📢 Attention Investors! 🚨

🔍 Dive into the latest bombshell from SEBI regarding Brightcom. This time, it's about the Promoter's alarming and unusual trading behaviour.

Let's dive into the details 🧵! 📈

#Brightcom #SEBI #redflag #corporategovernance

🔍 Dive into the latest bombshell from SEBI regarding Brightcom. This time, it's about the Promoter's alarming and unusual trading behaviour.

Let's dive into the details 🧵! 📈

#Brightcom #SEBI #redflag #corporategovernance

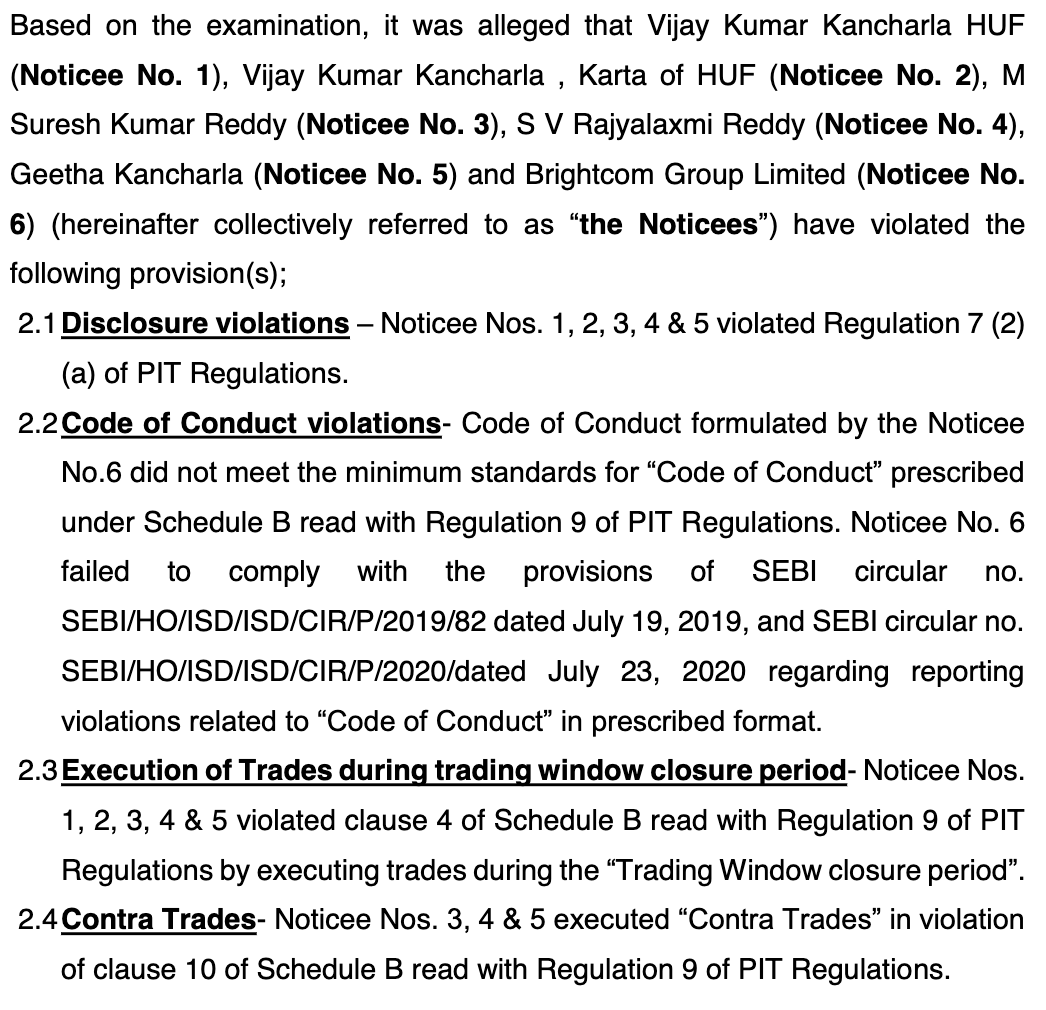

The background : Promoters are purportedly disregarding regulations pertaining to their trading activities⚠️🤯

1. Disclosure Lapses in trading by promoters: Law says you have to disclose if your traded value is more than 10L

There were instances where disclosures were not made. Promoter denied wrong-doing but was termed untenable by SEBI

There were instances where disclosures were not made. Promoter denied wrong-doing but was termed untenable by SEBI

Beat The Street also raised concern on trades which require disclosure earlier

https://twitter.com/BeatTheStreet10/status/1522566857047547904?s=20

2. Promoters & Insiders are not allowed to trade during trading window closure period (restricted period). This generally happens when co possess some UPSI.

In case of BCG- promoters traded in this restricted period

In case of BCG- promoters traded in this restricted period

3. Code of Conduct of BCG as required by SEBI regulations was not as per standards

To which BCG says exchanges should have flagged this 😂 as they expect minimum supervision from them.

SEBI says ignorance of the law is not an excuse of non-compliance

To which BCG says exchanges should have flagged this 😂 as they expect minimum supervision from them.

SEBI says ignorance of the law is not an excuse of non-compliance

Finally SEBI has imposed penalty of INR 40 Lakhs on Brightcom and its promoters for above non compliance

• • •

Missing some Tweet in this thread? You can try to

force a refresh