Bitcoin made easy | Leading BTC-only exchange | Empowering financial freedom | Secure buying, saving & education | Your trusted partner on your bitcoin journey.

How to get URL link on X (Twitter) App

1/

1/

We have been hyper-focused on solving a very specific problem: making bitcoin user-friendly.

We have been hyper-focused on solving a very specific problem: making bitcoin user-friendly.

2/

2/https://twitter.com/CoinbitsApp/status/1539257660888989699?s=20&t=-9rmxJUg4XjMz3nHy684Eg

2/

2/https://twitter.com/CoinbitsApp/status/1580537129222180866?s=20&t=2TauXsjSvHri-GjcfuawuA

2/

2/

2/

2/

https://twitter.com/CoinbitsApp/status/1569178869244076037?s=20&t=TscMi6vmTvHxn_7CWfIA3g

2/

2/https://twitter.com/CoinbitsApp/status/1509199799320522762?s=20&t=H6MzTOLIhLrXciCi_CRceQ

2/

2/https://twitter.com/CoinbitsApp/status/1552287842910478336

https://twitter.com/CoinbitsApp/status/1504072457577283585?s=20&t=m2EJVYQlv1VhI5m5l1tOSw

2/

2/

2/

2/https://twitter.com/coinbitsapp/status/1547203332330196992

https://twitter.com/CoinbitsApp/status/1554892785903435780?s=20&t=JRUOFun83w4sn9FXlKxOOw27/

2/

2/

2/

2/ https://twitter.com/CoinbitsApp/status/1504072457577283585?s=20&t=LYcV91vnpng-A38g388ZUQ

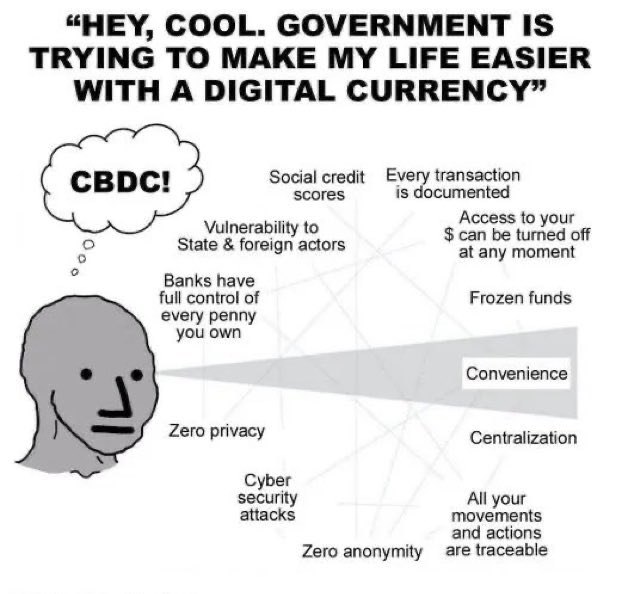

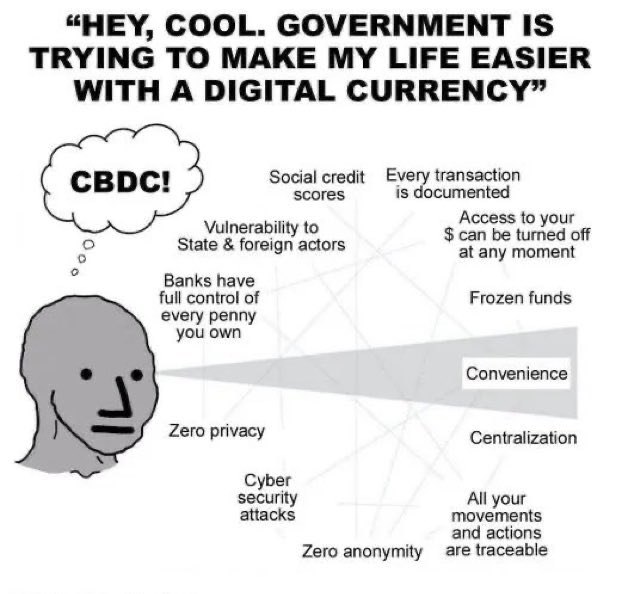

https://twitter.com/BrianDeeseNEC/status/15469167527555072011/

https://twitter.com/CoinbitsApp/status/1536804762456313858

bis.org/publ/arpdf/ar2…

bis.org/publ/arpdf/ar2…