How to get URL link on X (Twitter) App

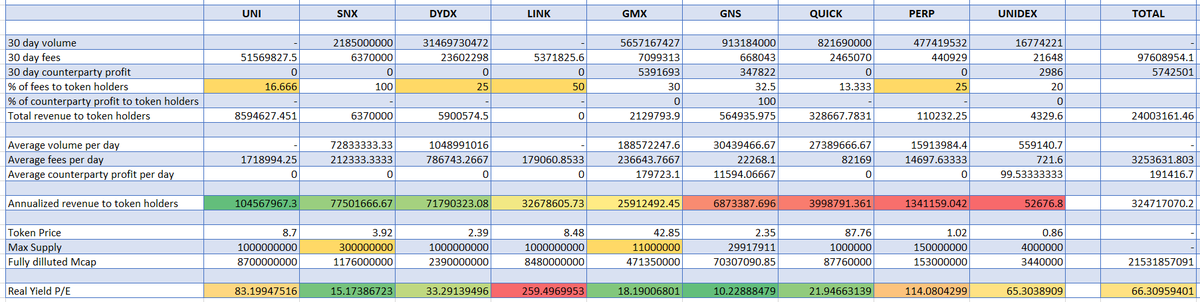

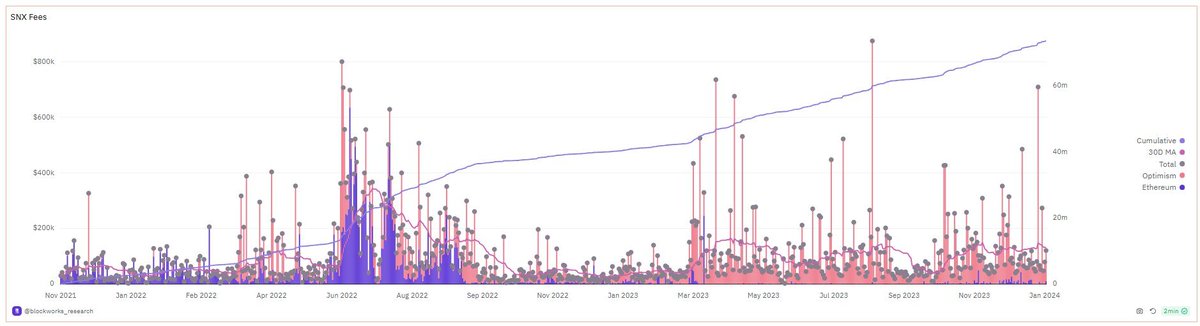

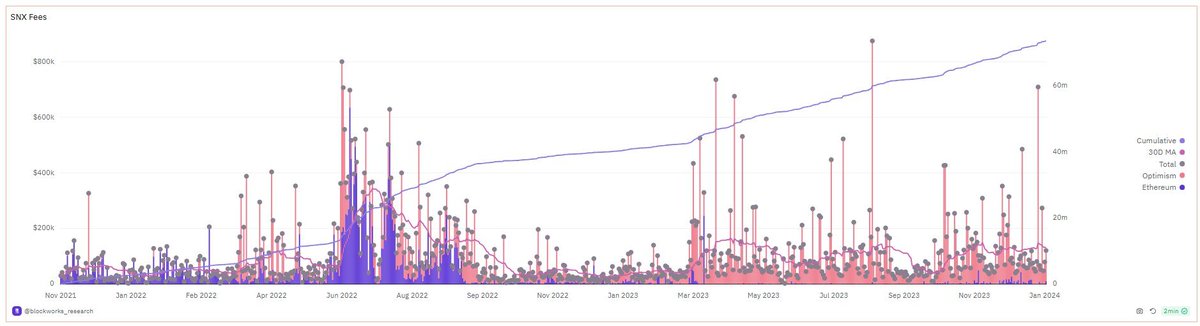

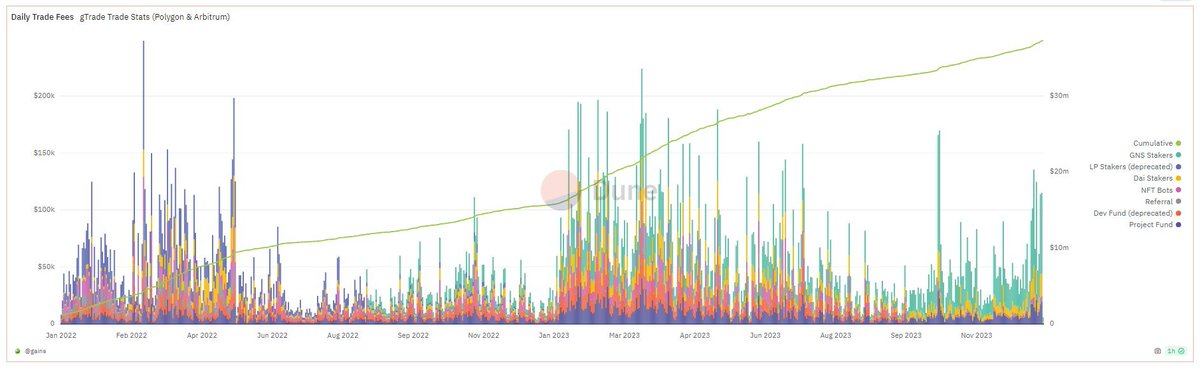

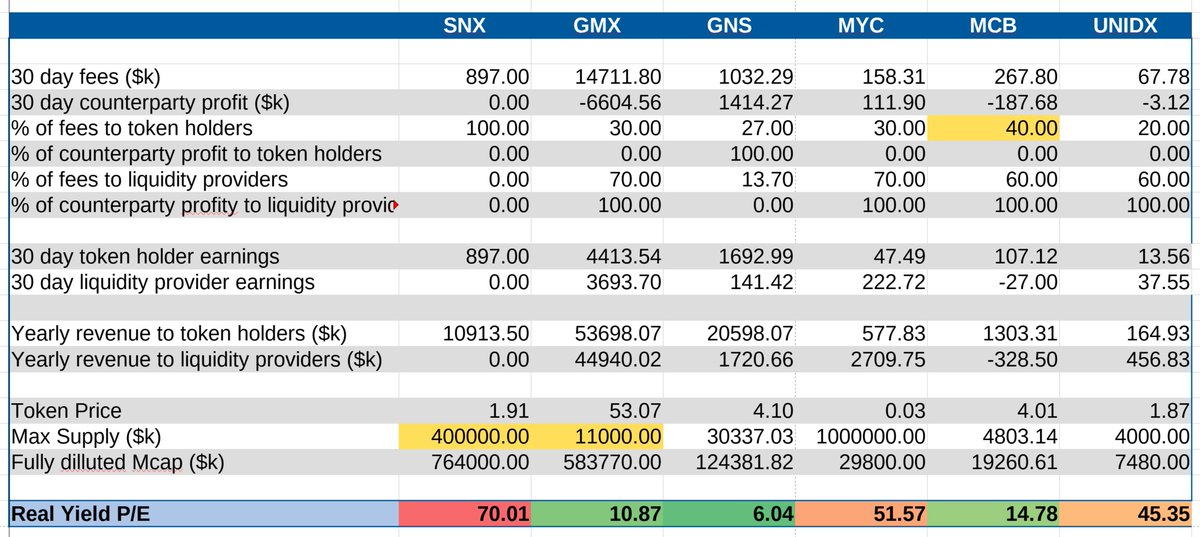

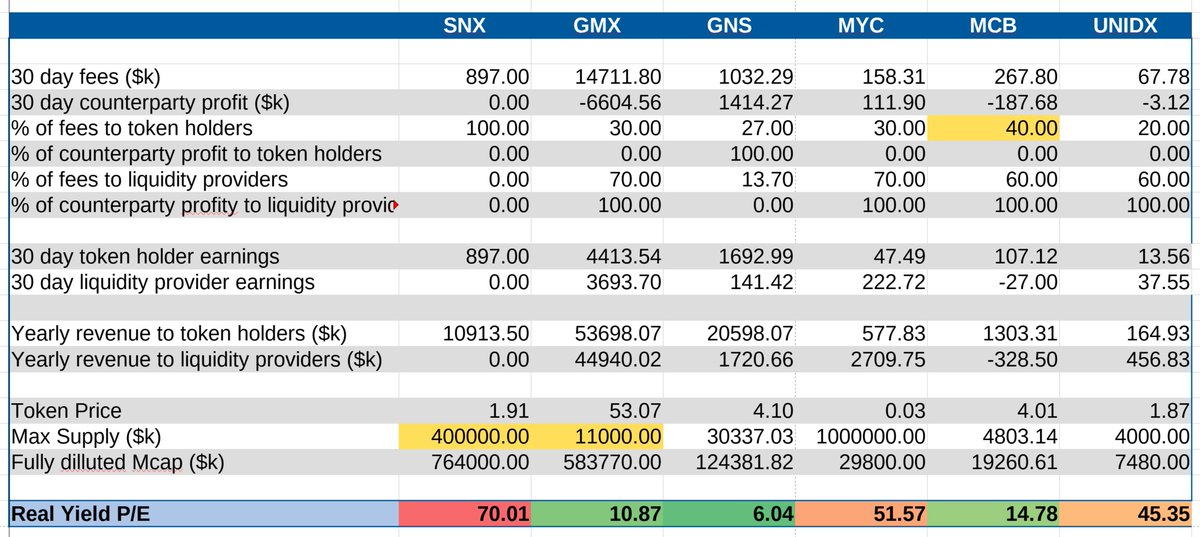

$GNS has only made $37.27M in fees in 27 months or $16.63M per year. Only 61.5% of those fees go to $GNS token holders. Leaving only $10.23M/yr for token holders.

$GNS has only made $37.27M in fees in 27 months or $16.63M per year. Only 61.5% of those fees go to $GNS token holders. Leaving only $10.23M/yr for token holders.

https://twitter.com/derpaderpederp/status/1648270029899661312I bought even more $GNS!

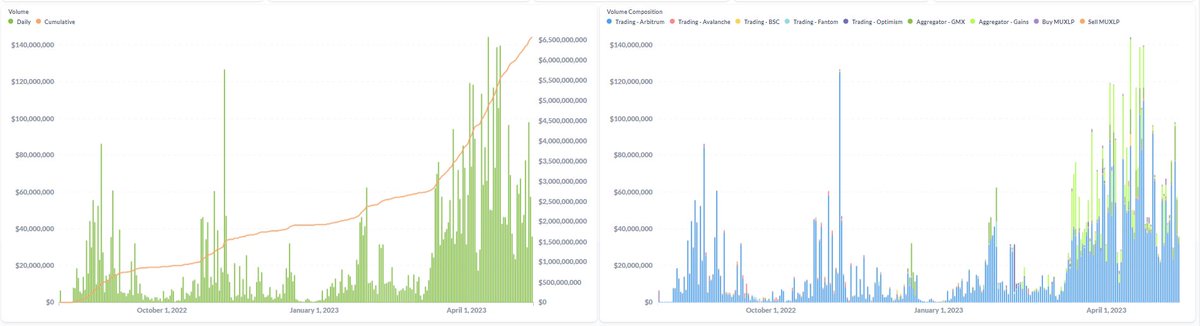

Best performance (+60%) out of the bunch was for $MCB / $MUX.

Best performance (+60%) out of the bunch was for $MCB / $MUX.

One of the things that really jump out is how $GMX gives almost 5x as many fees to token holders as $SNX yet has a lower estimated FDV.

One of the things that really jump out is how $GMX gives almost 5x as many fees to token holders as $SNX yet has a lower estimated FDV.

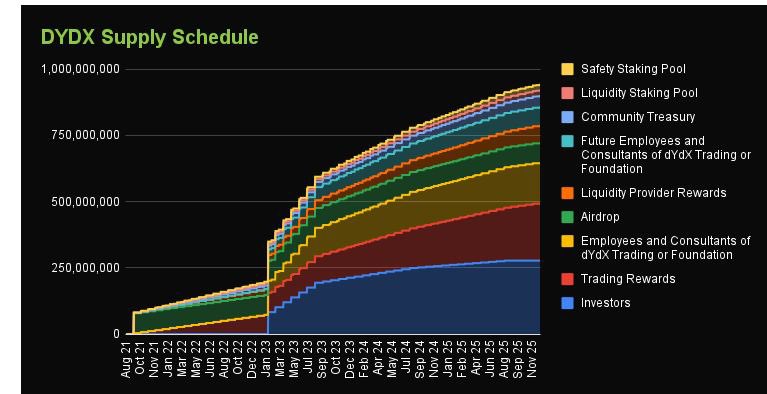

$DYDX was once valued at 24.5 Billion with only a tiny fraction of their tokens in circulation. Continued dillution that incentivizes trading pushed token price ever lower.

$DYDX was once valued at 24.5 Billion with only a tiny fraction of their tokens in circulation. Continued dillution that incentivizes trading pushed token price ever lower.

https://twitter.com/mtaibbi/status/1598822959866683394In 2018 this video surfaced where the hyperbiased nature of Google (and daughter company Youtube) is on display.

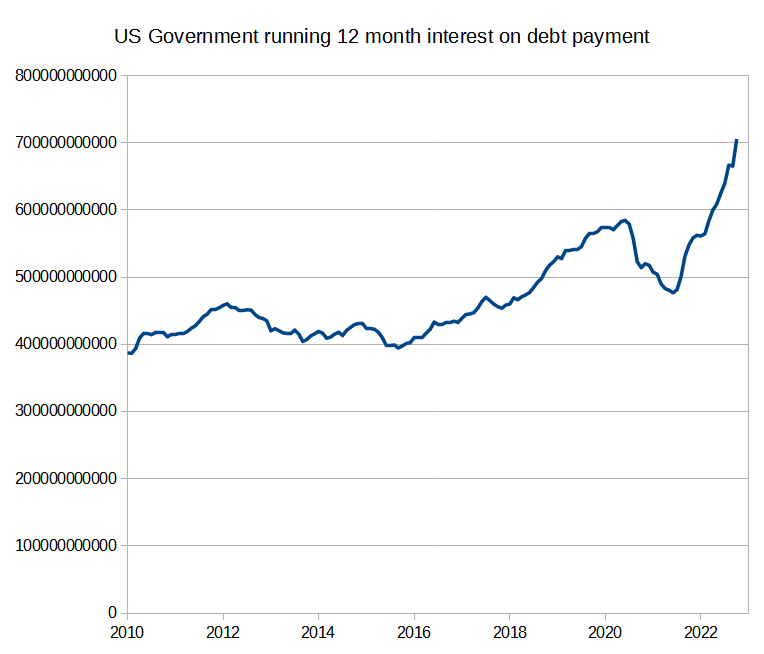

By issuing more debt!

By issuing more debt!

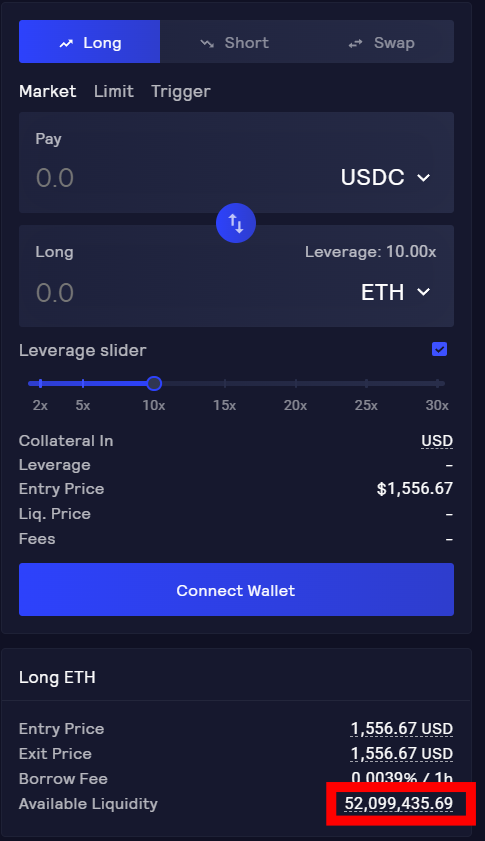

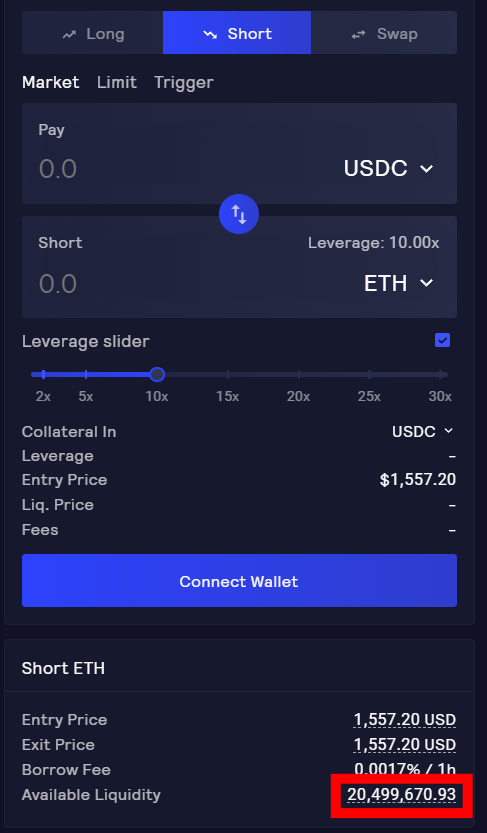

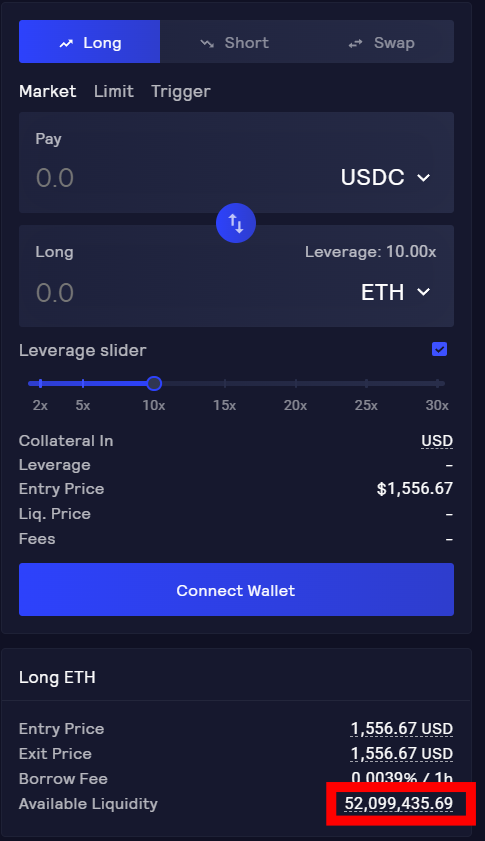

https://twitter.com/flywheelpod/status/1565719949435338752GMX allows you to long $ETH with 52 million dollars whilst not moving the price of $ETH at all. It then also allows you to short $ETH with $20 million again with no price impact.