⚠️❌⛳️

Rajesh Exports Governance Issue Saga Continues

- No Audit Report in Financials

- Questionable RPTs

- FS of FY22 not matches with FS in AR of 22

- More Redflags

A thread 🧵

#corpoategovernance #redflag #fraud

Like Retweet Follow if you find this valuable

Rajesh Exports Governance Issue Saga Continues

- No Audit Report in Financials

- Questionable RPTs

- FS of FY22 not matches with FS in AR of 22

- More Redflags

A thread 🧵

#corpoategovernance #redflag #fraud

Like Retweet Follow if you find this valuable

https://twitter.com/BeatTheStreet10/status/1547866856832151552

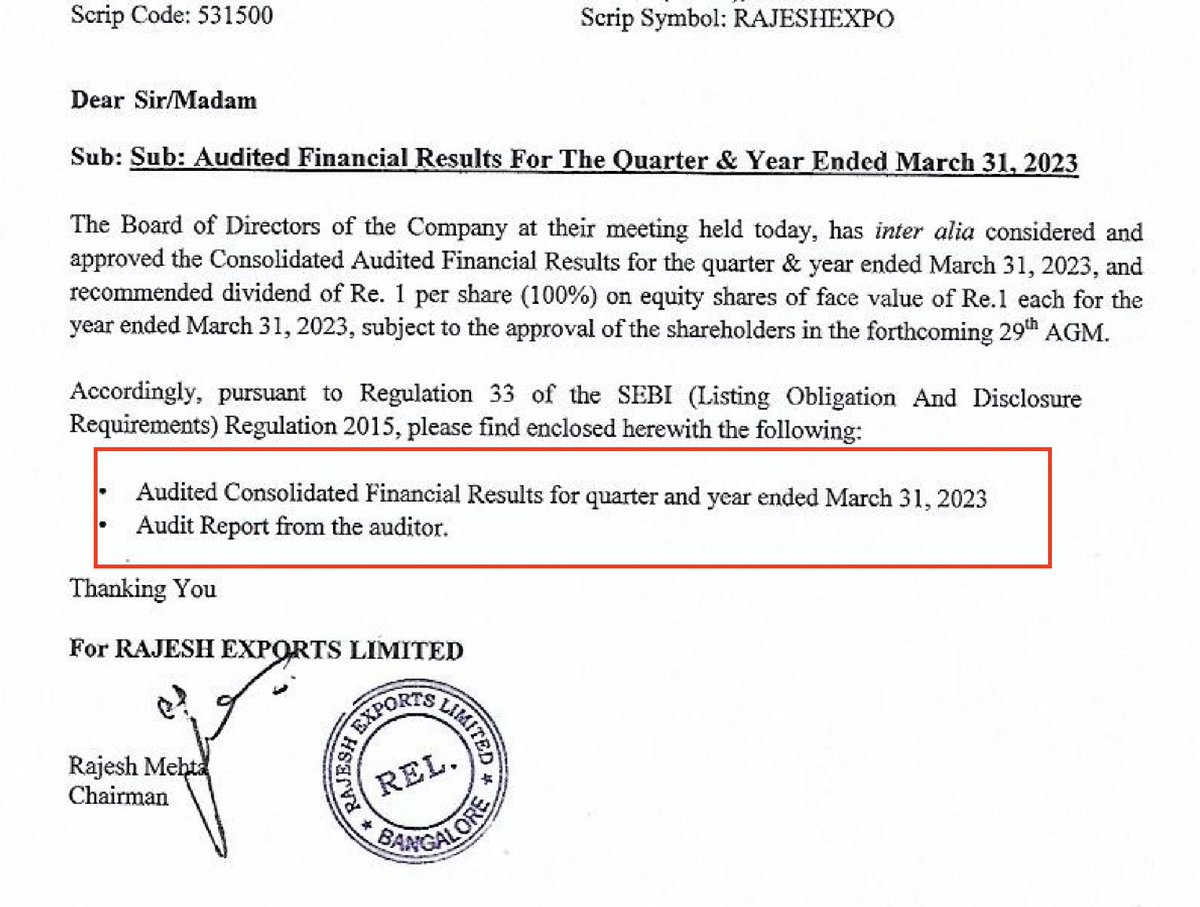

Rajesh Exports did not released Audit Report for FY23 though co claims its financials are audited

