Co-Founder @zukunftfab2050 | Lecturer University of St. Gallen | Ex-@GCEE_en

How to get URL link on X (Twitter) App

What is there already?

What is there already?

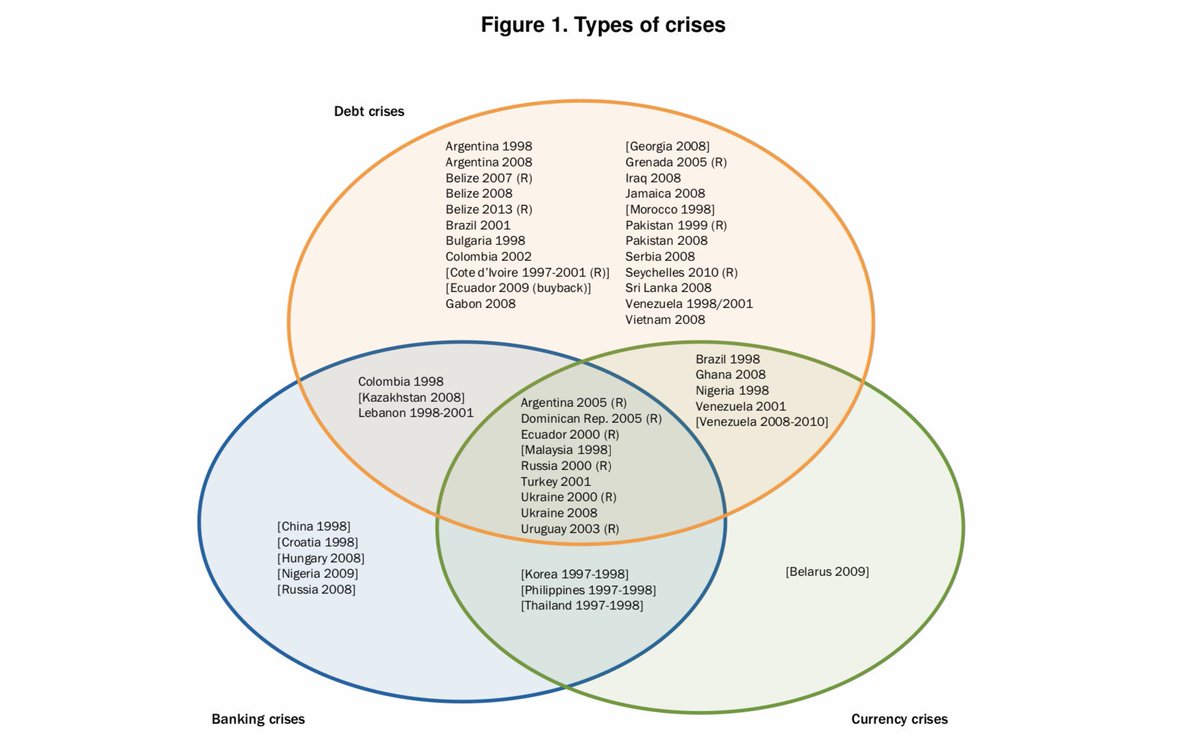

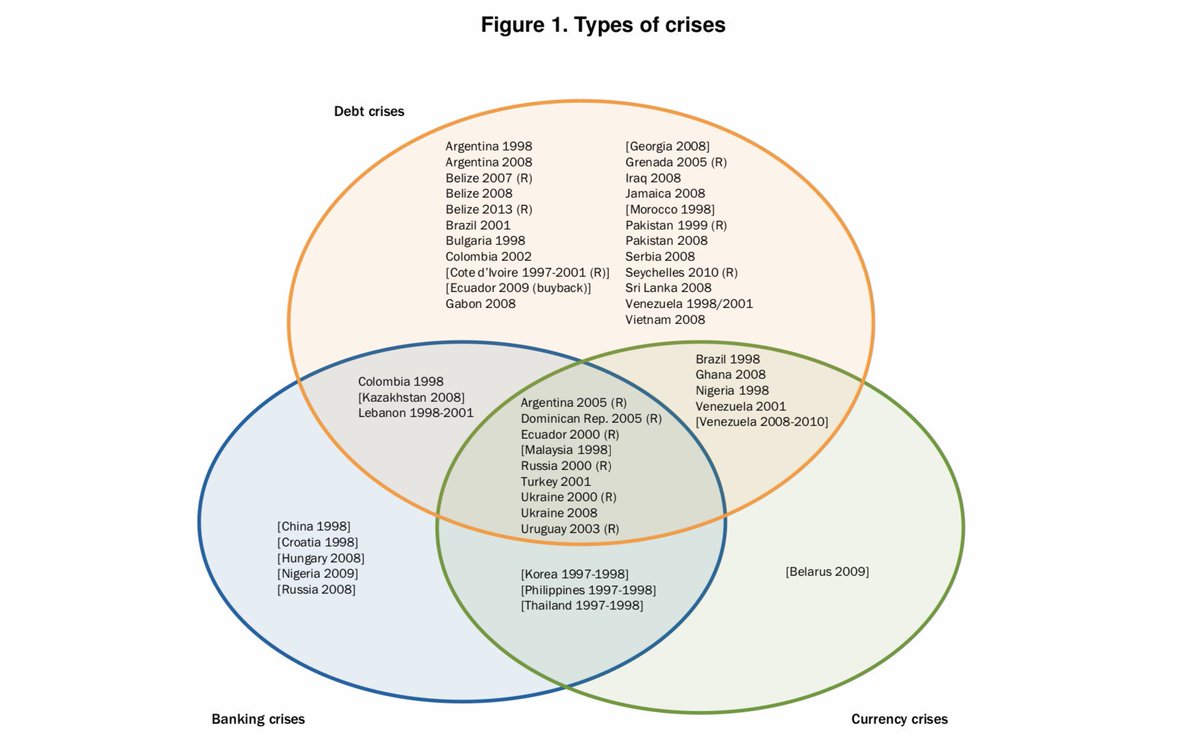

Point-in-time analyses like Cruses & Trebesch (2013) find that investors incur massive losses in sovereign debt restructuring of 40% of NPV on average. Our longer view also incorporates risk premia earned before a crisis & the recovery rally afterwards. What do we find? 2/7

Point-in-time analyses like Cruses & Trebesch (2013) find that investors incur massive losses in sovereign debt restructuring of 40% of NPV on average. Our longer view also incorporates risk premia earned before a crisis & the recovery rally afterwards. What do we find? 2/7