Learning the story of markets, one graph at a time.

Investing | Finance | Tableau | Python

How to get URL link on X (Twitter) App

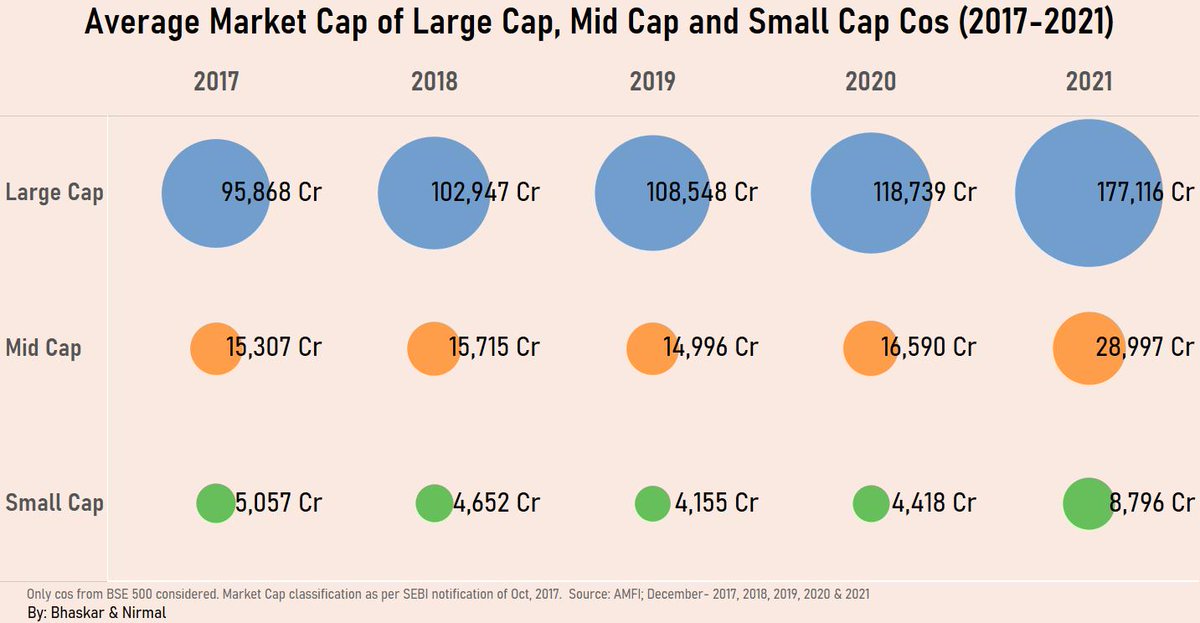

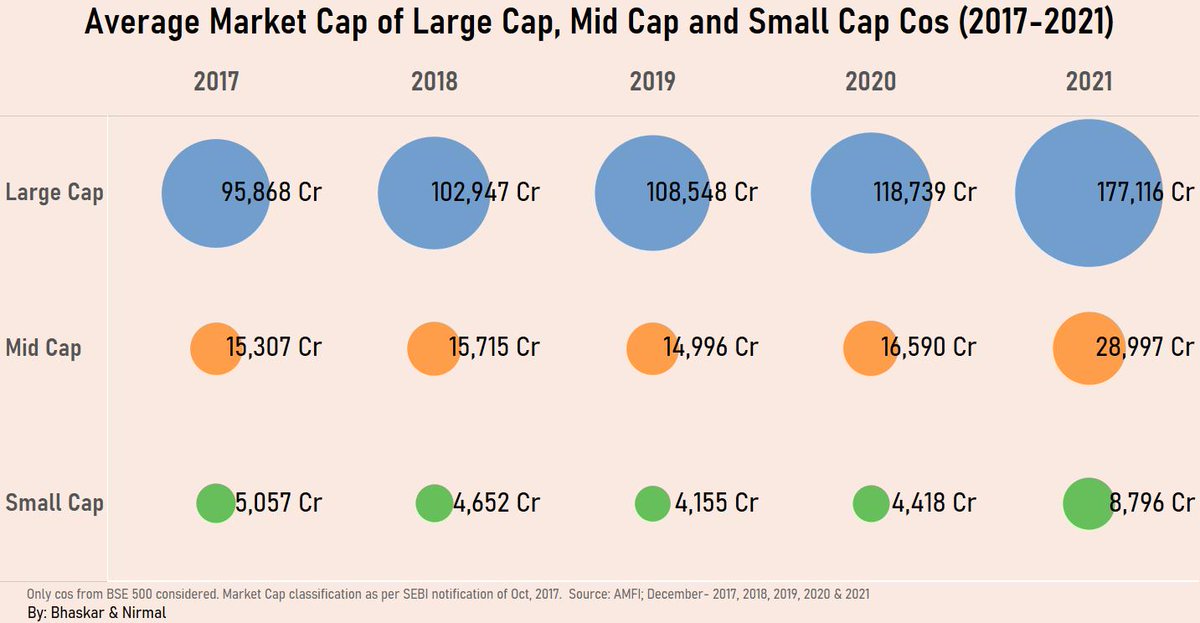

Large-cap: top 100 cos as per market capitalization (mcap)

Large-cap: top 100 cos as per market capitalization (mcap)

Some numbers to put things in context-

Some numbers to put things in context-