Adjunct professor @nuseai National University Singapore. Non-resident senior fellow MERICS, Asia Society Policy Institute. On substack and the blue place.

How to get URL link on X (Twitter) App

I talked about how global trade tension is affecting RCEP. Though I am pessimistic on the former, the outcome for RCEP may not be all that negative. In particular, the trade tensions have intensified the China -ASEAN cooperation. The story for Japan and Korea is less clear.

I talked about how global trade tension is affecting RCEP. Though I am pessimistic on the former, the outcome for RCEP may not be all that negative. In particular, the trade tensions have intensified the China -ASEAN cooperation. The story for Japan and Korea is less clear.

https://twitter.com/zichenwanghere/status/1777342316359074014mechanism at work, and supply and demand balance is relative, with imbalance often being the norm. This can occur in any economy operating under a market economy system, including historical instances in the U.S. and other Western countries. Solutions to these issues primarily 2/

The report focuses on business strategies to deal with US-China decoupling. The uncertainty that the thread of decoupling creates has spill-over effects for companies around the world. Governments can help companies by (i) providing clear policies for their own companies with

The report focuses on business strategies to deal with US-China decoupling. The uncertainty that the thread of decoupling creates has spill-over effects for companies around the world. Governments can help companies by (i) providing clear policies for their own companies with

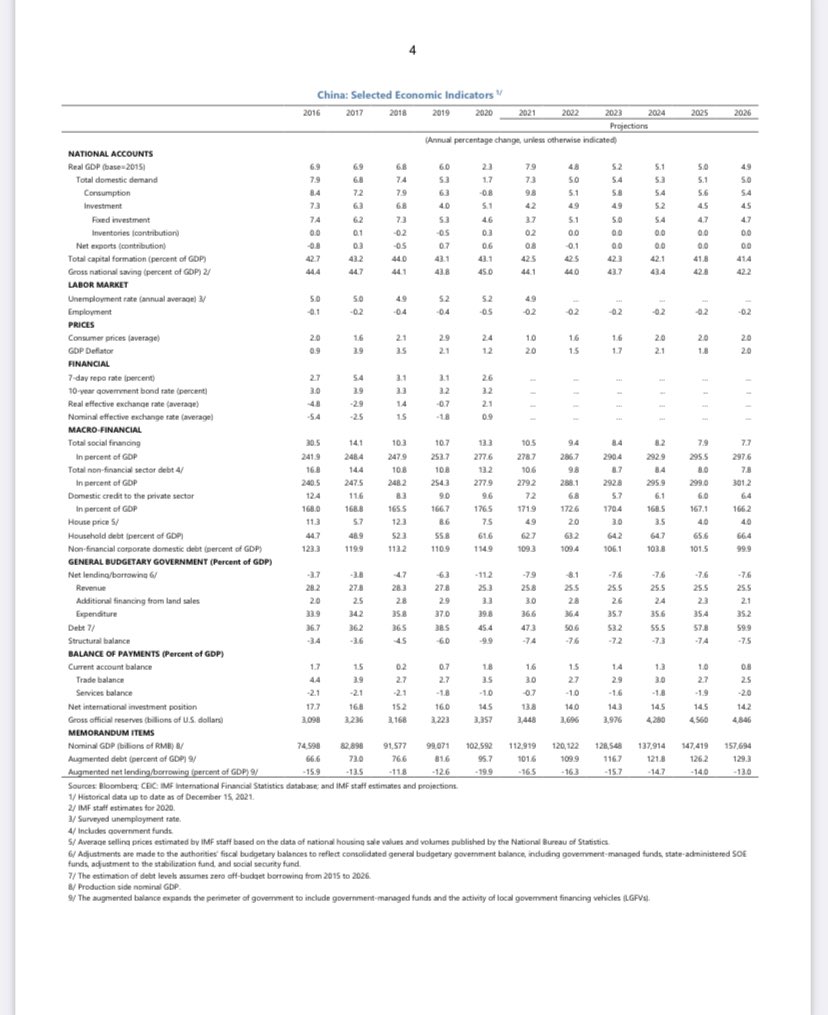

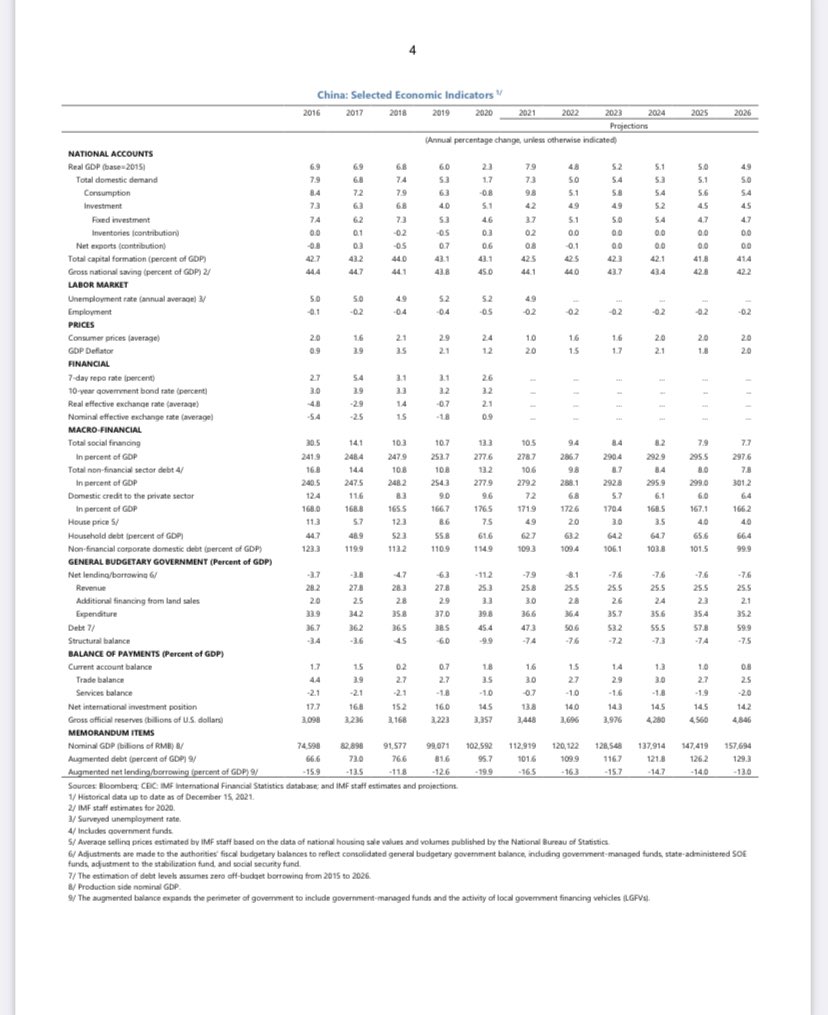

The IMF projects total social financing to continue to grow as a share of GDP to top 320 percent by 2028. The government's augmented debt (including most Local government financing vehicles and government guided funds) to top 143 percent by 2028.

The IMF projects total social financing to continue to grow as a share of GDP to top 320 percent by 2028. The government's augmented debt (including most Local government financing vehicles and government guided funds) to top 143 percent by 2028.

A remarkable turnaround for the EU as well. Their growing science funding programs are an attraction for many!

A remarkable turnaround for the EU as well. Their growing science funding programs are an attraction for many!

I will be watching from Singapore, and will live tweet some of Xi Jinping's speech and comment on it as it happens.

I will be watching from Singapore, and will live tweet some of Xi Jinping's speech and comment on it as it happens.

At the same time, China must succeed, as it is now by far the largest greenhouse gas emitter, and its per capita emission levels is considerably higher than the EU, Japan, and other comparators.

At the same time, China must succeed, as it is now by far the largest greenhouse gas emitter, and its per capita emission levels is considerably higher than the EU, Japan, and other comparators.

https://twitter.com/ftchina/status/1552503502764662786--this risks perpetuating the misallocation of capital that has been plaguing China for some years now. Property and infrastructure have accounted for a growing share of total investments in China, which has been a key cause of the decline in productivity during the past decade.

adb.org/publications/a…

adb.org/publications/a…

COVID restrictions are the main chokepoint for China's growth, but the country would have sufficient macro policy space to boost growth.

COVID restrictions are the main chokepoint for China's growth, but the country would have sufficient macro policy space to boost growth.

Comparable to that of OECD countries. But Chinese households do not pay any real estate tax (or "recurrent taxes on immovable property" as the OECD parlance goes). Even if the Chinese authorities manage to introduce a real estate tax for household s(and that is a big if) 2/

Comparable to that of OECD countries. But Chinese households do not pay any real estate tax (or "recurrent taxes on immovable property" as the OECD parlance goes). Even if the Chinese authorities manage to introduce a real estate tax for household s(and that is a big if) 2/