What's going on with UK interest rates? 📈💵

And are we now being sucked back into an economic crisis we thought we’d escaped?

A thread...🧵1/

And are we now being sucked back into an economic crisis we thought we’d escaped?

A thread...🧵1/

...This is the chart which is fuelling the perception that we're back in the mire.

Two year UK sovereign market borrowing costs are now actually higher than they were in the wake of last Autumn's mini-Budget...2/

Two year UK sovereign market borrowing costs are now actually higher than they were in the wake of last Autumn's mini-Budget...2/

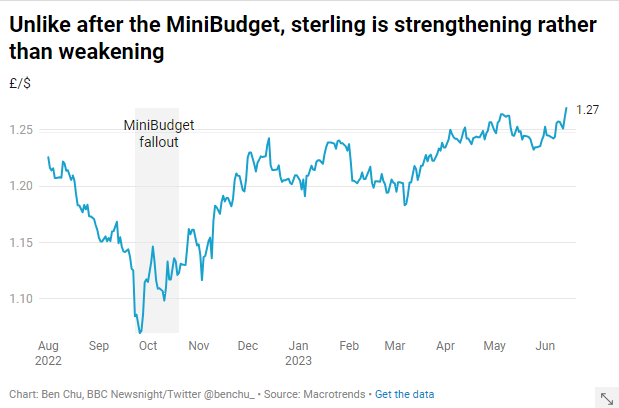

...The good news is that the economic context today is different.

Unlike after the mini-Budget, today the rise in UK borrowing costs is being accopanied by a *strengthening* of sterling.

What that means is that investors are *not*, this time, dumping UK assets in a panic...3/

Unlike after the mini-Budget, today the rise in UK borrowing costs is being accopanied by a *strengthening* of sterling.

What that means is that investors are *not*, this time, dumping UK assets in a panic...3/

...Rather, they're repricing them in the expectation of the Bank of England raising its own short-term interest rates considerably higher than previously anticipated.

Markets see UK rates rising to 5.75% (up from 4.5% today).

Above the projected peak of 🇺🇸and 🇪🇺 rates...4/

Markets see UK rates rising to 5.75% (up from 4.5% today).

Above the projected peak of 🇺🇸and 🇪🇺 rates...4/

...Why would the Bank hike rates still further?

Because we seem to have a sticky inflation problem here - and to have it worse than other developed countries..

This shows core inflation, which excludes volatile food and fuel.

The UK appears rather an outlier...5/

Because we seem to have a sticky inflation problem here - and to have it worse than other developed countries..

This shows core inflation, which excludes volatile food and fuel.

The UK appears rather an outlier...5/

...And that’s all reflected in the UK’s two year borrowing costs versus the rest of the G7.

Note that the UK’s costs are now even higher than even in the US...6/

Note that the UK’s costs are now even higher than even in the US...6/

...Why does it matter to you?

Because higher interest rates push up mortgage costs.

Take someone with a £200,000 mortgage who needs to refinance.

1.25 percentage points more on mortgage costs (the further Bank rate rises priced in by markets) implies an extra £157/month....7/

Because higher interest rates push up mortgage costs.

Take someone with a £200,000 mortgage who needs to refinance.

1.25 percentage points more on mortgage costs (the further Bank rate rises priced in by markets) implies an extra £157/month....7/

...Interest rates of 5.75% would probably help crush inflation fast - but also at the risk of pushing the UK into a recession this year or next that we thought we’d dodged courtesy of slumping wholesale gas prices....8/

....The tough question for the Bank of England is whether the UK really *does* have much stickier inflation than elsewhere, requiring higher peak rates than the US/Euro area.

By no means all economists and investors think that.

Some suspect markets have overreacted...9/

By no means all economists and investors think that.

Some suspect markets have overreacted...9/

...The FT here quotes some investors who think UK short-term sovereign debt is now wrongly priced ...10/ ft.com/content/77135f…

...When I recently interviewed Gita Gopinath, the deputy boss of the IMF, she downplayed the idea the UK has a particular core inflation problem... 11/ bbc.co.uk/news/business-…

...The danger some see is the Bank itself going too far, raising interest rates so high that it inflicts excessive pain on the economy when inflation is set to come down any way due to the existing rate rises in the system...12/

...Bear in mind that it's estimated that only around a third of the pain of the 4.4 percentage points of rate rises from the Bank since December 2021 has so far filtered through to UK households.

Some see a case for letting that impact play out...13/ resolutionfoundation.org/press-releases…

Some see a case for letting that impact play out...13/ resolutionfoundation.org/press-releases…

...But it has to be said that UK inflation data has repeatedly come in worse than the Bank of England expected in recent months.

And it is wary of being caught out again.

Rightly or wrongly, that points to further rate rises - and all the attendant consequences...14/

And it is wary of being caught out again.

Rightly or wrongly, that points to further rate rises - and all the attendant consequences...14/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter