Energy and commodities columnist at Bloomberg.

Co-author of the 'The World for Sale'

Any views expressed are my own. jblas3@bloomberg.net

19 subscribers

How to get URL link on X (Twitter) App

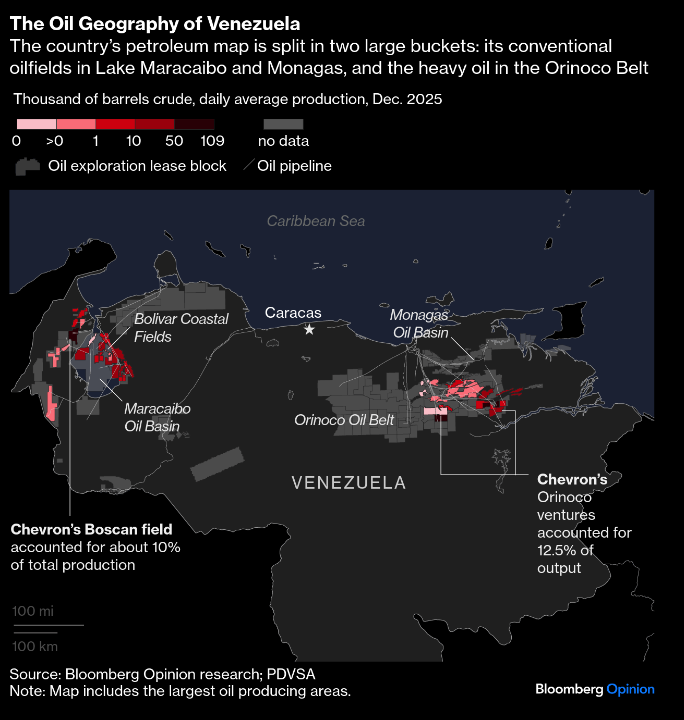

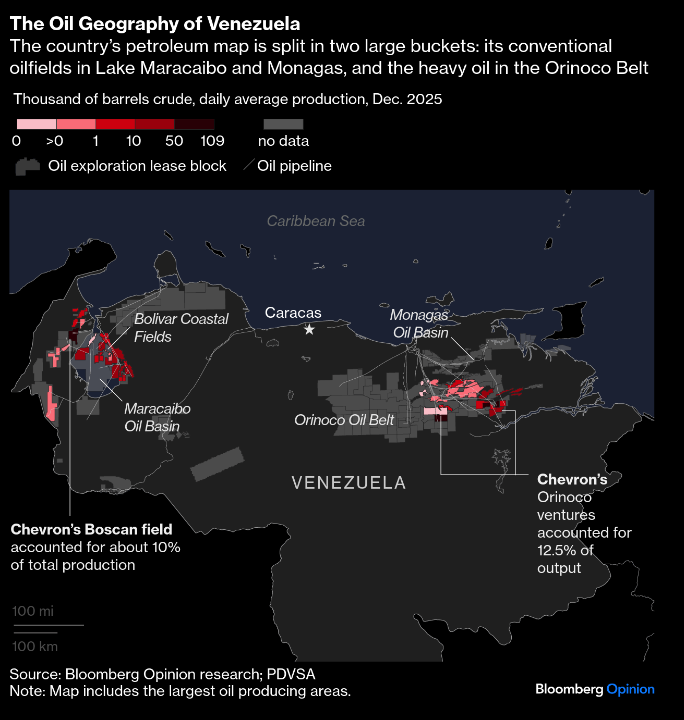

Sure, I’m talking about a *modest* recovery: hundreds of thousands of b/d rather than the millions needed to lift Venezuela’s production back to its 1970s peak. Still, this can be brought on stream over 12 to 18 months — and without eyewatering spending.

Sure, I’m talking about a *modest* recovery: hundreds of thousands of b/d rather than the millions needed to lift Venezuela’s production back to its 1970s peak. Still, this can be brought on stream over 12 to 18 months — and without eyewatering spending.

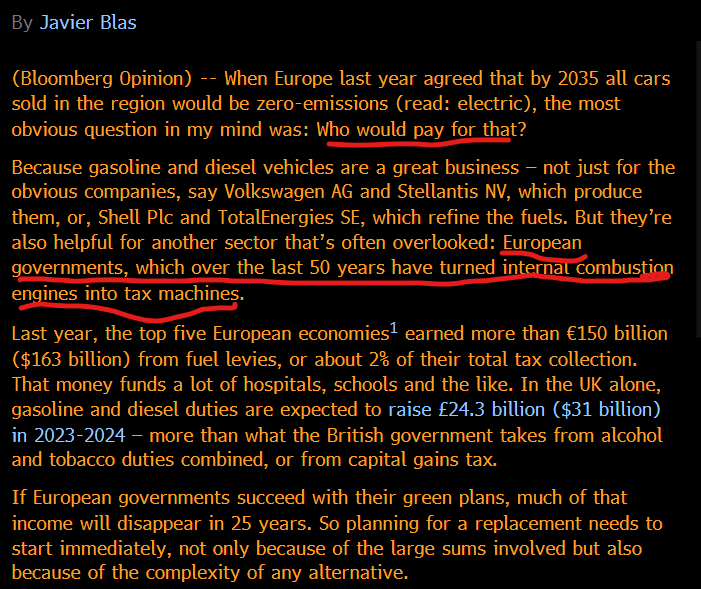

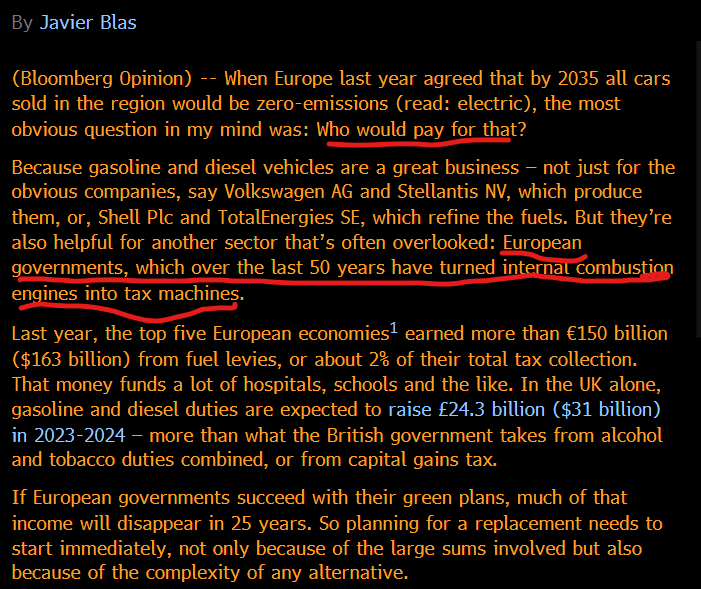

How to replace fuel duty taxes is a crucial question for European govs, which makes lots of money (more than oil companies) from fuel sales.

How to replace fuel duty taxes is a crucial question for European govs, which makes lots of money (more than oil companies) from fuel sales.

The opposite may even be true. It's a long shot, but a brief military campaign that triggered the collapse of the regime in Caracas — perhaps echoing the US invasions of Panama in 1989 — could go from bullish to bearish for the oil market rather quickly.

The opposite may even be true. It's a long shot, but a brief military campaign that triggered the collapse of the regime in Caracas — perhaps echoing the US invasions of Panama in 1989 — could go from bullish to bearish for the oil market rather quickly.

Coconut oil is an important ingredient of industrial-made gelatos. It's even more critical for a corner of industry: dairy-free (or vegan) ice cream wouldn’t exist without it.

Coconut oil is an important ingredient of industrial-made gelatos. It's even more critical for a corner of industry: dairy-free (or vegan) ice cream wouldn’t exist without it.

First, the magnitude of the rally:

First, the magnitude of the rally:

To understand the crisis, one has to travel to West Africa, home to ~75% of the worlds production. The king of cocoa is Ivory Coast, which accounts for 2 million tons of bean output, compared to global consumption of about 5 million tons.

To understand the crisis, one has to travel to West Africa, home to ~75% of the worlds production. The king of cocoa is Ivory Coast, which accounts for 2 million tons of bean output, compared to global consumption of about 5 million tons.

The full letter from Teck rejecting the unsolicited approach by Glencore is here: teck.com/media/Letter-A…

The full letter from Teck rejecting the unsolicited approach by Glencore is here: teck.com/media/Letter-A…

The easing of the oil sanctions come as the Venezuelan government and the democratic opposition re-started talks, brokered by Norway and Mexico. The talks between the two sides are the first direct contact in a year | #OOTT

The easing of the oil sanctions come as the Venezuelan government and the democratic opposition re-started talks, brokered by Norway and Mexico. The talks between the two sides are the first direct contact in a year | #OOTT

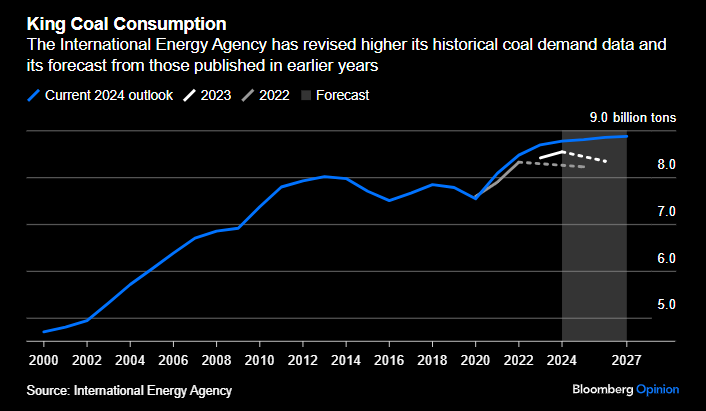

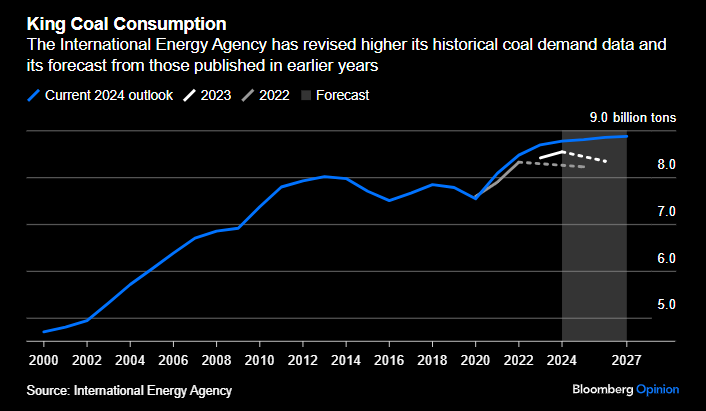

A couple of additional points: no advance from COP26 on coal: the COP27 document simply reiterates the Glasgow wording: coal remains a phase down, not a phase-out (and, in reality, coal demand is going up, on track for a record high both in 2022-23, surpassing the 2013 peak) 2/4

A couple of additional points: no advance from COP26 on coal: the COP27 document simply reiterates the Glasgow wording: coal remains a phase down, not a phase-out (and, in reality, coal demand is going up, on track for a record high both in 2022-23, surpassing the 2013 peak) 2/4

To trade oil with Iran and Burundi, Rich created a mysterious outfit called the Compagnie Burundaise de Commerce, (or Cobuco for short), directed by an enterprising employee who went by the pseudonym Monsieur Ndolo | 2/5

To trade oil with Iran and Burundi, Rich created a mysterious outfit called the Compagnie Burundaise de Commerce, (or Cobuco for short), directed by an enterprising employee who went by the pseudonym Monsieur Ndolo | 2/5

The report says that "the proximate cause of the crisis was Russia’s invasion of Ukraine". But it adds that "pressure on markets was visible before February 2022". Per the IEA: "The key underlying imbalance, which had been some years in the making, relates to

The report says that "the proximate cause of the crisis was Russia’s invasion of Ukraine". But it adds that "pressure on markets was visible before February 2022". Per the IEA: "The key underlying imbalance, which had been some years in the making, relates to