How to get URL link on X (Twitter) App

🎙 Join us as we discuss balancing risk & reward in DeFi and automating yield farming strategies with special guests @smokatokey of @harvest_finance and @LinkSemper of Bancor!

🎙 Join us as we discuss balancing risk & reward in DeFi and automating yield farming strategies with special guests @smokatokey of @harvest_finance and @LinkSemper of Bancor!

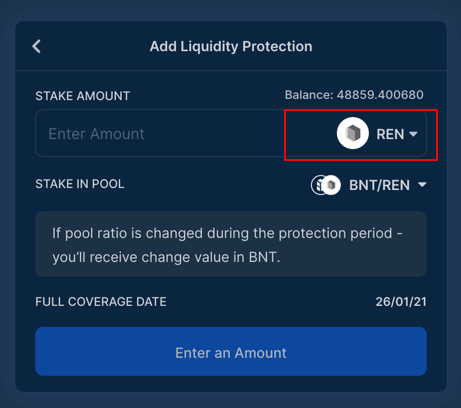

1/ Currently, as a liquidity provider, you need to manually re-add collected $BNT rewards to a pool to increase your staked liquidity.

1/ Currently, as a liquidity provider, you need to manually re-add collected $BNT rewards to a pool to increase your staked liquidity.

1/ The problem:

1/ The problem:

Whitelists:

Whitelists:

🐮 High Volume Bancor Bull 🐮

🐮 High Volume Bancor Bull 🐮