How to get URL link on X (Twitter) App

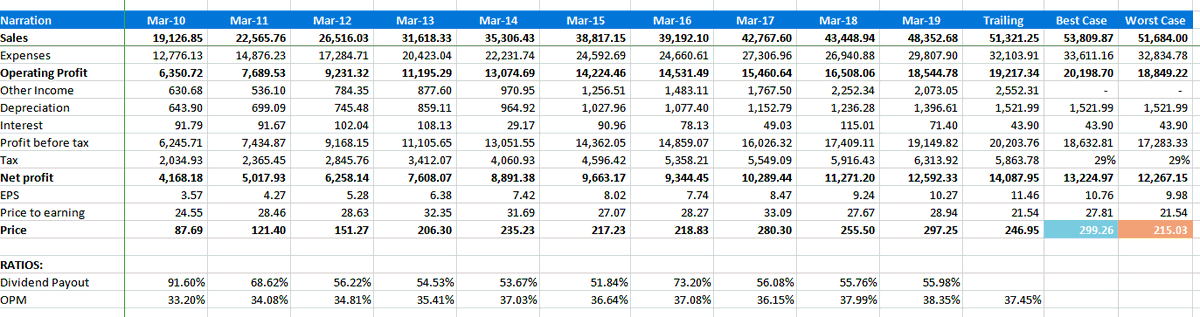

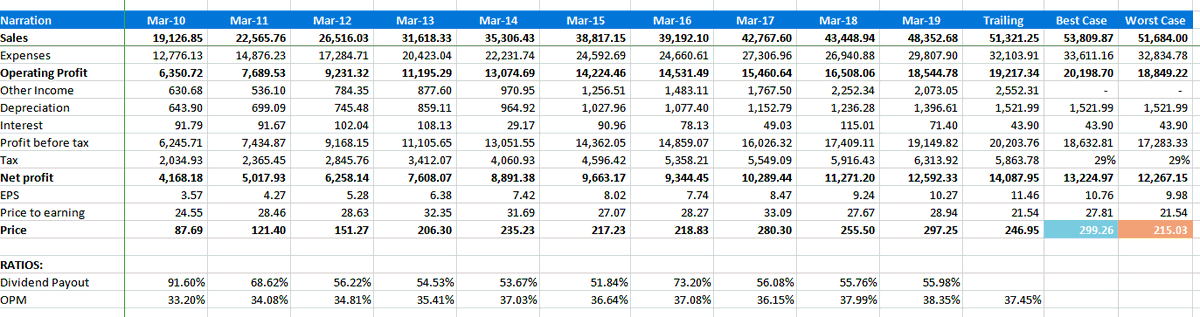

FMCG + Agri: YoY Sales up by 8% & 19% respectively.

FMCG + Agri: YoY Sales up by 8% & 19% respectively.

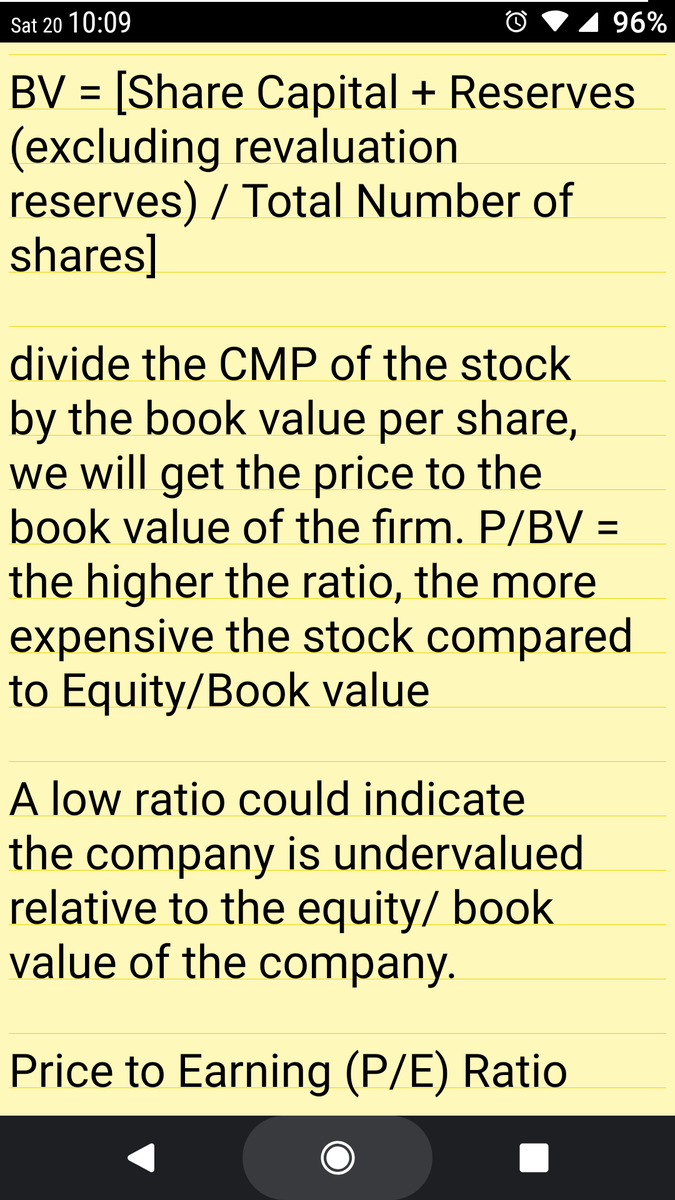

2/n Price to Book Value, one of the method to know if CMP is overvalued or undervalued compared to Book Value or Value if Liquidated, cases like Jet, Rcom may have BV higher > CPM but doesn't mean it's attractive price, a detailed article to read on BV m.businesstoday.in/story/stocks-t…

2/n Price to Book Value, one of the method to know if CMP is overvalued or undervalued compared to Book Value or Value if Liquidated, cases like Jet, Rcom may have BV higher > CPM but doesn't mean it's attractive price, a detailed article to read on BV m.businesstoday.in/story/stocks-t…

Example on L&TFH

Example on L&TFH