Individual Investor| Tweets /threads on books, ideas, learnings on personal finance & investing

Open to collaborate for content creation in this domain

How to get URL link on X (Twitter) App

What is fragile business?

What is fragile business?

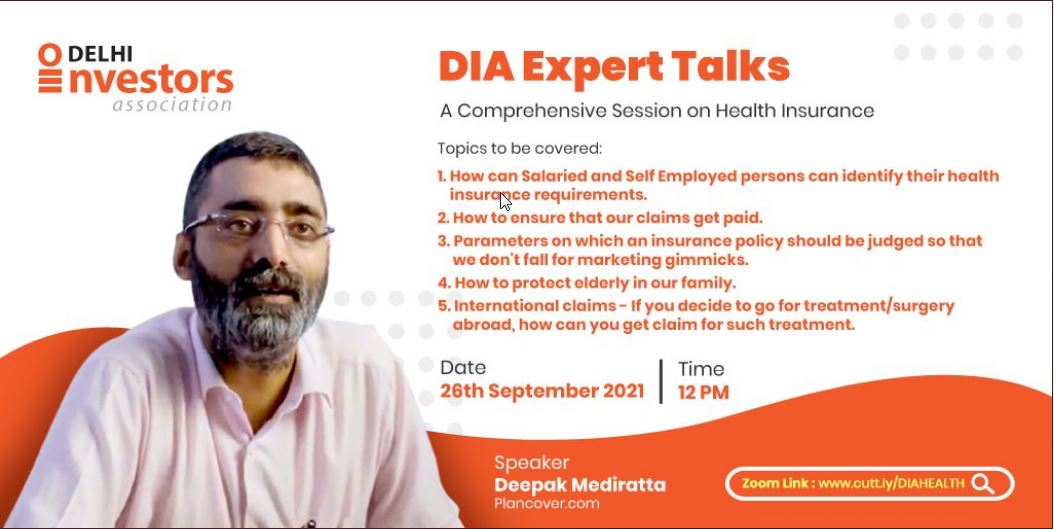

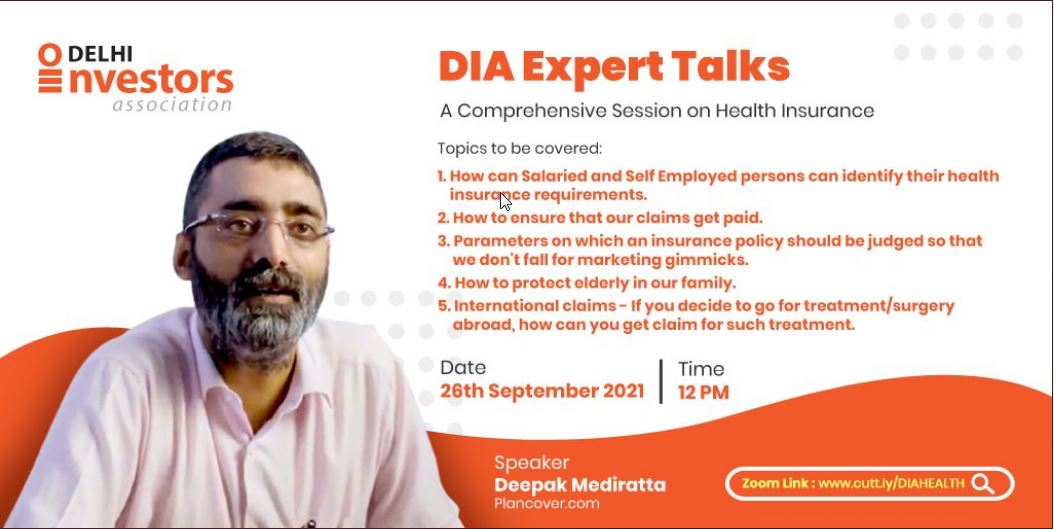

Why health insurance?

Why health insurance?

What is the philosophy of Investment of Marcellus?

What is the philosophy of Investment of Marcellus?https://twitter.com/LarissaFernand/status/14605784040470200371. Have the right expectations:

Learnings from pandemic:

Learnings from pandemic:

How to select companies that can give high returns.

How to select companies that can give high returns.

A common investing mistake:

A common investing mistake:

An important reminder in this rising market:

An important reminder in this rising market:

What is asset allocation?

What is asset allocation?

1. If it's gone down this much already, it can't go much lower

1. If it's gone down this much already, it can't go much lower

How should you buy a stock?

How should you buy a stock?

The early life of Li Lu

The early life of Li Luhttps://twitter.com/Finalysis20/status/13672974636865495071. INCOME STATEMENT