Interestingly - there is no sign & seal of auditor on FS

PS - In FY21 - we found two different financials of co in Annual Report & in Q4FY21 Results (check quoted tweet)

Interestingly - there is no sign & seal of auditor on FS

PS - In FY21 - we found two different financials of co in Annual Report & in Q4FY21 Results (check quoted tweet)

Link to incomplete financials of FY23

Consolidated - bseindia.com/xml-data/corpf…

Standalone - bseindia.com/xml-data/corpf…

Consolidated - bseindia.com/xml-data/corpf…

Standalone - bseindia.com/xml-data/corpf…

No RPTs in FY 23

Only possible if there is no remuneration to directors/KMPs and no transactions with its subsidiaries & JVs (it has 1 associate, 1 subsidiary, 1 step down subsidiary as on 30th Sept 22)

Only annual report can give ans why there was no transactions

Only possible if there is no remuneration to directors/KMPs and no transactions with its subsidiaries & JVs (it has 1 associate, 1 subsidiary, 1 step down subsidiary as on 30th Sept 22)

Only annual report can give ans why there was no transactions

Its pertinent to note that co don't pay remuneration to its non executive and independent directors

RPT Disclosure is required only for two executive directors - Let's see what Annual Report says

This might not be redflag if nothing comes in AR

RPT Disclosure is required only for two executive directors - Let's see what Annual Report says

This might not be redflag if nothing comes in AR

AOC -1 is incomplete - Part B - which requires details of JVs and Associate is not available even though co has associates

Related Party Disclosures required under SEBI regulations are not matching with RPT disclosures in Annual Report

In AR, there is no reporting of Dividend, transactions with common director entity - 200 crore equity investment

In AR, there is no reporting of Dividend, transactions with common director entity - 200 crore equity investment

Moreover its interesting why company gave zero interest rate loan of 75 crore and made 200 crore equity investment into Elest Pvt Ltd, a common director entity

Its pertinent to note that co has negative operating cash flows

Its pertinent to note that co has negative operating cash flows

Cash flow statements (FY22 & FY23) are submitted without giving comparative figures of previous year even though their is requirement to give comparative figures

Financial statements of FY22 not matches with Financial Statement in Annual Report of 2022

Total Exp 24,212,973 vs 24,212,986

PBT 103,846 vs 103,832

PAT 100,856 vs 100,918

TCI 100,875 vs 100,937

EPS 34.16 vs 34.19

We raised same issue in FY21 too

Total Exp 24,212,973 vs 24,212,986

PBT 103,846 vs 103,832

PAT 100,856 vs 100,918

TCI 100,875 vs 100,937

EPS 34.16 vs 34.19

We raised same issue in FY21 too

https://twitter.com/BeatTheStreet10/status/1547866856832151552?s=20

We at Beat The Street work hard to make investor community an informed one. If you like our work please do follow us and retweet the first tweet

Credit @mukesh634 who has also contributed in the research and was first on to raise some of the key redlfags

https://twitter.com/BeatTheStreet10/status/1664906129942646784?s=20

Credit @mukesh634 who has also contributed in the research and was first on to raise some of the key redlfags

Featured in Moneylife

moneylife.in/article/rajesh…

moneylife.in/article/rajesh…

NSE has sought clarification on 14th June-23. But still company did not reply even though the company replied to the clarification sought on 16th June-23.

In ET report company spokesperson, said they will file the audit report if asked...!

Interesting case study..

In ET report company spokesperson, said they will file the audit report if asked...!

Interesting case study..

• • •

Missing some Tweet in this thread? You can try to

force a refresh