BlackRock's new #Bitcoin Trust is half good & half terrible.

It's imperative that every Bitcoiner know what they've created & why it's a threat to Bitcoin's values.

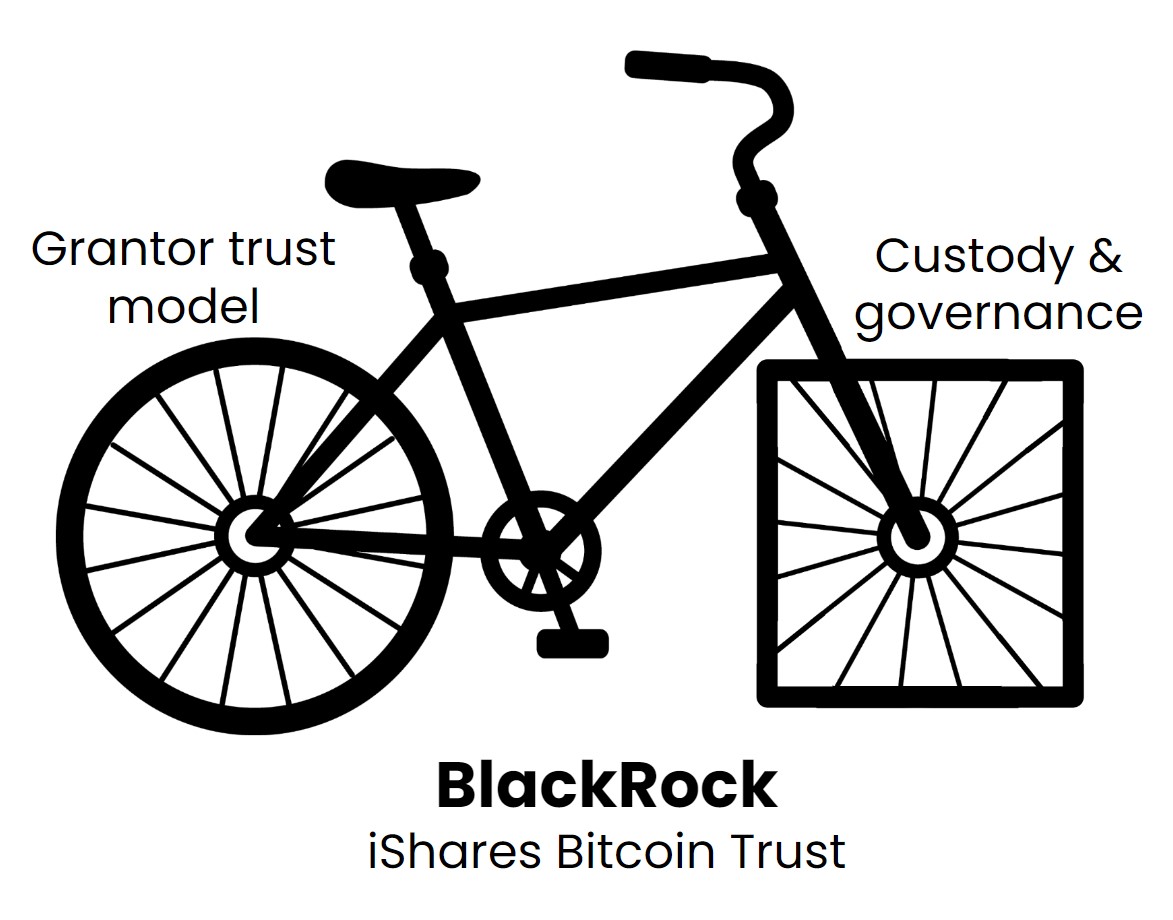

As an investment vehicle, this is the BlackRock Bitcoin Trust:

It's imperative that every Bitcoiner know what they've created & why it's a threat to Bitcoin's values.

As an investment vehicle, this is the BlackRock Bitcoin Trust:

On June 15th, BlackRock filed an S-1 with the SEC, a registration statement detailing its intended Bitcoin Trust product.

This is not technically an ETF, but it is functionally equivalent to an ETF because it allows for daily subscriptions and redemptions.

This is not technically an ETF, but it is functionally equivalent to an ETF because it allows for daily subscriptions and redemptions.

THE GOOD:

- BlackRock utilized a "grantor trust" model

- This enables in-kind redemptions without a taxable event (meaning, investors can take self-custody when they are ready, unlike with GBTC)

- BlackRock has $10T in AUM. A small re-allocation to this product is bullish BTC🚀

- BlackRock utilized a "grantor trust" model

- This enables in-kind redemptions without a taxable event (meaning, investors can take self-custody when they are ready, unlike with GBTC)

- BlackRock has $10T in AUM. A small re-allocation to this product is bullish BTC🚀

THE BAD:

In-kind redemptions - the catch:

- Deep in S-1 filing, there's this description of who is allowed to redeem bitcoin (image)

- Meaning, the privilege of withdrawing Bitcoin from the Trust is reserved for broker-dealer investment firms in the good graces of BlackRock

In-kind redemptions - the catch:

- Deep in S-1 filing, there's this description of who is allowed to redeem bitcoin (image)

- Meaning, the privilege of withdrawing Bitcoin from the Trust is reserved for broker-dealer investment firms in the good graces of BlackRock

Rehypothecation:

- The norm with ETFs in tradfi is to lend out the assets in the fund in order to get some extra yield. Nothing prohibits this in BlackRock's S-1, so that's what they will do here

- Means BlackRock's Trust will be massive creator of paper Bitcoin (much like FTX)

- The norm with ETFs in tradfi is to lend out the assets in the fund in order to get some extra yield. Nothing prohibits this in BlackRock's S-1, so that's what they will do here

- Means BlackRock's Trust will be massive creator of paper Bitcoin (much like FTX)

Forks:

- BlackRock asserts the right to decide which fork is the "real" Bitcoin

- This raises the possibility of BlackRock (creators of the "ESG Score" capitalist social credit system) pushing an ESG-friendly BTC fork, with investors as hostages (Bitcoin Cash but much scarier)

- BlackRock asserts the right to decide which fork is the "real" Bitcoin

- This raises the possibility of BlackRock (creators of the "ESG Score" capitalist social credit system) pushing an ESG-friendly BTC fork, with investors as hostages (Bitcoin Cash but much scarier)

https://twitter.com/2373203378/status/1669475269244235776

Onramp: a better Bitcoin Trust

Onramp has the same "grantor trust" model BUT leverages Bitcoin's native properties to deliver best-in-class custody & governance.

We believe that a #bitcoin investment vehicle should serve the interests of clients & Bitcoin as a whole.

Onramp has the same "grantor trust" model BUT leverages Bitcoin's native properties to deliver best-in-class custody & governance.

We believe that a #bitcoin investment vehicle should serve the interests of clients & Bitcoin as a whole.

Core to this goal is the Onramp Multi-Party Custody Solution.

- Bitcoin held in on-chain multisig vaults with 3 separate institutions holding keys (incl. 2 qualified custodians)

- Minimizes counterparty risk while maximizing security

- No ability to rehypothecate funds

- Bitcoin held in on-chain multisig vaults with 3 separate institutions holding keys (incl. 2 qualified custodians)

- Minimizes counterparty risk while maximizing security

- No ability to rehypothecate funds

Overall, we can either allow BlackRock (and similar tradfi giants) to bring their square wheel practices to Bitcoin...

Or we can highlight & promote better alternatives, built with Bitcoin in mind.

That's what @allenf32 concluded after his deep dive into BlackRock's product:

Or we can highlight & promote better alternatives, built with Bitcoin in mind.

That's what @allenf32 concluded after his deep dive into BlackRock's product:

https://twitter.com/1101235206059581441/status/1670119876373954560

Help us raise awareness of BlackRock's flawed product. (Retweets of the first tweet appreciated!)

Get the full @Croesus_BTC breakdown of BlackRock's rather scary Bitcoin Trust proposal (and how it compares to Onramp Bitcoin Trust) here 👇 onrampbitcoin.com/newsletter/bla…

Get the full @Croesus_BTC breakdown of BlackRock's rather scary Bitcoin Trust proposal (and how it compares to Onramp Bitcoin Trust) here 👇 onrampbitcoin.com/newsletter/bla…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter