1/ Markets are down and the Vix is...down.

Why is the Vix sub-14? And what is the Vix?

Debrief from my convo with a equity volatility options trader.

What happens from here?

Charts below.

#VIX #volatility #nvidia

Why is the Vix sub-14? And what is the Vix?

Debrief from my convo with a equity volatility options trader.

What happens from here?

Charts below.

#VIX #volatility #nvidia

2/ Vix closed at 13.5 today.

The VIX, or Volatility Index, is a measure of expected price fluctuations in the S&P 500 Index options over the next 30 days.

It is often referred to as the "fear index" or "fear gauge" because it represents the market's expectation of volatility.

The VIX, or Volatility Index, is a measure of expected price fluctuations in the S&P 500 Index options over the next 30 days.

It is often referred to as the "fear index" or "fear gauge" because it represents the market's expectation of volatility.

3/ The Black-Scholes (or related equations) are used to back-out the implied volatility. Observed put/call prices on front-month contracts

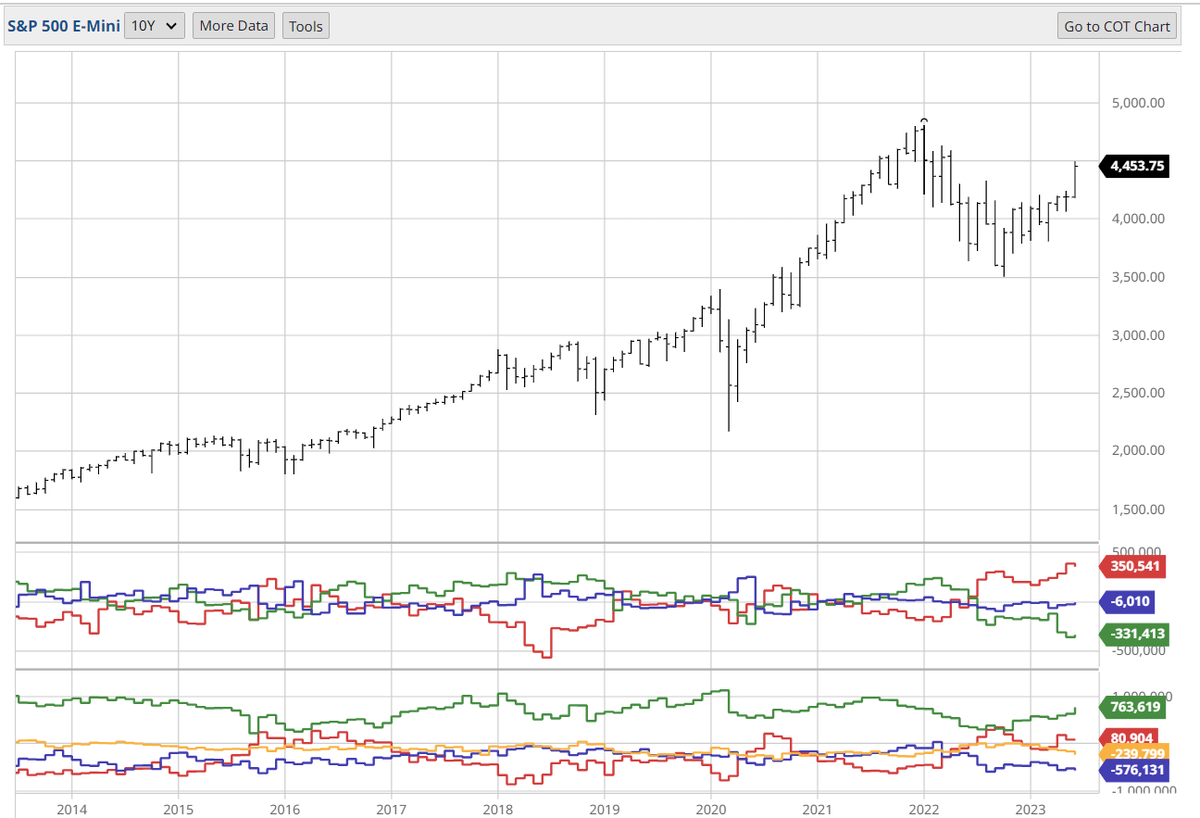

4/ This is the Commitment of Traders report on the Vix published by the CFTC.

Red = Dealer

Green = Asset Manager (think Bridgewater)

Blue = Small speculator

Rules of thumb:

- Avoid being on the side of small speculators

- Avoid crowded positions (which is the case now)

Red = Dealer

Green = Asset Manager (think Bridgewater)

Blue = Small speculator

Rules of thumb:

- Avoid being on the side of small speculators

- Avoid crowded positions (which is the case now)

5/ Nvidia is going parabolic.

A site to behold.

Prior thread shows Nvidia does have a multi-year fundamentals trend behind it. Nvidia is not Cisco.

But, Nvidia's PEG (P/E ratio divided by growh rate) - a loose proxy for assessing value - is > 5

A site to behold.

Prior thread shows Nvidia does have a multi-year fundamentals trend behind it. Nvidia is not Cisco.

But, Nvidia's PEG (P/E ratio divided by growh rate) - a loose proxy for assessing value - is > 5

https://twitter.com/ramahluwalia/status/1663887193218113539?s=20

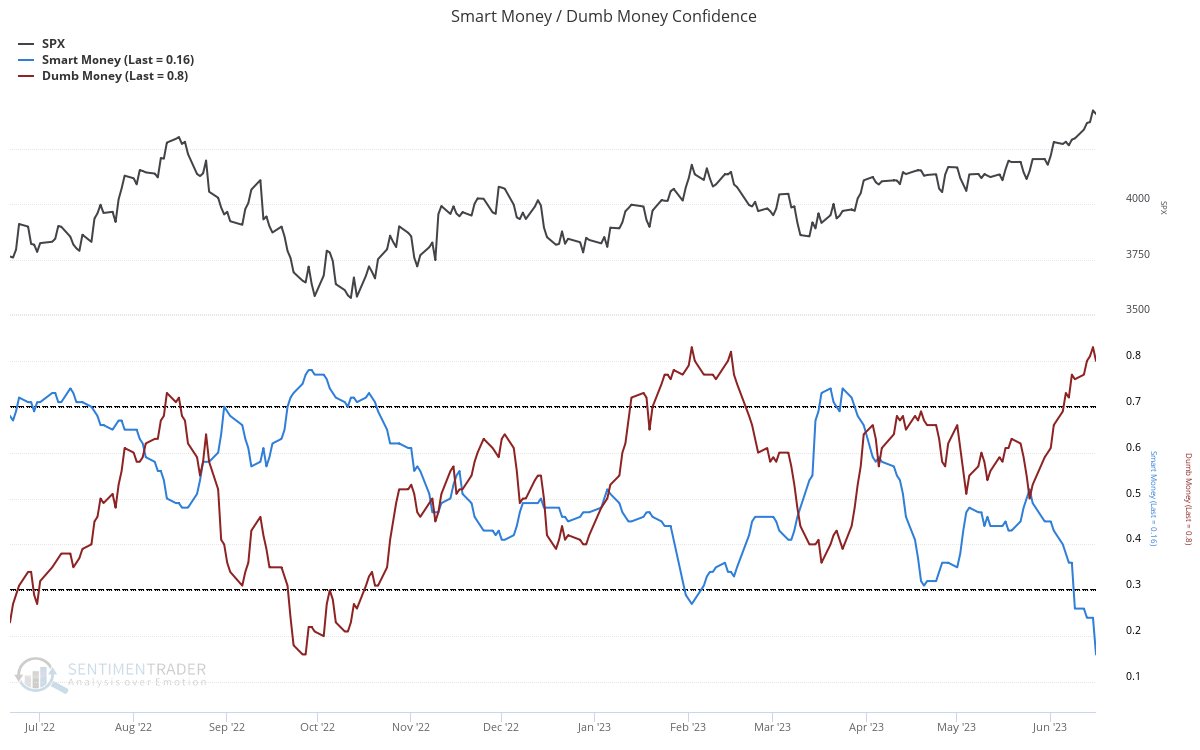

6/ One of my favorite indicators - Smart Money vs. Dumb Money index.

Each index is an amalgamation of various indicators (e.g., retail open interest, the COT report, etc.)

Short-term this suggests close to near-term top. )

Note: All indicators are fallible.

Each index is an amalgamation of various indicators (e.g., retail open interest, the COT report, etc.)

Short-term this suggests close to near-term top. )

Note: All indicators are fallible.

• • •

Missing some Tweet in this thread? You can try to

force a refresh