I want to share some data. Many people will jump to one of two thoughts: "Aha, I was right", or 'Yeah, but..." based on preconceptions. I want you to hold back on that :)

Here are some retail sales stats, showing that two things can be true at the same time.

A 🧵

1/n

#ausbiz

Here are some retail sales stats, showing that two things can be true at the same time.

A 🧵

1/n

#ausbiz

Are retail sales good or bad? Yes :)

Both.

Retail sales for March 2024 were up by a relatively poor 0.85%, year-on-year, in seasonally adjusted terms.

*And* up 5.5% per annum compounded (30.8% in total) over the past 5 years.

2/n

Both.

Retail sales for March 2024 were up by a relatively poor 0.85%, year-on-year, in seasonally adjusted terms.

*And* up 5.5% per annum compounded (30.8% in total) over the past 5 years.

2/n

Let's do other categories:

Food: + 2.2% YoY, +4.9% pa last 5 yrs (27.3% total)

Household Goods: -3.1% YoY, +4.3% pa last 5 yrs (23.2% total)

Clothing/Footwear: -0.4% YoY, +6.6% pa last 5 yrs (37.8% total)

Department Stores: -0.2% YoY, +4.3% pa last 5 yrs (23.2% total)

3/n

Food: + 2.2% YoY, +4.9% pa last 5 yrs (27.3% total)

Household Goods: -3.1% YoY, +4.3% pa last 5 yrs (23.2% total)

Clothing/Footwear: -0.4% YoY, +6.6% pa last 5 yrs (37.8% total)

Department Stores: -0.2% YoY, +4.3% pa last 5 yrs (23.2% total)

3/n

Other Retail: +2.4% YoY, +7.2% pa last 5 yrs (41.4% total)

Cafes/Restaurants/Take Away +1.2% YoY, +6.7% pa last 5 yrs (38.1% total)

You're already doing the 'Aha' / 'Yeah but', aren't you? :)

Let's cover those off...

4/n

Cafes/Restaurants/Take Away +1.2% YoY, +6.7% pa last 5 yrs (38.1% total)

You're already doing the 'Aha' / 'Yeah but', aren't you? :)

Let's cover those off...

4/n

Is retail doing well, or badly?

Yes. Both. :)

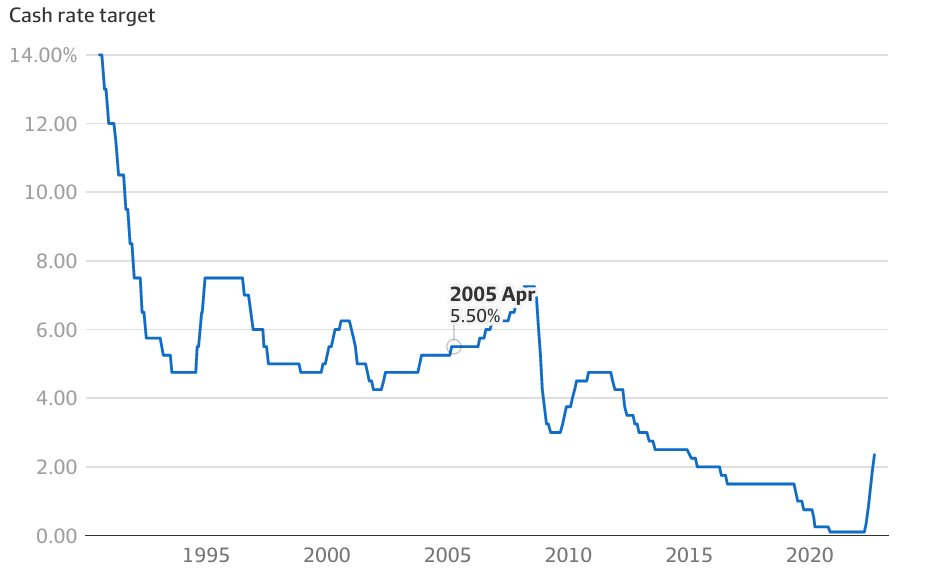

And I think 'both' is the right word. We're preconditioned to think about year-on-year growth or decline, and fair enough. It's true that retail spending is looking pretty sickly on that basis, with interest rates biting.

5/n

Yes. Both. :)

And I think 'both' is the right word. We're preconditioned to think about year-on-year growth or decline, and fair enough. It's true that retail spending is looking pretty sickly on that basis, with interest rates biting.

5/n

And, indeed, that's what inflation tends to both be measured on and impacted by. So it's (one of) the right things to focus on.

But, a thought experiment:

6/n

But, a thought experiment:

6/n

If I had told you, in March 2019, that we were less than 12 months away from a once-in-a-century pandemic, and offered you a 5.5% per annum growth in retail sales over the next half-decade, would you have taken it? Would I have taken it?

Bloody oath!

But here's the thing:

7/n

Bloody oath!

But here's the thing:

7/n

Even outside a pandemic, a 5.5% annual growth in retail sales is excellent.

Another 'Yeah, but...'? Thought so. Let's talk about the two Is.

Yes, Inflation is pushing that number up. By less than you'd think, actually, over that period, but it's still contributing a lot.

8/n

Another 'Yeah, but...'? Thought so. Let's talk about the two Is.

Yes, Inflation is pushing that number up. By less than you'd think, actually, over that period, but it's still contributing a lot.

8/n

And yes, immigration (properly, 'population growth') is also pushing that number up by a decent whack.

Overall, retail sales per capita fell by 3.3% over the past 12 months, and is up only 0.4% per annum over the past 5 years (+2.1% in total).

9/n

Overall, retail sales per capita fell by 3.3% over the past 12 months, and is up only 0.4% per annum over the past 5 years (+2.1% in total).

9/n

More 'Ahas' and 'Yeah buts...'? :)

The thing is, it's not either/or.

There are more people. More jobs. More retail sales.

There's also lower retail sales per capita, recently, and it's flat over the past 5 years.

Both are true.

And so?

10/n

The thing is, it's not either/or.

There are more people. More jobs. More retail sales.

There's also lower retail sales per capita, recently, and it's flat over the past 5 years.

Both are true.

And so?

10/n

Sorry, but there's no clear 'so'.

Immigration might have lowered per-capita retail sales. Or, it might have added to aggregate demand, and things might have been worse without it.

Inflation sucks. There's no upside here. But it's not the whole retail story.

11/n

Immigration might have lowered per-capita retail sales. Or, it might have added to aggregate demand, and things might have been worse without it.

Inflation sucks. There's no upside here. But it's not the whole retail story.

11/n

Perhaps the key takeaway: Things are not as bad, over a longer timeframe, as they might appear.

But they're also not particularly good.

It's the result of unwelcome inflation, but also of deliberate actions to get that inflation under control.

12/n

But they're also not particularly good.

It's the result of unwelcome inflation, but also of deliberate actions to get that inflation under control.

12/n

Also, a reminder that cycles happen. They're not unusual, historically; the last 30 years, largely without them, are the unusual thing.

That doesn't make them welcome, but we should make our peace with it.

13/n

That doesn't make them welcome, but we should make our peace with it.

13/n

The 'so what'?

I guess that, as a society and economy, we should plan our economy, businesses and lives accordingly - and our social and economic support systems.

But I hope this has been interesting and useful.

Okay, now hit me with the 'Ahas' and 'Yes, buts...' :)

14/14

I guess that, as a society and economy, we should plan our economy, businesses and lives accordingly - and our social and economic support systems.

But I hope this has been interesting and useful.

Okay, now hit me with the 'Ahas' and 'Yes, buts...' :)

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh