The most efficient yield-bearing index asset on Arbitrum - $ALP, has landed on Trader Joe.

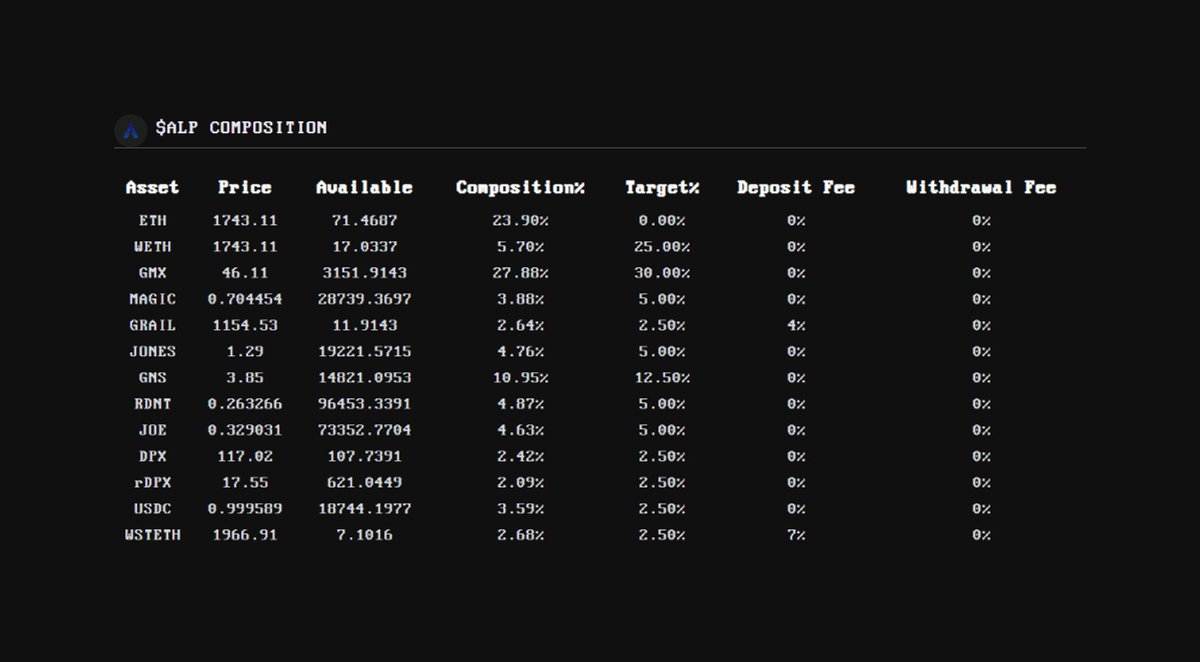

Developed by the @nitrocartel, $ALP offers exposure to #Arbitrum blue chips inside one transferable index token.

Developed by the @nitrocartel, $ALP offers exposure to #Arbitrum blue chips inside one transferable index token.

ALP includes assets such as $JOE, $ETH and $RDNT and automatically rebalances in response to the market.

Tokens inside the index are dynamically deployed into the yield-generating strategies across the ecosystem, with the yield flowing back to the ALP stakers.

Tokens inside the index are dynamically deployed into the yield-generating strategies across the ecosystem, with the yield flowing back to the ALP stakers.

The ALP index and the entire Arbitrove platform are governed by the $TROVE token holders.

They can decide on the future direction of the protocol, asset composition of ALP and new indices.

🏦

They can decide on the future direction of the protocol, asset composition of ALP and new indices.

🏦

In future, the protocol will launch vertical-specific indices for Web3 gaming, socials and other Arbitrum chains.

Pending governance approval, TROVE stakers will also be able to receive a share of the protocol revenue.

✍️

Pending governance approval, TROVE stakers will also be able to receive a share of the protocol revenue.

✍️

Arguably one of the most exciting developments to come is from the integration of $ALP to partner protocols, the possibilities of new yield-generating strategies will then really unfold.

👨🌾

👨🌾

With the ALP staking unleashed and beta testing finished, users can now join the Cartel by purchasing and providing liquidity for $ALP and $TROVE using Liquidity Book

🌊📘

🌊📘

The true magic of #DeFi lies in its unique financial tools and services, crafted independently, yet working seamlessly together and $ALP is an innovation at this frontier.

Trader Joe is delighted to be partnered with @nitrocartel to help push this frontier forward.

Trader Joe is delighted to be partnered with @nitrocartel to help push this frontier forward.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter