1/14 Insights from crypto VCs can help you discover the latest #DeFi trends.

I track the money flow to find the most innovative protocols that are winning over investors.

Here's where the money went last month: 🧵

I track the money flow to find the most innovative protocols that are winning over investors.

Here's where the money went last month: 🧵

2/14 Sadly, the fundraising data is not showing any bullish signs.

There were 120 crypto fundraising deals worth $1.20B in May, down from 130 deals last month.

There were 120 crypto fundraising deals worth $1.20B in May, down from 130 deals last month.

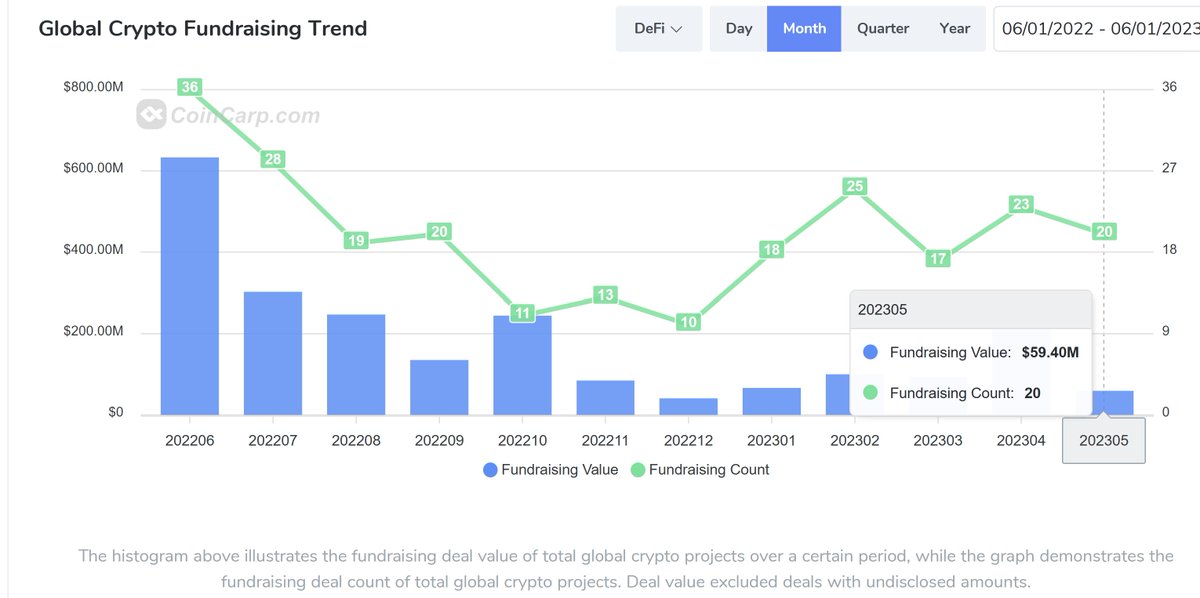

3/14 The same goes for the DeFi sector as well.

After bullish April, only 20 DeFi projects managed to raise funds last month, accounting for just $59M USD.

In fact, DeFi was the smallest crypto sector by dollar amount raised. 🥲

After bullish April, only 20 DeFi projects managed to raise funds last month, accounting for just $59M USD.

In fact, DeFi was the smallest crypto sector by dollar amount raised. 🥲

4/14 But here's an important point to consider from the chart below.

It shows the #BTC price vs amount raised.

It's clear that fundraising correlates with BTC.

So, VC funding amount will pick up when market sentiment/prices improve.

It shows the #BTC price vs amount raised.

It's clear that fundraising correlates with BTC.

So, VC funding amount will pick up when market sentiment/prices improve.

5/14 Yet, I believe that early-stage projects that secure funding during bear markets have a good chance of thriving in bull runs.

Because there are just a few projects that manage to raise money, it's easier to find potential winners.

Below are the top 4 that caught my eye:

Because there are just a few projects that manage to raise money, it's easier to find potential winners.

Below are the top 4 that caught my eye:

6/14

1️⃣ @zkLinkorg is building a unified multichain trading layer for DeFi & NFTs secured with zk-SNARKS.

It connects various L1s & L2s into one Zk-Rollup middleware to aggregate assets and liquidity.

You can try out their orderbook DEX for a potential airdrop 👀

1️⃣ @zkLinkorg is building a unified multichain trading layer for DeFi & NFTs secured with zk-SNARKS.

It connects various L1s & L2s into one Zk-Rollup middleware to aggregate assets and liquidity.

You can try out their orderbook DEX for a potential airdrop 👀

7/14 zkLink promises a CEX like experience with multichain token listing, trading, and unified portfolio management.

The team raised $10M USD from Coinbase, Ascensive Assets, Big Brain Holdings, and other VCs.

The team raised $10M USD from Coinbase, Ascensive Assets, Big Brain Holdings, and other VCs.

https://twitter.com/zkLinkorg/status/1663571647255953416

8/14

2️⃣ @Dolomite_io brings you a next-gen money market and margin trading on Arbitrum.

Thanks to its 'virtual liquidity' capital efficient system, it offers over-collateralized loans, margin trading, spot trading, etc.

TVL stands at $5M. No token yet.

2️⃣ @Dolomite_io brings you a next-gen money market and margin trading on Arbitrum.

Thanks to its 'virtual liquidity' capital efficient system, it offers over-collateralized loans, margin trading, spot trading, etc.

TVL stands at $5M. No token yet.

9/14 Dolomite's goal is to become a DeFi hub where protocols, yield aggregators, DAOs, market makers, hedge funds manage portfolios and execute on-chain strategies.

The team raised $2.5M from Coinbase, NGC Ventures, and others.

The team raised $2.5M from Coinbase, NGC Ventures, and others.

https://twitter.com/Slappjakke/status/1641423433446862848

10/14

3️⃣ @asymmetryfin addresses the staked Ether market centralization.

The solution is simple: safETH aligns incentives by driving TVL to a diverse set of LSTs while bringing users market-leading yield.

So, instead of all ETH going to wstETH, deposits are diversified.

3️⃣ @asymmetryfin addresses the staked Ether market centralization.

The solution is simple: safETH aligns incentives by driving TVL to a diverse set of LSTs while bringing users market-leading yield.

So, instead of all ETH going to wstETH, deposits are diversified.

11/14 In theory, because safETH is made up of many staked ETH derivatives, you diffuse risk that comes with owning a single derivative.

The Asymmetry team raised $3M at $20M valuation from Ecco, Republic Capital, and @ankr

The Asymmetry team raised $3M at $20M valuation from Ecco, Republic Capital, and @ankr

12/14

4️⃣ @hourglasshq launched a marketplace where time can be traded.

The key innovation is Time-Bound Tokens (TBTs).

You get a TBT upon staking tokens for a committed time period.

4️⃣ @hourglasshq launched a marketplace where time can be traded.

The key innovation is Time-Bound Tokens (TBTs).

You get a TBT upon staking tokens for a committed time period.

13/14 E.g, if you stake frxETH for 3 months to boost your yield, you could sell the position in case you need to cash out before expiry.

The team raised $4.2M from Electric Capital, Coinbase, Circle, and others.

The team raised $4.2M from Electric Capital, Coinbase, Circle, and others.

https://twitter.com/definapkin/status/1665377483636764682

14/14 If you liked this thread, check out the top 5 DeFi protocols that raised money in April.

Spoiler alert: You'll find a protocol to trade narratives, innovative AMM solutions, and a protocol that doesn't want to be discovered just yet.

Oh, and follow me @DefiIgnas for more!

Spoiler alert: You'll find a protocol to trade narratives, innovative AMM solutions, and a protocol that doesn't want to be discovered just yet.

Oh, and follow me @DefiIgnas for more!

https://twitter.com/DefiIgnas/status/1656188333335388160

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter