Passionate about crypto. Sharing the best models, on-chain metrics, findings, knowledge & thoughts from the space. Nothing I say/show is financial advice.

2 subscribers

How to get URL link on X (Twitter) App

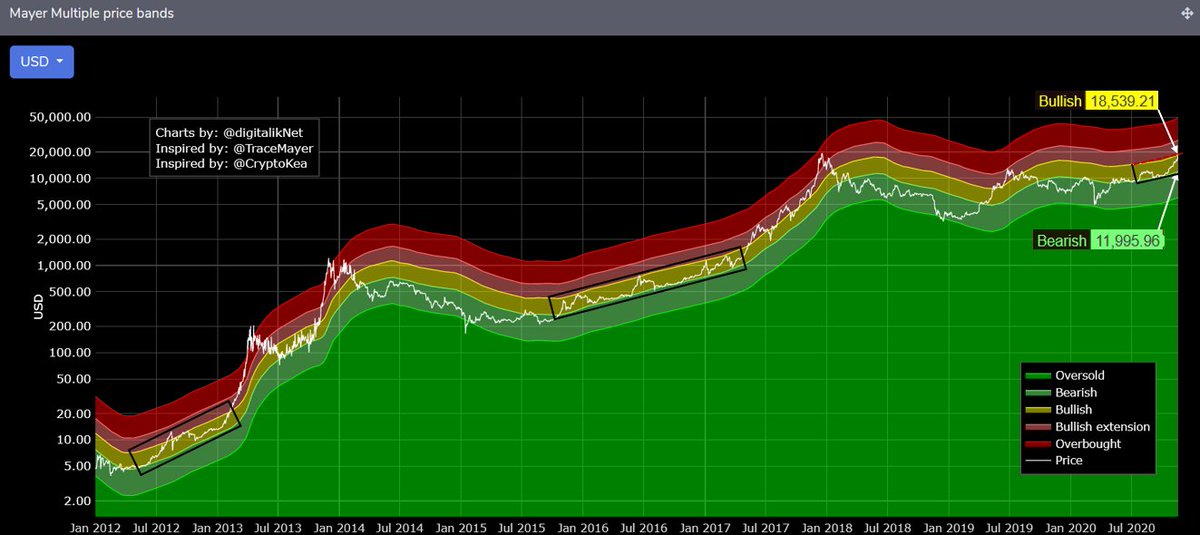

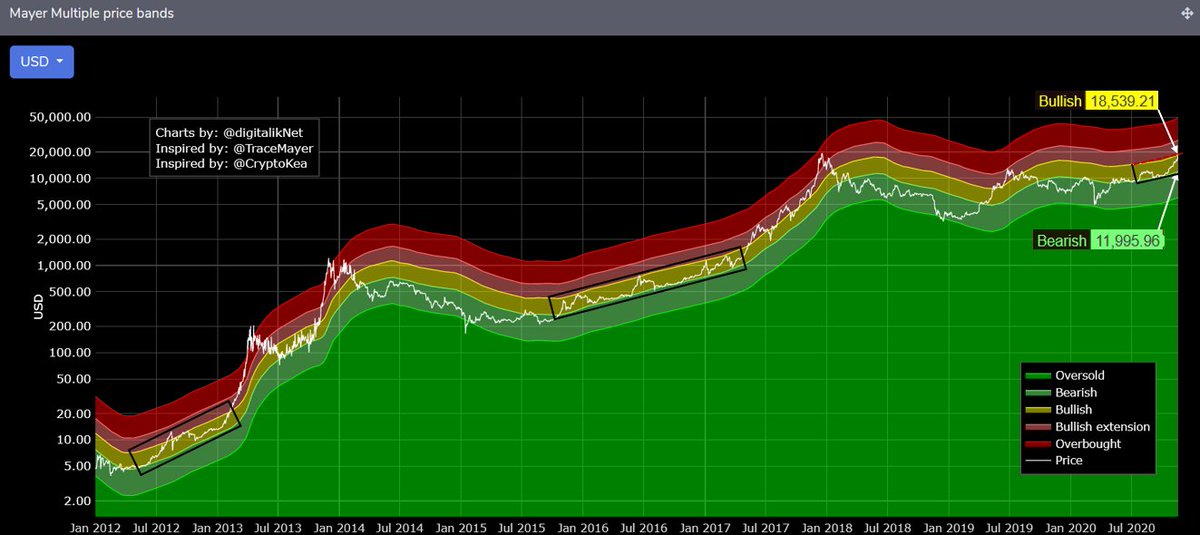

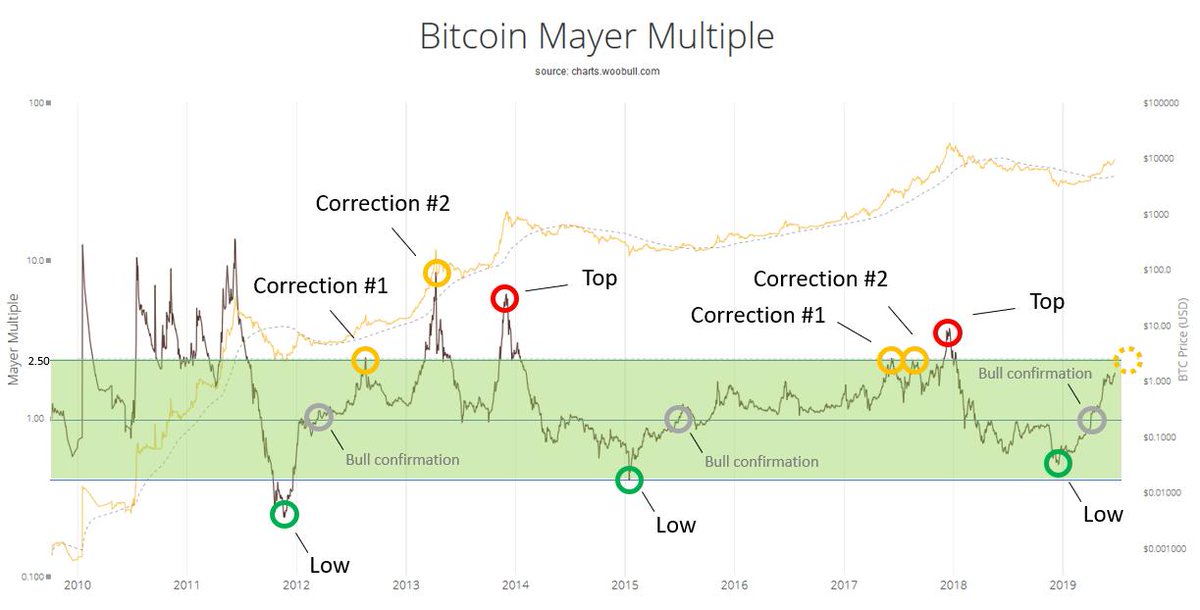

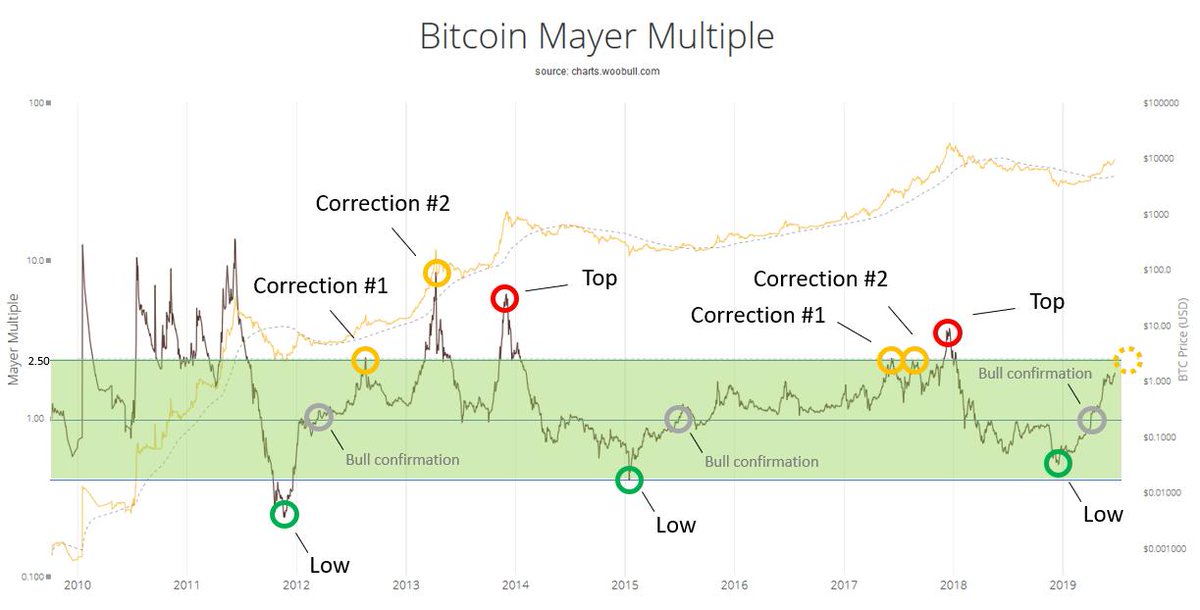

2/ In March this year, the Mayer Multiple Price Bands gave a great bottoming signal, just as in prior market cycles.

2/ In March this year, the Mayer Multiple Price Bands gave a great bottoming signal, just as in prior market cycles.https://twitter.com/CryptoKea/status/1238821057366085644?s=20

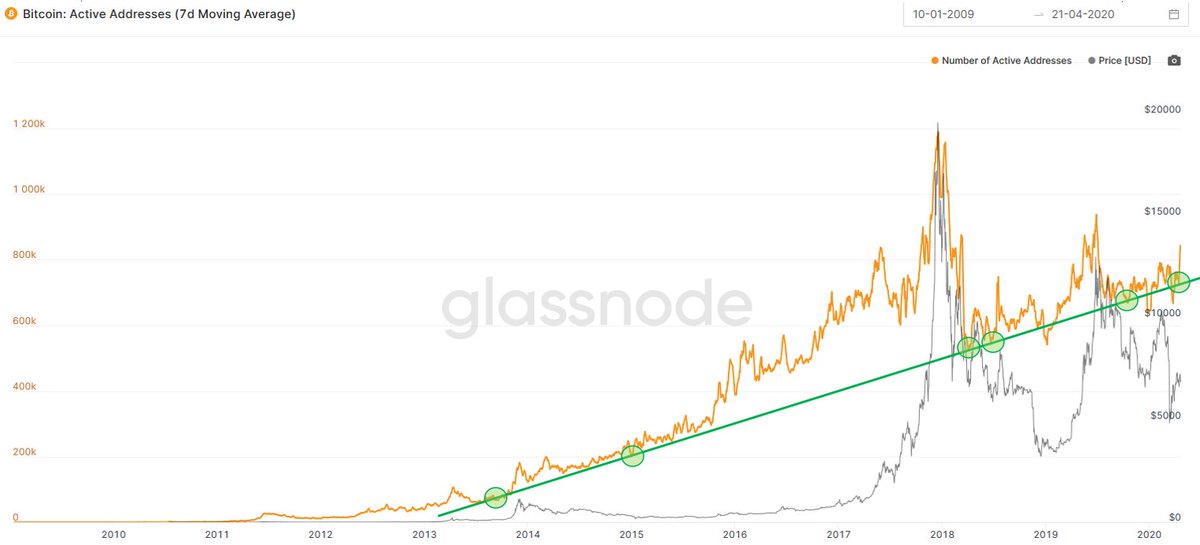

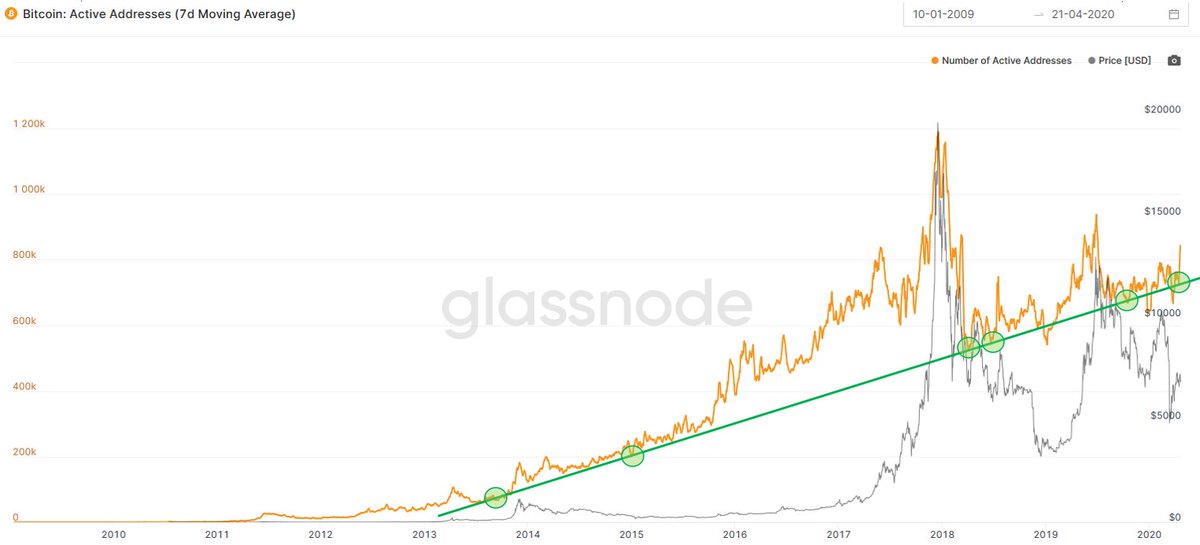

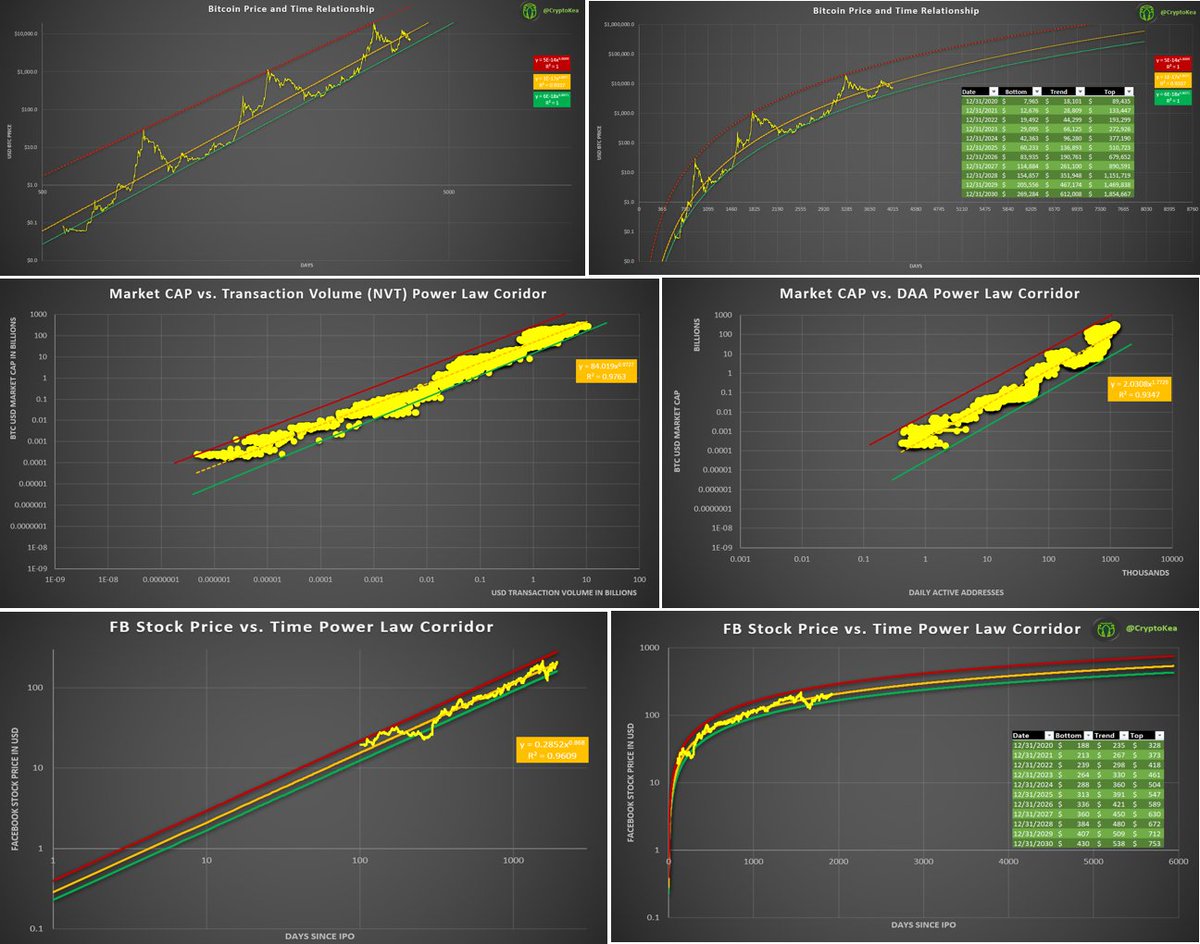

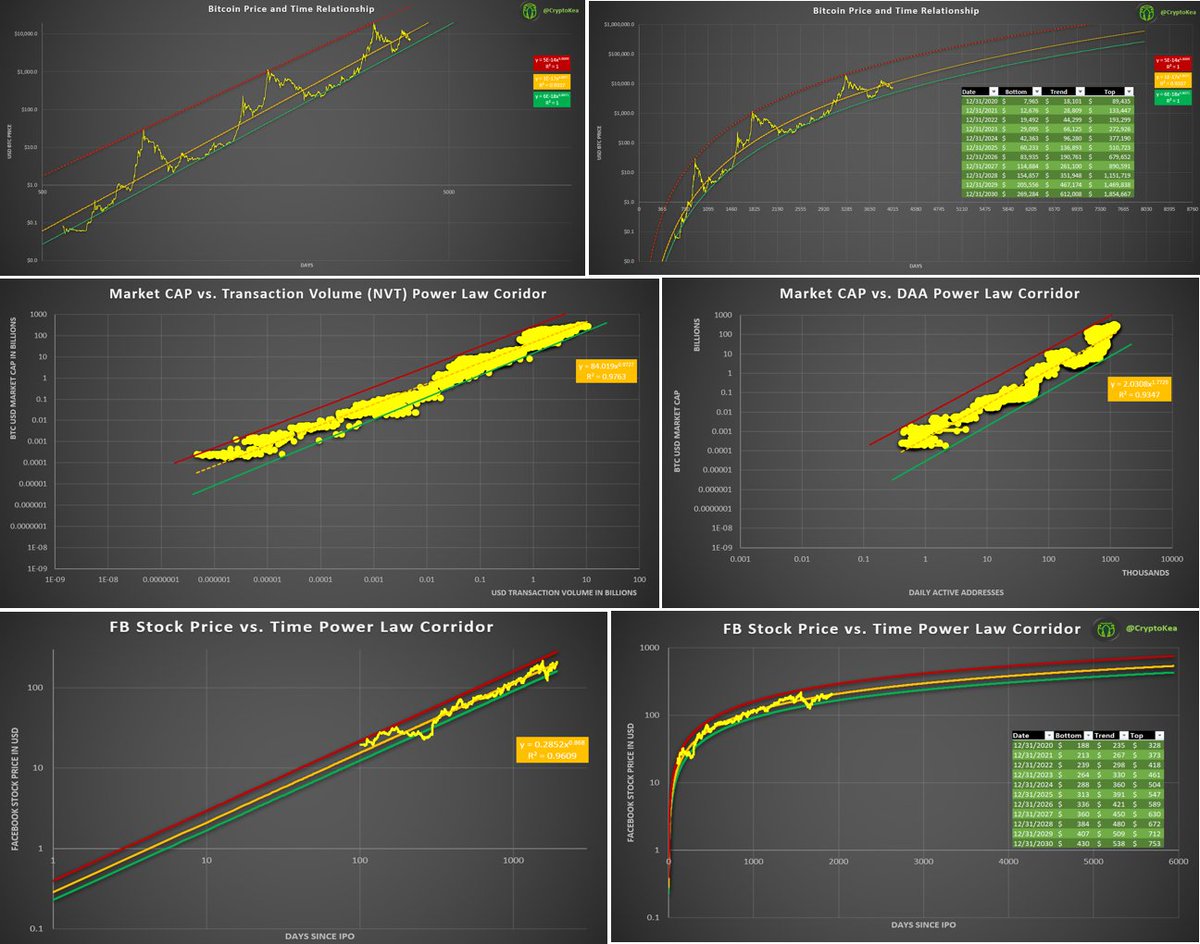

2/ 2 years ago, the low in Daily Active Addresses (DAA) was hit in the latest cycle (DAA is the number of unique addresses active as a sender or receiver on a daily basis). Price followed suit 8 months later at a low of $3.1k. Ever since then we had higher and higher lows in DAA

2/ 2 years ago, the low in Daily Active Addresses (DAA) was hit in the latest cycle (DAA is the number of unique addresses active as a sender or receiver on a daily basis). Price followed suit 8 months later at a low of $3.1k. Ever since then we had higher and higher lows in DAA

2/ The above mentioned metric measures the total hodl age of all Bitcoins moved on a given day by multiplying those coins with the number of days they got hodled. This metric is called Coin Days Destroyed (CDD).

2/ The above mentioned metric measures the total hodl age of all Bitcoins moved on a given day by multiplying those coins with the number of days they got hodled. This metric is called Coin Days Destroyed (CDD).

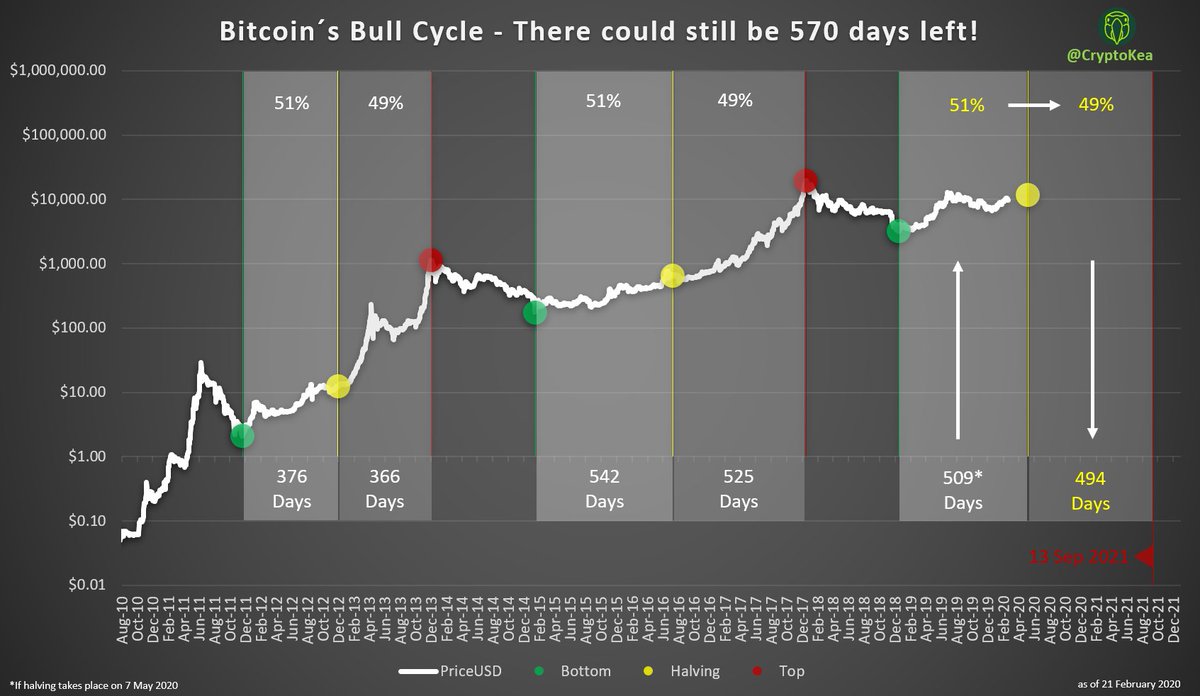

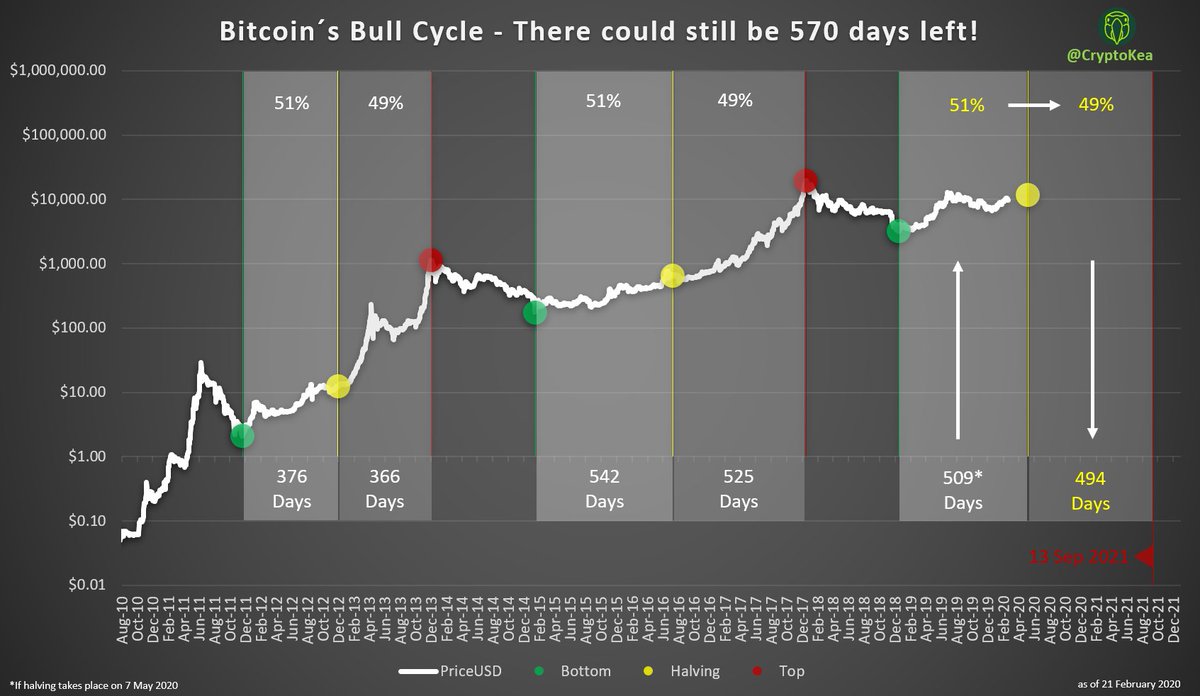

2/ It is still the big question whether Bitcoin´s bull and bear markets take longer each cycle or oscillate around halving cycles. While there are enough good reasons to suggest that cycles are lengthening over time and

2/ It is still the big question whether Bitcoin´s bull and bear markets take longer each cycle or oscillate around halving cycles. While there are enough good reasons to suggest that cycles are lengthening over time and

2/ Besides many Bitcoin logarithmic regression models that appeared in recent years (e.g. logarithmic regression by Trololo or Awe & Wonder), the first more scientific approach through defining a power-law channel for price and time was taken by @hcburger1 through the following

2/ Besides many Bitcoin logarithmic regression models that appeared in recent years (e.g. logarithmic regression by Trololo or Awe & Wonder), the first more scientific approach through defining a power-law channel for price and time was taken by @hcburger1 through the following

/2 Stock-to-Flow Model.

/2 Stock-to-Flow Model.

For some reason, I cannot attach this post to the prior thread. Please find it here for all the details:

For some reason, I cannot attach this post to the prior thread. Please find it here for all the details: https://twitter.com/CryptoKea/status/1143133558438936577

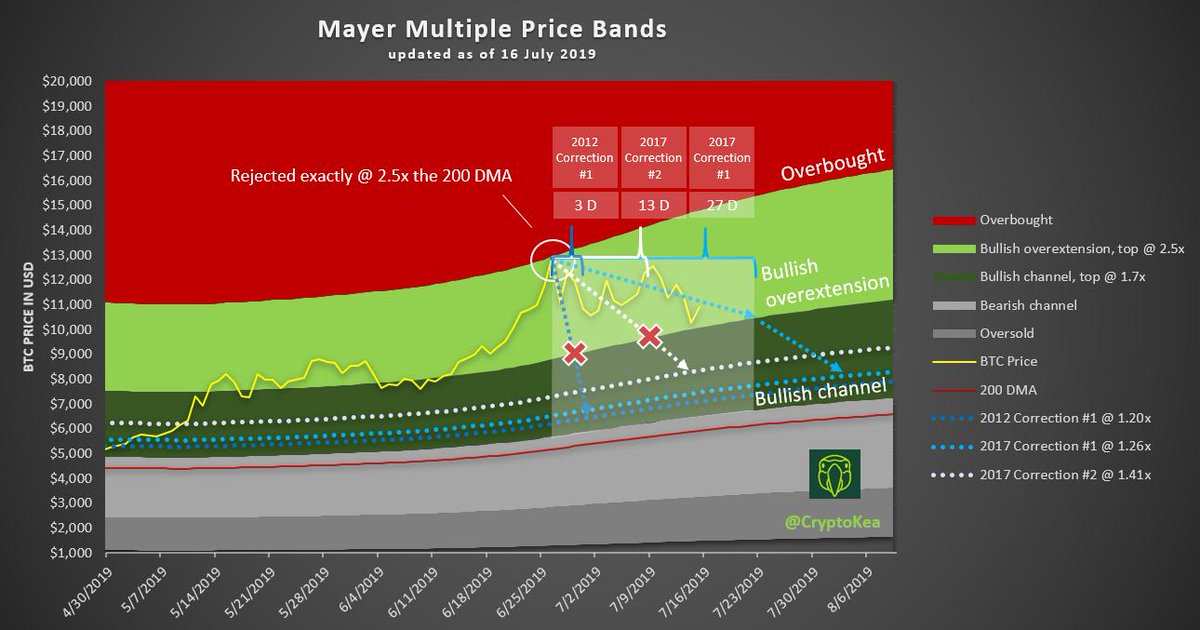

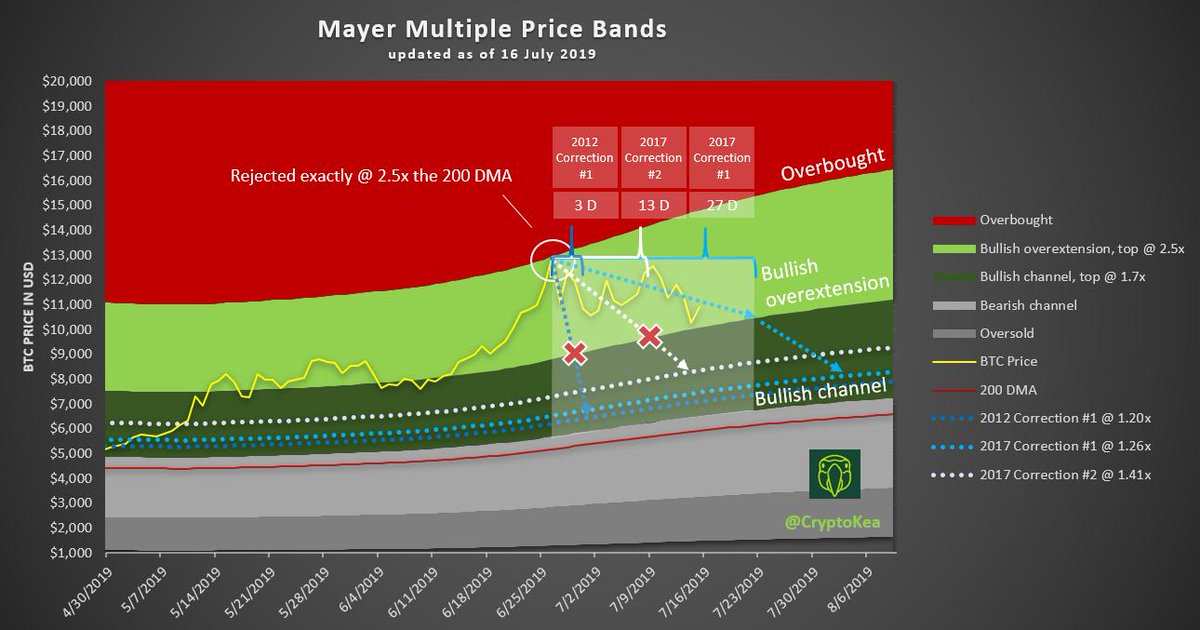

1/ During the last two bull markets, 3 of the 4 major corrections came in exactly at 2.5x the 200 DMA. Assuming that the low is in at $3150 and we are in a bull market, a current 200 DMA of $5070, suggests Correction #1 to take place at around $12,7k. Considering that

1/ During the last two bull markets, 3 of the 4 major corrections came in exactly at 2.5x the 200 DMA. Assuming that the low is in at $3150 and we are in a bull market, a current 200 DMA of $5070, suggests Correction #1 to take place at around $12,7k. Considering that