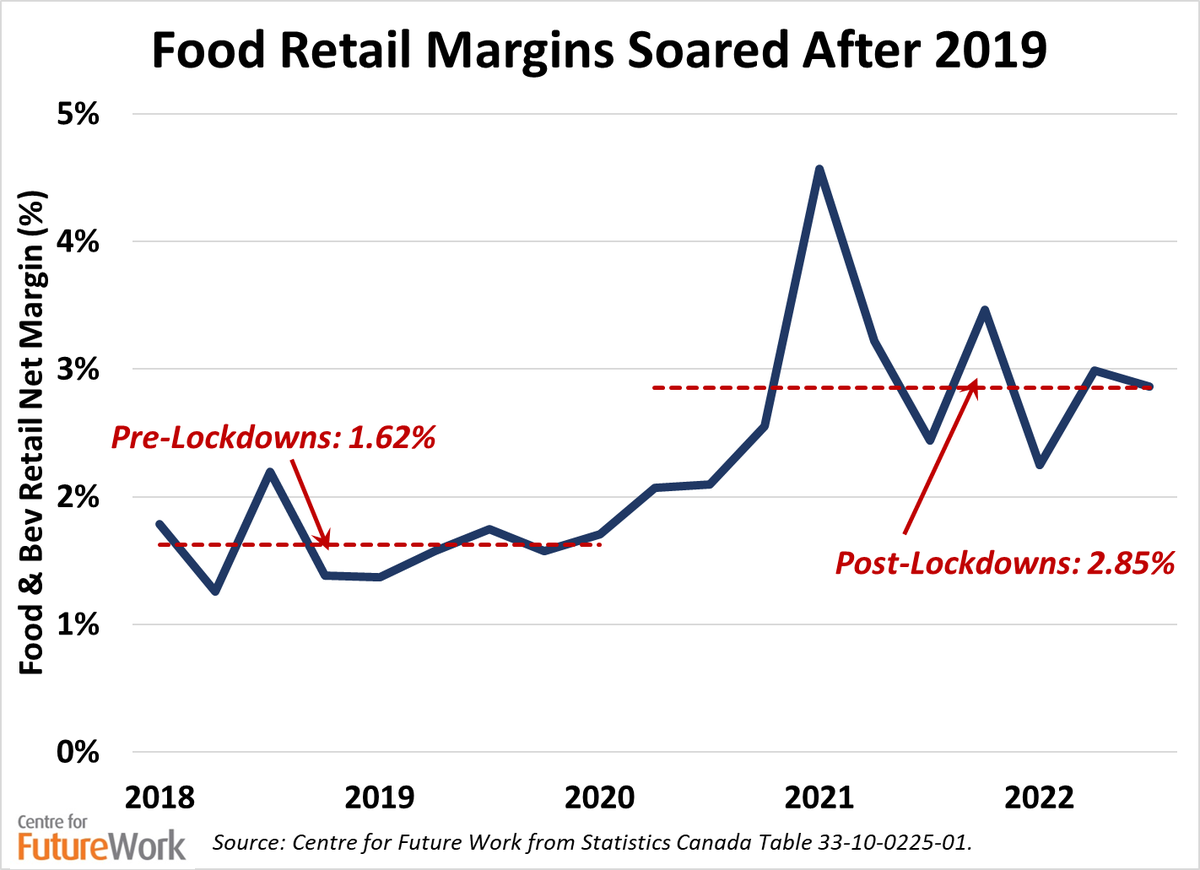

We had documented the sectors that had seen the biggest increases in profits (and biggest price hikes) when inflation peaked in mid-2022; see our @CntrFutureWork report on 15 super-profitable sectors: centreforfuturework.ca/2022/12/02/fif…. /4

Profits are still elevated: higher as share of GDP than long-run avg. This is especially visible when we include the interest component of bank profits (int. is not included in GDP). After-tax profits in the financial sector up 1.5pts of GDP since interest hikes began Mar '22. /5

The easing of economy-wide GDP inflation is already matched by an easing of CPI inflation, and the two will converge as CPI inflation slows further. The two indices track closely over time: GDP inflation is more volatile, CPI catches up (typically with a lag). /6

The big policy takeaways from this new data:

i) Surging corp profits (in energy, yes, but other sectors too) drove the post-2021 surge in inflation.

ii) Factors that facilitated that excess profit-taking are abating.

iii) Inflation is slowing, and will slow further. /7

i) Surging corp profits (in energy, yes, but other sectors too) drove the post-2021 surge in inflation.

ii) Factors that facilitated that excess profit-taking are abating.

iii) Inflation is slowing, and will slow further. /7

Slowing inflation is occurring 'despite' an unemployment rate still near historic lows & nominal wage growth that is modestly higher. Amazing! If inflation wasn't caused by workers, it can be solved without punishing workers (through monetary austerity & unemployment). #canlab

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter