1/ @ph0rt0n compares the financial, network, and ecosystem analyses of 14 Layer-1s (L1) in Q1'23.

Featured L1s include @avax, @BNBCHAIN, @Cardano, @ethereum, @harmonyprotocol, @hedera, @NEARProtocol, @Polkadot, @0xPolygon, @solana, @Stacks, @tezos, @trondao, and @WAX_io. 👇🧵

Featured L1s include @avax, @BNBCHAIN, @Cardano, @ethereum, @harmonyprotocol, @hedera, @NEARProtocol, @Polkadot, @0xPolygon, @solana, @Stacks, @tezos, @trondao, and @WAX_io. 👇🧵

2/ The crypto market rebounded in Q1'23, with the market cap of featured Layer-1 (L1) smart-contract platforms increasing by an average of 83% QoQ, but still down 58% YoY.

@ethereum had the highest market cap, over 2x the other networks combined.

@ethereum had the highest market cap, over 2x the other networks combined.

2/ @ethereum generated the highest revenue in Q1, driven by its high usage and gas fees. Its revenue was $457M, almost 2.8x the combined revenue of all other featured L1s.

@hedera had the most significant revenue growth, with a 489% increase QoQ, driven by its Consensus Service.

@hedera had the most significant revenue growth, with a 489% increase QoQ, driven by its Consensus Service.

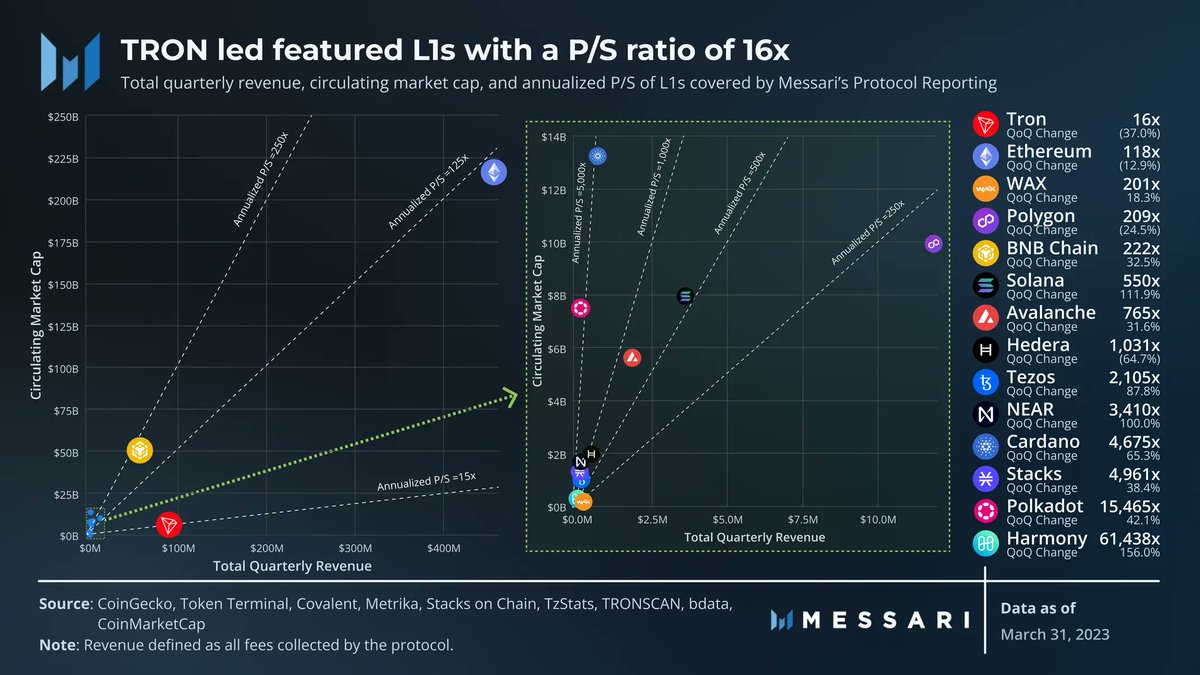

3/ @trondao had the highest P/S ratio at 16x, followed by Ethereum at 188x.

@WAX_io, a network outside the top 20 in market cap, stood out with a high P/S ratio due to revenue generated from a tax on #NFT marketplaces.

@WAX_io, a network outside the top 20 in market cap, stood out with a high P/S ratio due to revenue generated from a tax on #NFT marketplaces.

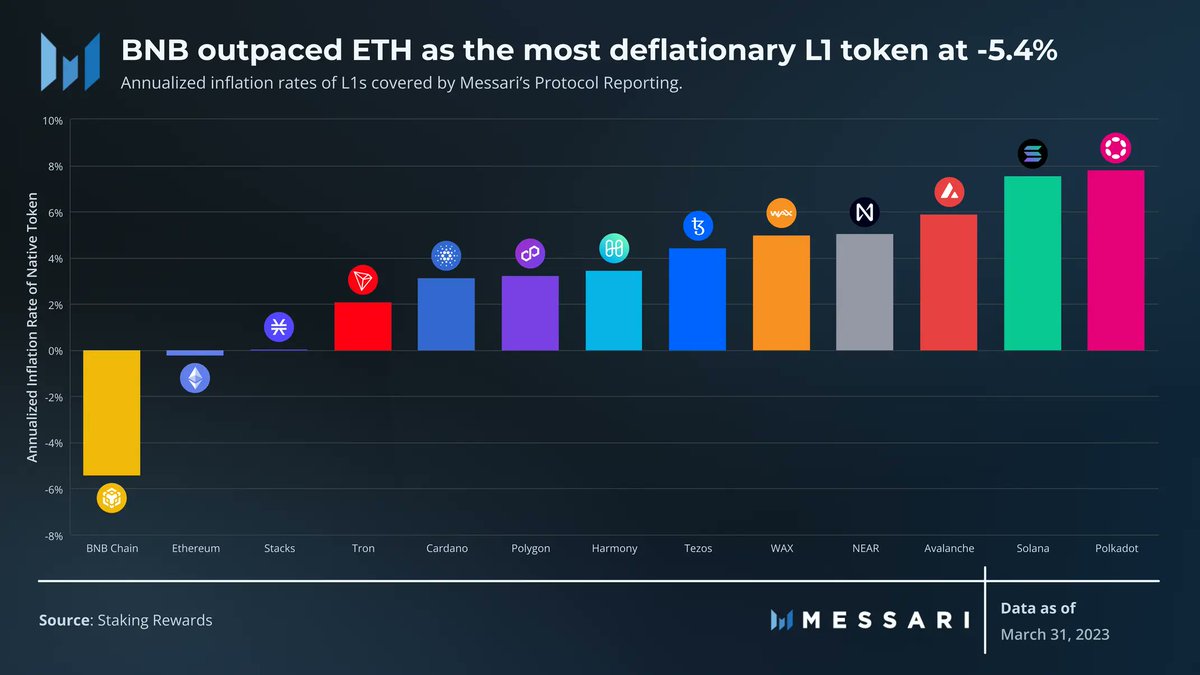

4/ @BNBCHAIN and @ethereum were the only deflationary tokens in Q1'23, with -5.4% and -0.2% inflation rates, respectively, due to burning a portion of their transaction fees.

Other networks had varying inflation rates from PoS reward issuance.

Other networks had varying inflation rates from PoS reward issuance.

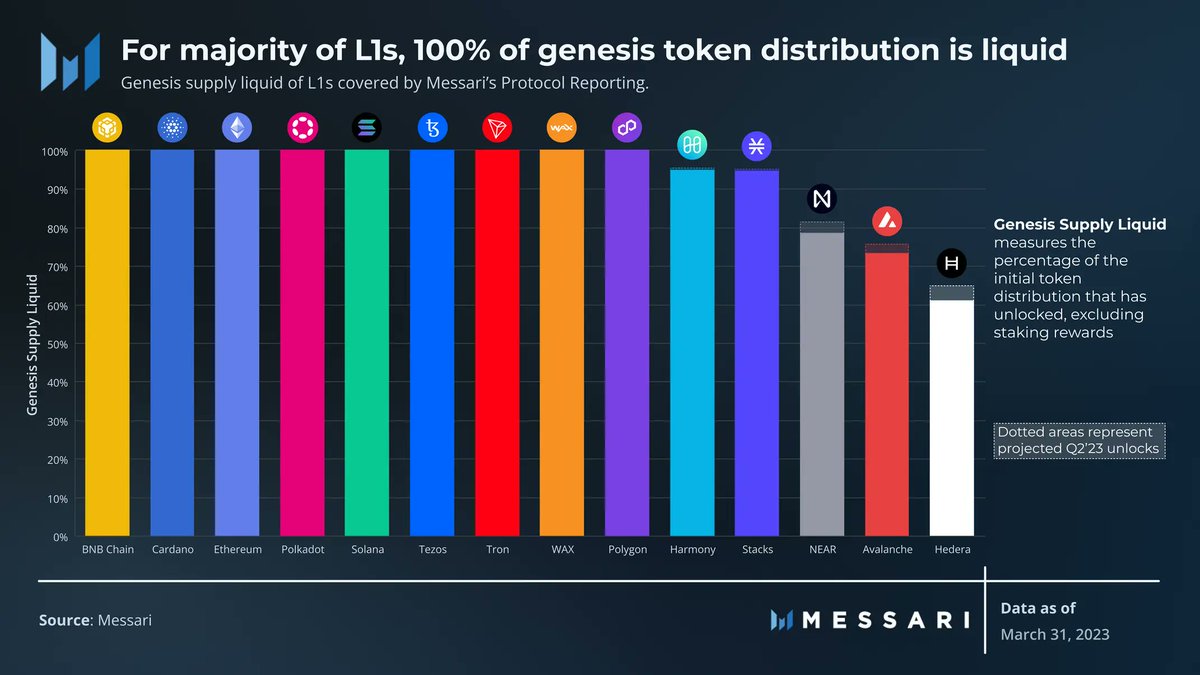

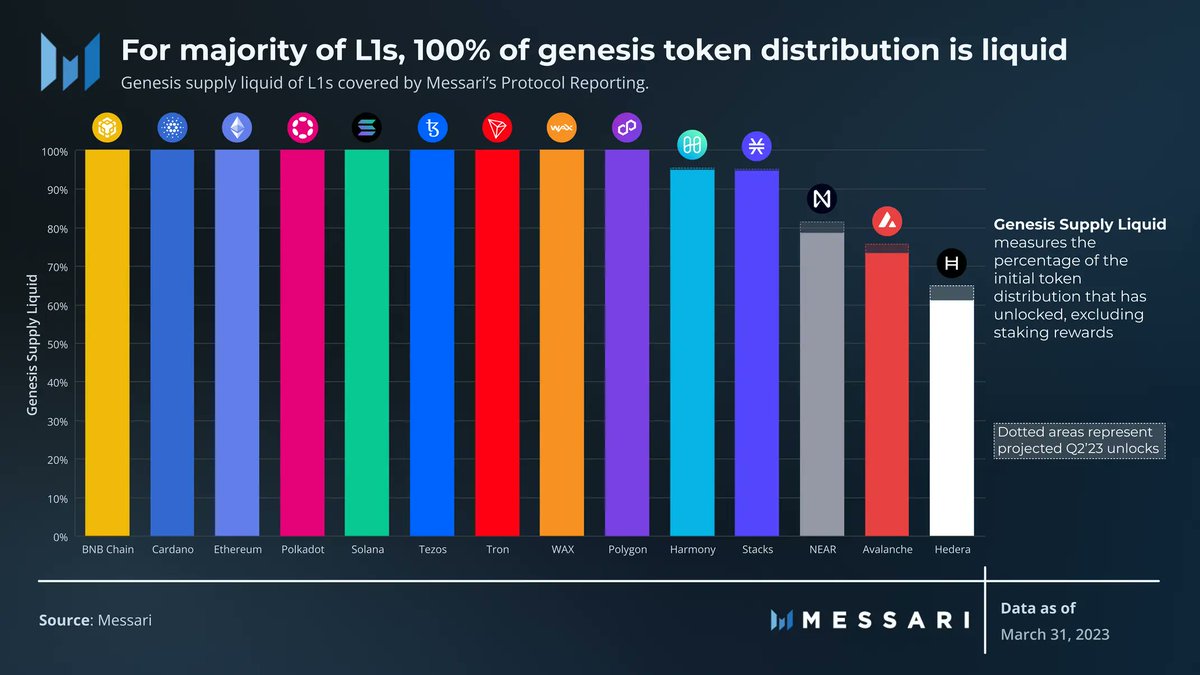

5/ Most featured networks' tokens have fully vested, except for @avax, @hedera, @NEARProtocol, and @harmonyprotocol.

Each network has different percentages of unlocked genesis supply, excluding staking rewards.

Each network has different percentages of unlocked genesis supply, excluding staking rewards.

6/ Transaction activity for featured networks did not grow significantly in Q1'23, with a slight decrease in daily transactions on average.

@Stacks was an exception with a 34% increase.

@avax's C-Chain activity was down due to the launch of subnets.

@Stacks was an exception with a 34% increase.

@avax's C-Chain activity was down due to the launch of subnets.

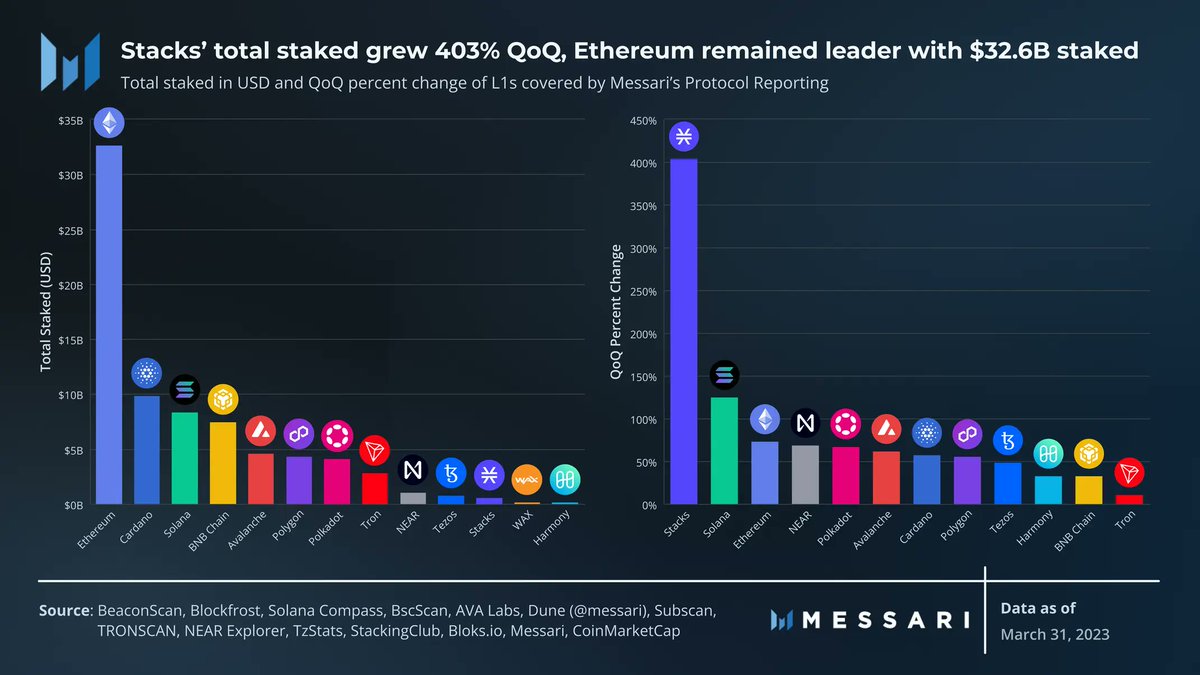

7/ Validator counts and staked tokens increased for all networks in Q1'23.

@ethereum had the largest security budget with $32.6B in ETH staked.

Nakamoto coefficient measures the number of entities that could cause a network halt, and ETH's figure is typically cited as 1 or 2.

@ethereum had the largest security budget with $32.6B in ETH staked.

Nakamoto coefficient measures the number of entities that could cause a network halt, and ETH's figure is typically cited as 1 or 2.

8/ TVL in DeFi increased during the market rebound, with @ethereum, @BNBCHAIN, and @trondao being the dominant players.

@Stacks and @Cardano had significant TVL growth.

@ethereum had a diverse DeFi ecosystem, while other networks had a more concentrated distribution.

@Stacks and @Cardano had significant TVL growth.

@ethereum had a diverse DeFi ecosystem, while other networks had a more concentrated distribution.

9/ Check out @ph0rt0n's full report for additional analysis on various topics, such as gas fees, usage metrics, staking yield, and ecosystem developments across these featured L1s.

messari.io/article/state-…

messari.io/article/state-…

Subscribe to the Unqualified Opinions newsletter for world-class research from the Messari analysts, straight to your inbox!

messari.io/newsletter?utm…

messari.io/newsletter?utm…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter