Mng Partner of Westwood Capital;

Sr. Fellow-Adjunct @CornellLaw;

Author of The Age of Oversupply;

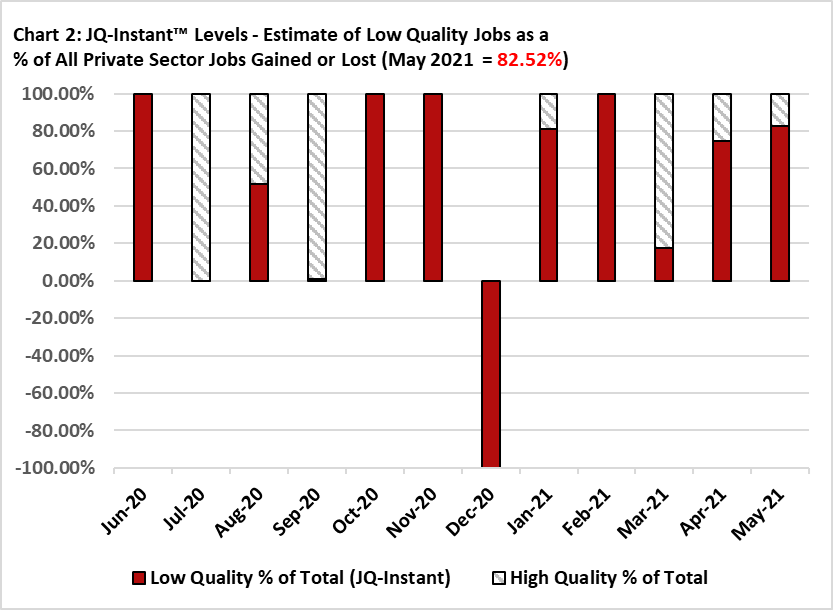

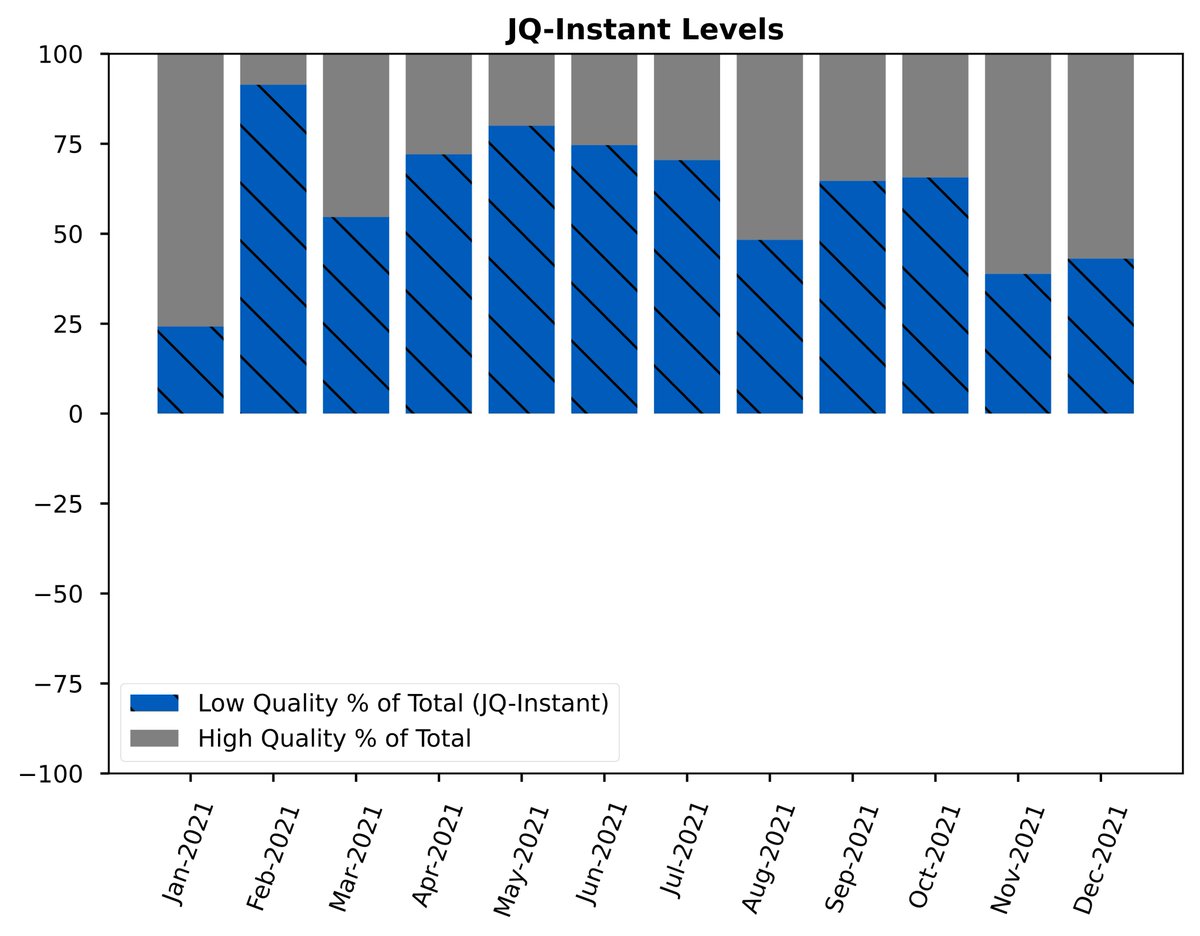

Co-creator of @jobqualityindex;

@BusinessInsider columnist

How to get URL link on X (Twitter) App

2/n (ex) Bloomberg's @Matthew_Winkler in 2020, ARKK hit nearly $140 a share and has lost nearly 80% of its then value.

2/n (ex) Bloomberg's @Matthew_Winkler in 2020, ARKK hit nearly $140 a share and has lost nearly 80% of its then value.

https://twitter.com/DanielAlpert/status/1479433415640457221Non-farms payrolls up 199,000