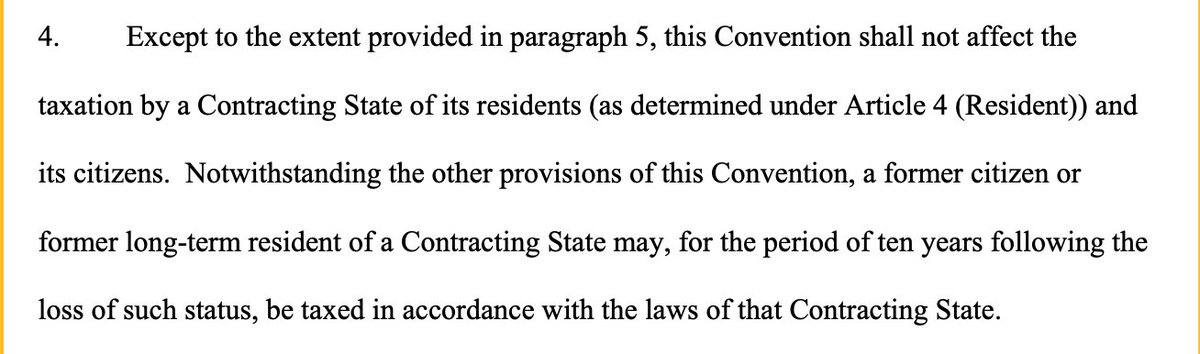

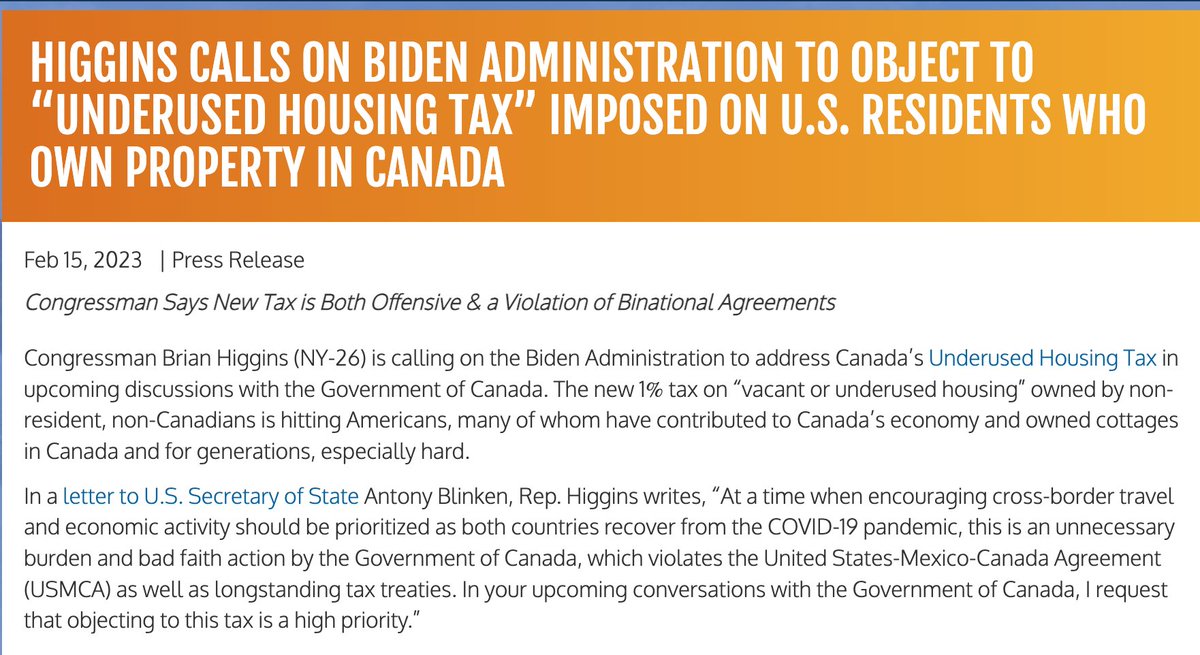

How will the US respond to Belgium's claim that the #FATCA IGA violates the #GDPR? Here is my proposal for ending the tax treaty #savingclause which would allow @USCitizenAbroad to become treaty nonresidents for US tax (effectively ending @CitizenshipTax). youtube.com/live/KqtFhae4i…

See the "third solution" in the thread below which discusses a number of responses/solutions to this #FATCA and @CitizenshipTax problem

https://twitter.com/ExpatriationLaw/status/1663541732238327810

More questions answered about Belgium, #FATCA, #GDPR and @CitizenshipTax ...

https://twitter.com/ExpatriationLaw/status/1664200353934368768

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter