How to get URL link on X (Twitter) App

US dollar weakness has helped #gold move higher, but gold in euros is also at an all-time-high, so gold is outperforming a weak USD.

US dollar weakness has helped #gold move higher, but gold in euros is also at an all-time-high, so gold is outperforming a weak USD.

Gold trading on the Shanghai #Gold Exchange has moved to a large premium to the international gold price. We've seen premiums before, but the current percentage premium is unprecedented.

Gold trading on the Shanghai #Gold Exchange has moved to a large premium to the international gold price. We've seen premiums before, but the current percentage premium is unprecedented.

https://twitter.com/KrishanGopaul/status/1659539704138571777Putting this another way, if all the sales from the CBT have been to fulfill demand for gold domestically, then retail investment demand for #gold has exploded in Turkey.

I'll tweet out some of the highlights from the report for those too lazy to download it.

I'll tweet out some of the highlights from the report for those too lazy to download it.

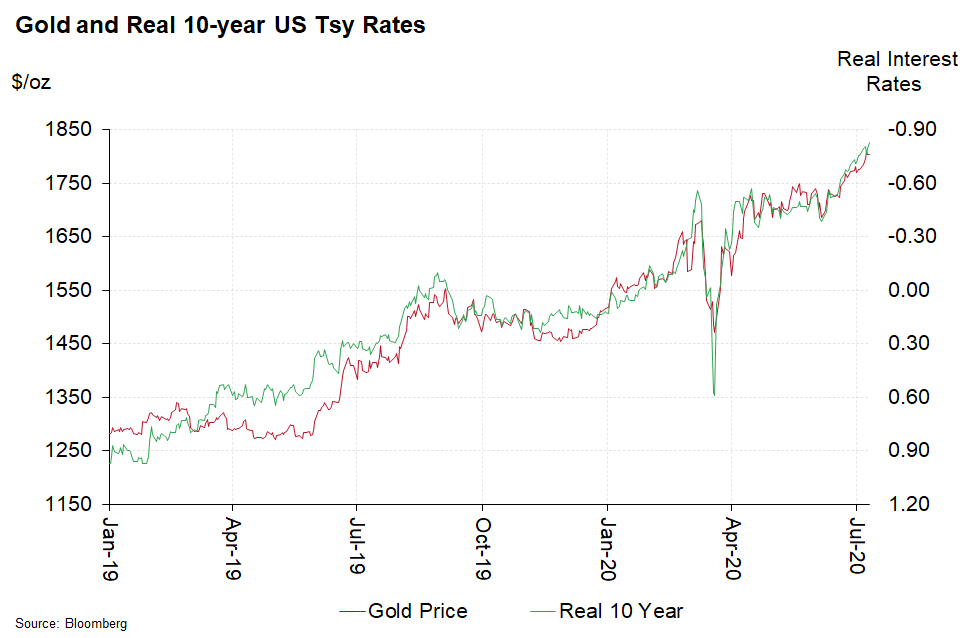

A version of this chart even made it into the FT recently, with the "TIPS implied gold price" from Macquarie.

A version of this chart even made it into the FT recently, with the "TIPS implied gold price" from Macquarie.

Since the start of the year, #gold is essentially flat...

Since the start of the year, #gold is essentially flat...

What triggered the initial move lower in #gold?

What triggered the initial move lower in #gold?

It’s great timing as far as we are concerned, as it means that #gold is getting a lot of attention ahead of the launch of our Q2-2020 / H1-2020 #GoldDemandTrends release, which will come out on Thursday.

It’s great timing as far as we are concerned, as it means that #gold is getting a lot of attention ahead of the launch of our Q2-2020 / H1-2020 #GoldDemandTrends release, which will come out on Thursday.

The best financial market-related explainer of the move in #gold is ever-falling real US yields and this relationship remains extremely important.

The best financial market-related explainer of the move in #gold is ever-falling real US yields and this relationship remains extremely important.

I’ve had a few questions this morning about

I’ve had a few questions this morning about

The Central Bank of the Russian Federation (CBR) had been a consistent gold buyer since 2006, reaching 2,279 tonnes of gold holdings as of March 2020 which accounted for 20.6% of total reserves. CBR’s announcement followed several signals that it was scaling back its gold buying.

The Central Bank of the Russian Federation (CBR) had been a consistent gold buyer since 2006, reaching 2,279 tonnes of gold holdings as of March 2020 which accounted for 20.6% of total reserves. CBR’s announcement followed several signals that it was scaling back its gold buying.

News that three large #gold Swiss refineries are halted for at least a week as this story from @peterhobson15 illustrates has played a role in this move.

News that three large #gold Swiss refineries are halted for at least a week as this story from @peterhobson15 illustrates has played a role in this move.

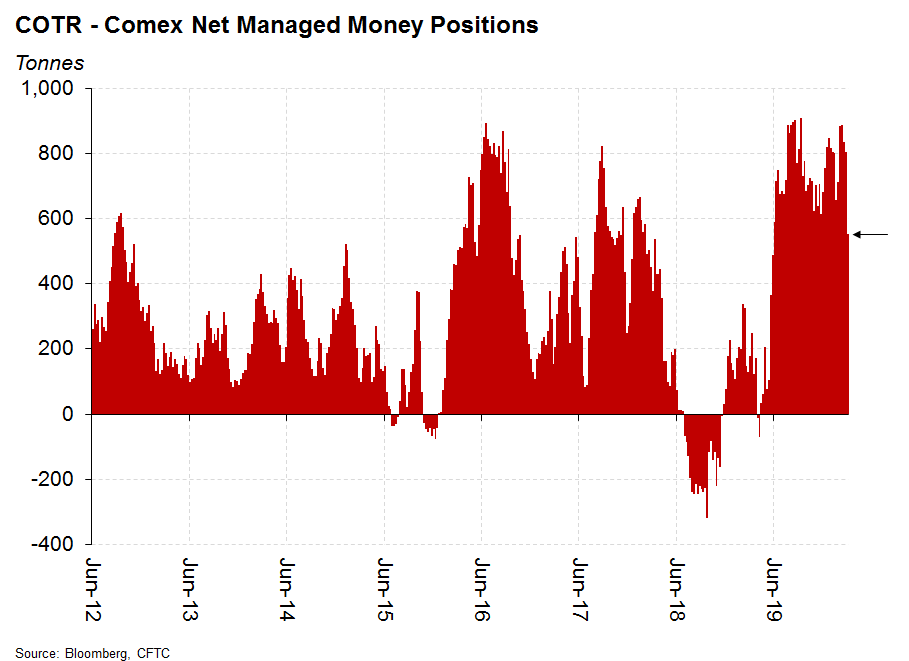

The key question for me is how much more leveraged selling will take place in #gold.

The key question for me is how much more leveraged selling will take place in #gold.

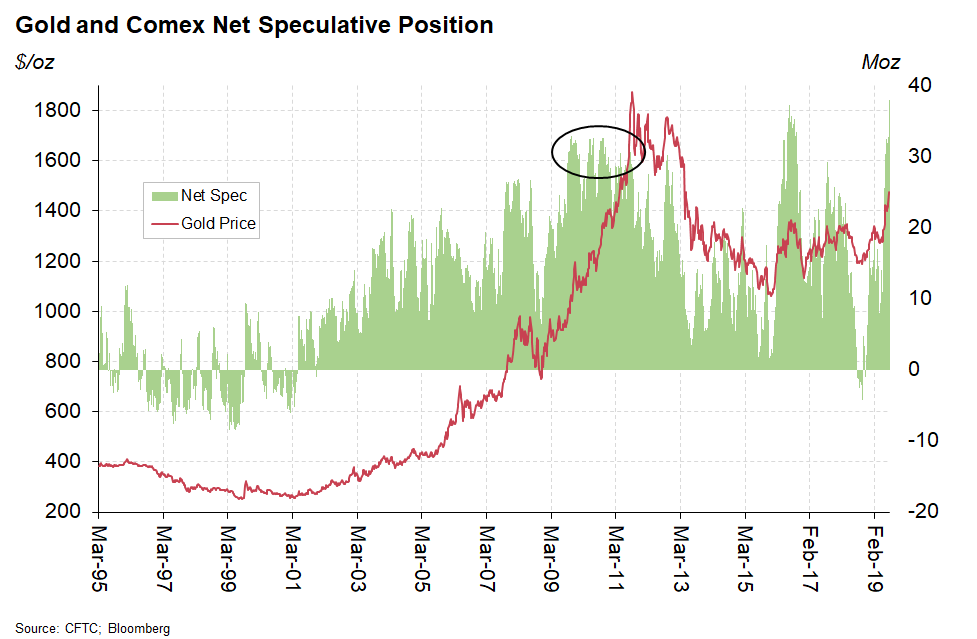

Gold has been a one-sided market for a while: investment and speculative demand is dominating trading while the Indian and Chinese physical markets have been quiet.

Gold has been a one-sided market for a while: investment and speculative demand is dominating trading while the Indian and Chinese physical markets have been quiet.

Switching to the Comex active contract, there is no sign of a particular jump in #gold volume such as was seen on Friday.

Switching to the Comex active contract, there is no sign of a particular jump in #gold volume such as was seen on Friday.

Today marks the end of the final Central Bank Gold Agreement (CBGA). Over the last twenty years, the agreement has helped stabilise the #gold market by limiting the amount of gold that signatories, all European central banks, could collectively sell in any one year.

Today marks the end of the final Central Bank Gold Agreement (CBGA). Over the last twenty years, the agreement has helped stabilise the #gold market by limiting the amount of gold that signatories, all European central banks, could collectively sell in any one year.

Firmer US equity futures (EUS9 up 24 points at the time of writing) and less negative real US yields appear to be driving #gold today, perhaps related to the story indicating that China won’t retaliate to new US Tariffs (for now).

Firmer US equity futures (EUS9 up 24 points at the time of writing) and less negative real US yields appear to be driving #gold today, perhaps related to the story indicating that China won’t retaliate to new US Tariffs (for now).

I’m not sure what the trigger was, although I suspect concern about the skirmishes in the looming trade war were to blame.

I’m not sure what the trigger was, although I suspect concern about the skirmishes in the looming trade war were to blame.

The sell-off triggered some outflows in #gold ETFs, which posted their first decline in 12 sessions and the largest one-day outflow in 3 months, accordiing to Bloomberg's robots.

The sell-off triggered some outflows in #gold ETFs, which posted their first decline in 12 sessions and the largest one-day outflow in 3 months, accordiing to Bloomberg's robots.

BUT

BUT