welp

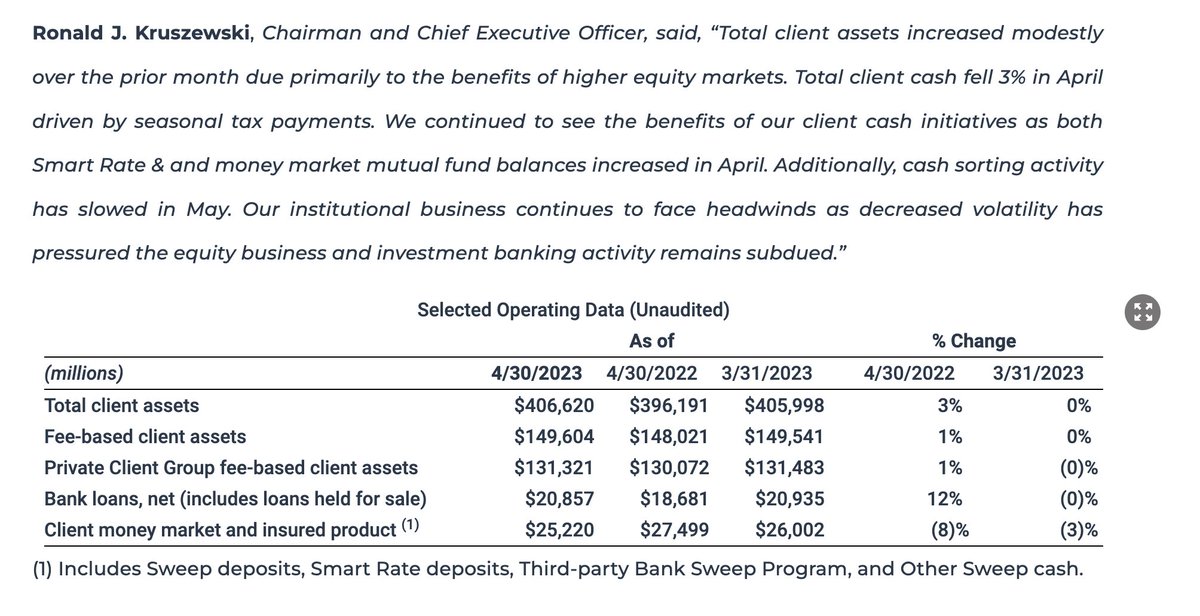

"While our client cash balances declined modestly due to seasonality and cash sorting in February, over the past two weeks, we have attracted over $1.3 billion in additional bank deposits, including an increase in uninsured deposits" $SF

"While our client cash balances declined modestly due to seasonality and cash sorting in February, over the past two weeks, we have attracted over $1.3 billion in additional bank deposits, including an increase in uninsured deposits" $SF

oh boy... #fundbanking at $SF

🧵 probably should have noted $SF's large quantity of C&I loans... you can't use those for FHLB collateral and they are generally considered less resilient to downturns in the economy.

https://twitter.com/Cryptadamist/status/1666874164672708608

🧵 kind of confused about what kind of bank $SF is exactly... $406 billion in client assets (2x $SIVB), mkt cap $6-7bn, only $20bn in loans.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter