How to get URL link on X (Twitter) App

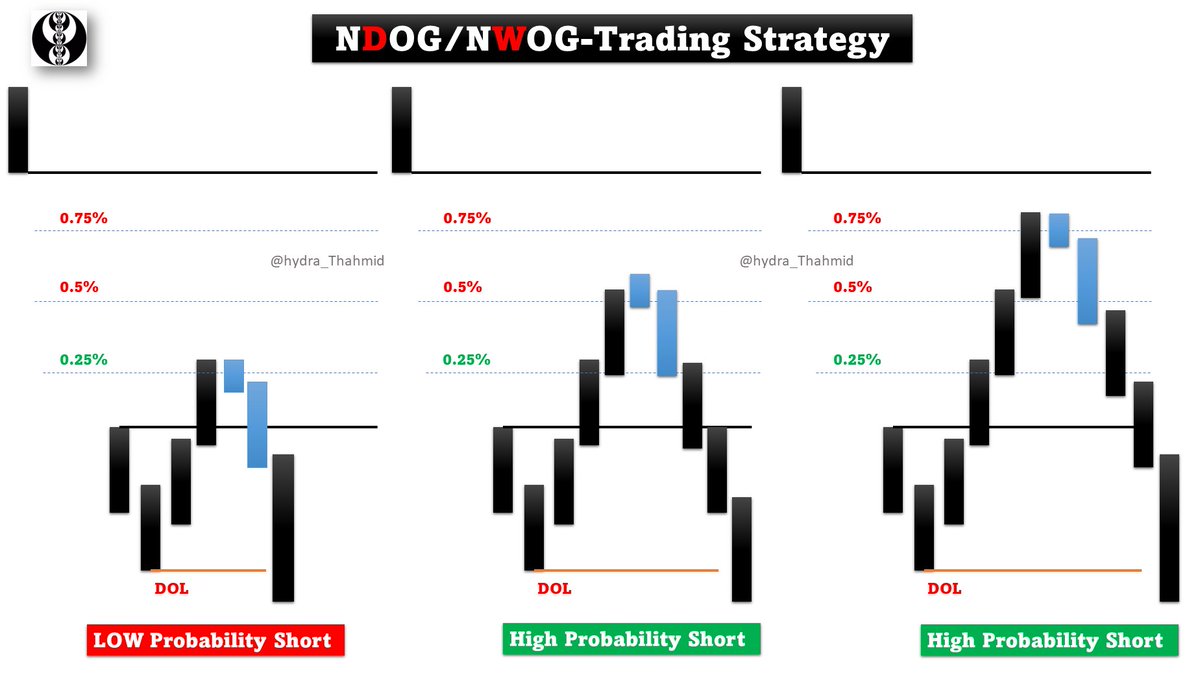

On LTF [Daily] we can see that price confirming our BIAS even more as -

On LTF [Daily] we can see that price confirming our BIAS even more as -

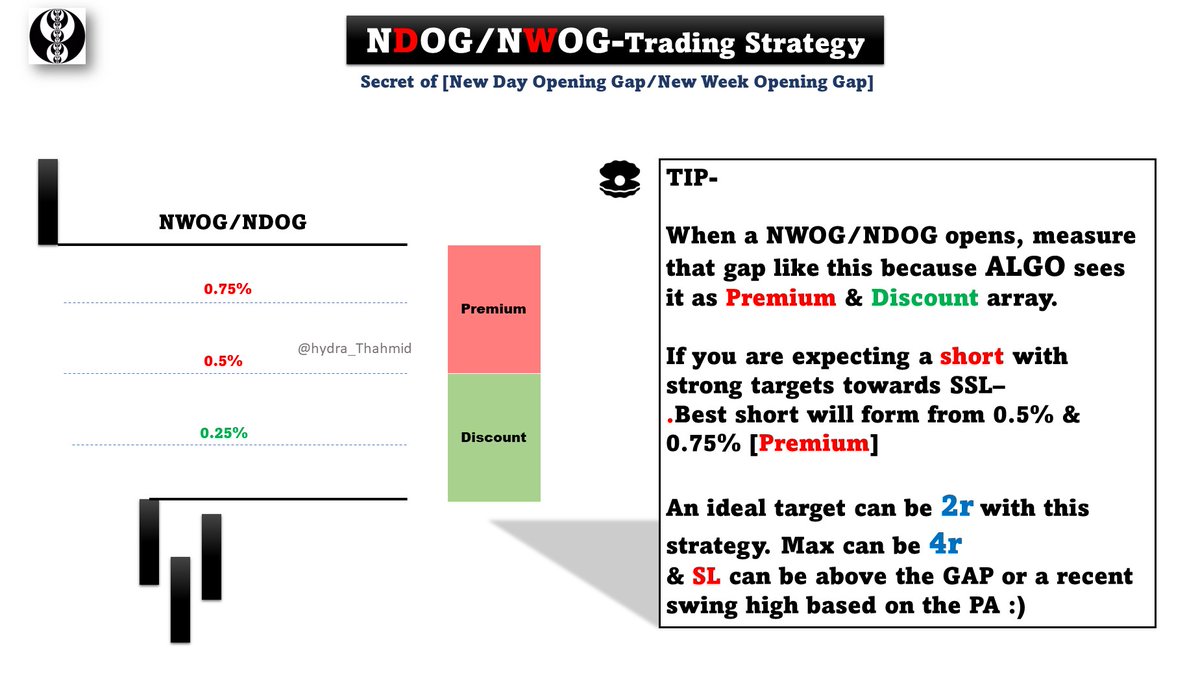

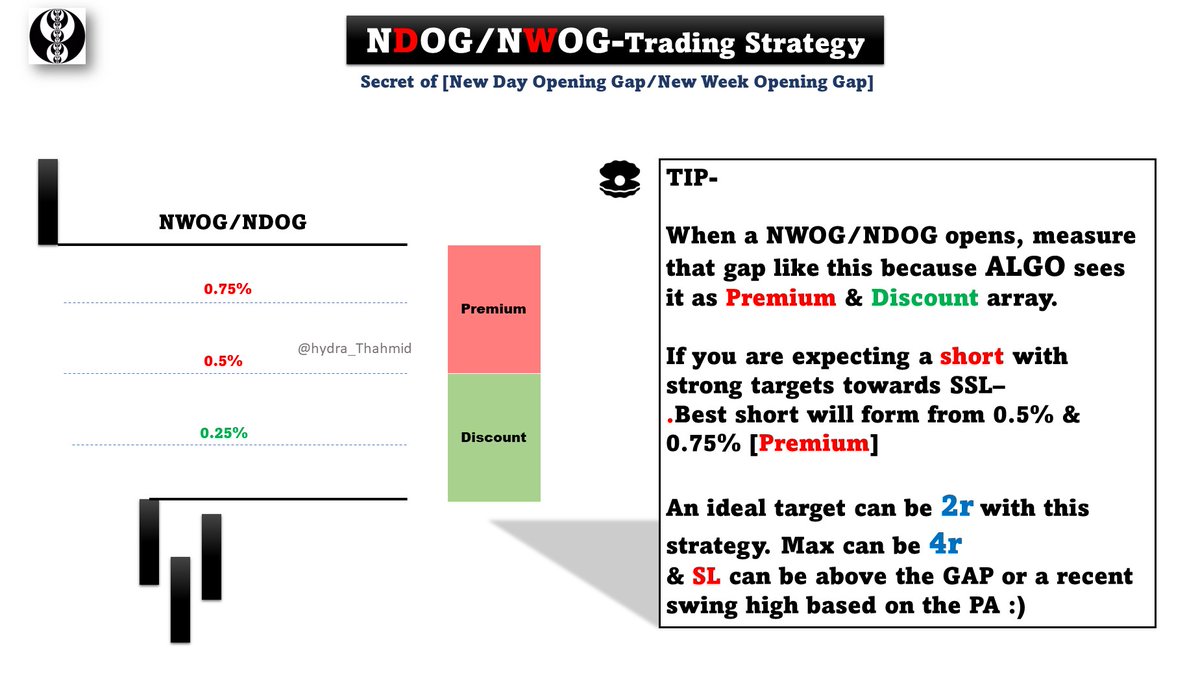

💎Your Best short using this trading Model will form-

💎Your Best short using this trading Model will form-

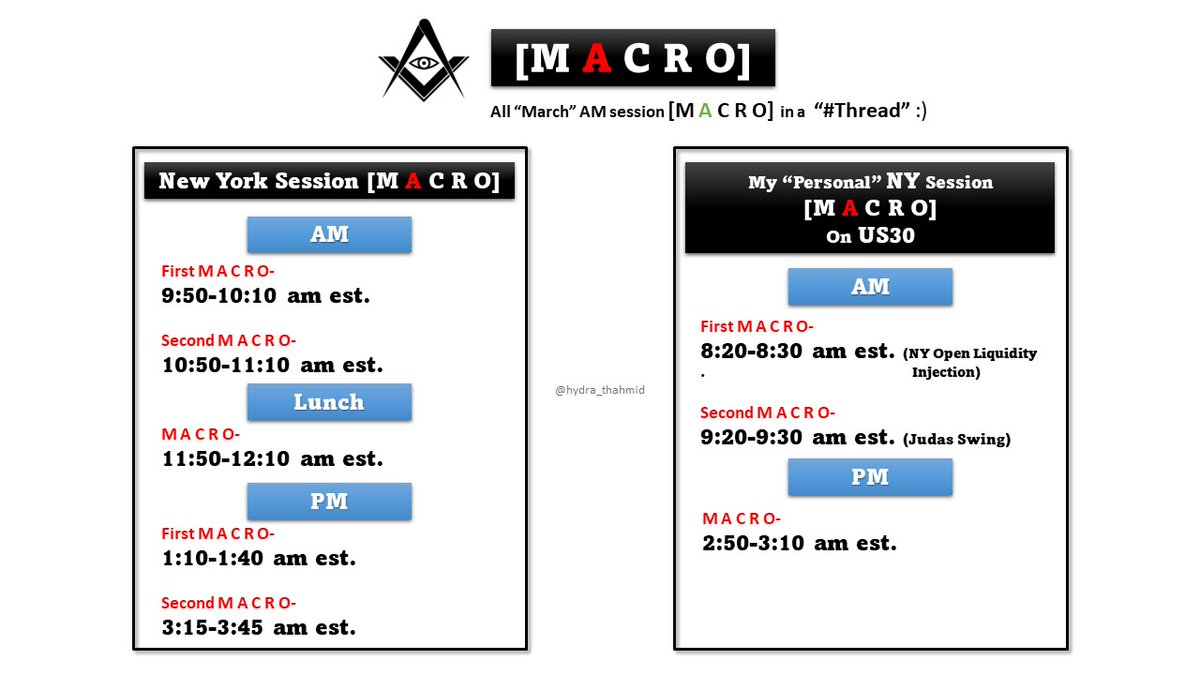

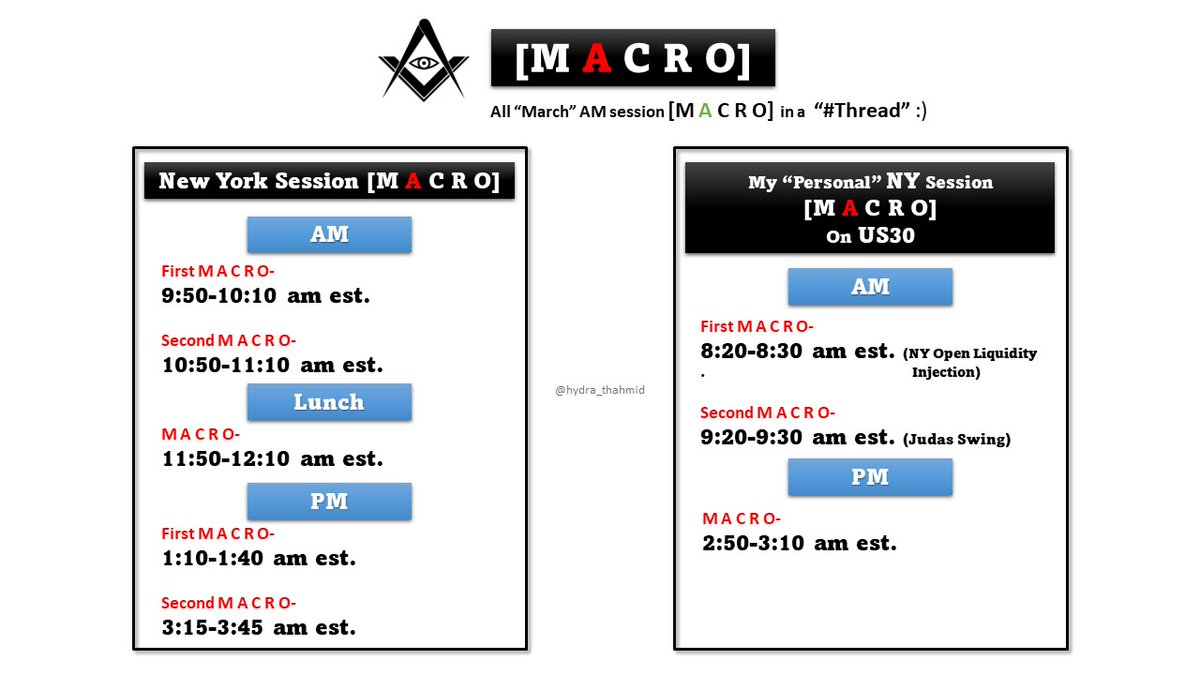

💎[M A C R O] for "BB"

💎[M A C R O] for "BB"

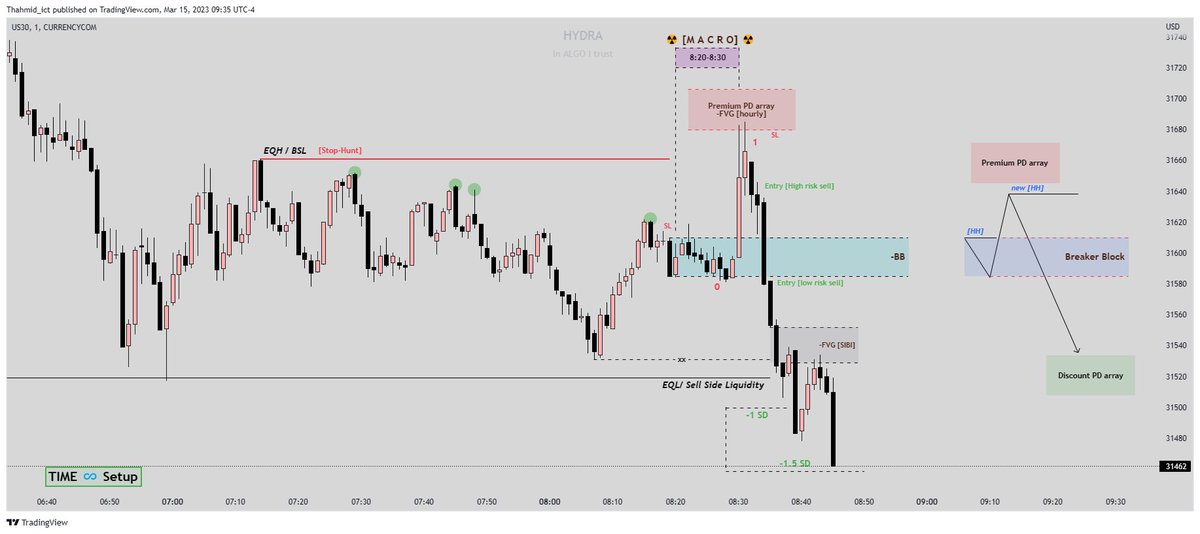

https://twitter.com/hydra_thahmid/status/1637837862916718592

♻️March 3, "9:20-9:30" [M A C R O]

♻️March 3, "9:20-9:30" [M A C R O]https://twitter.com/Hydra_Thahmid/status/1631681150803496960?s=20

Example of "Inversion/ Reclaimed FVG" on #US30

Example of "Inversion/ Reclaimed FVG" on #US30https://twitter.com/Hydra_Thahmid/status/1628893049437782016?s=20

🦄Took the risk & it paid well

🦄Took the risk & it paid well