J Auto Trading Strategies, LLC

Think It 》Trade It 》Automate It

JATS: https://t.co/OFhHcSykxq

NT Vendor Affiliate

Disclosure: https://t.co/ZNROC7VB7x

How to get URL link on X (Twitter) App

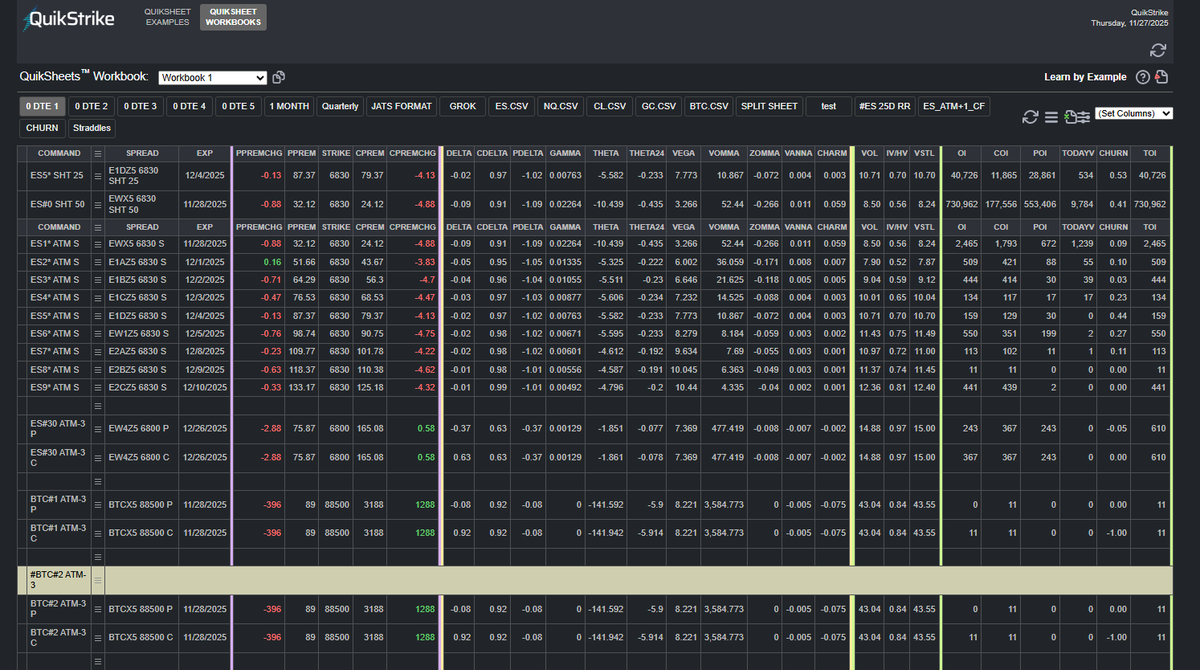

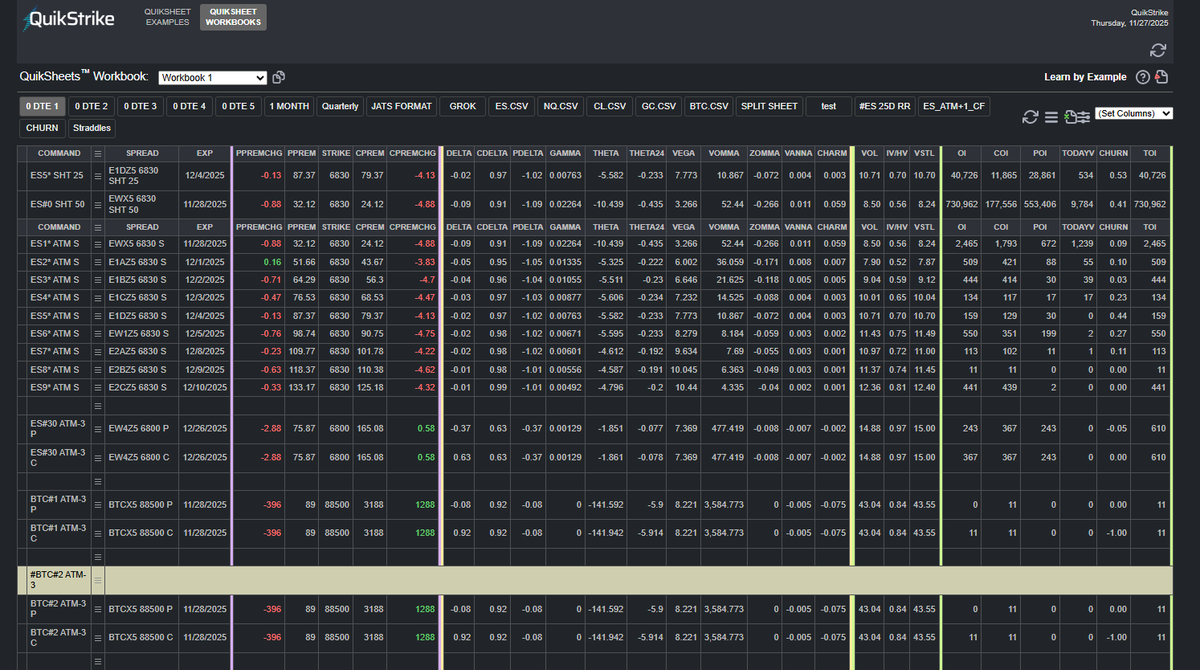

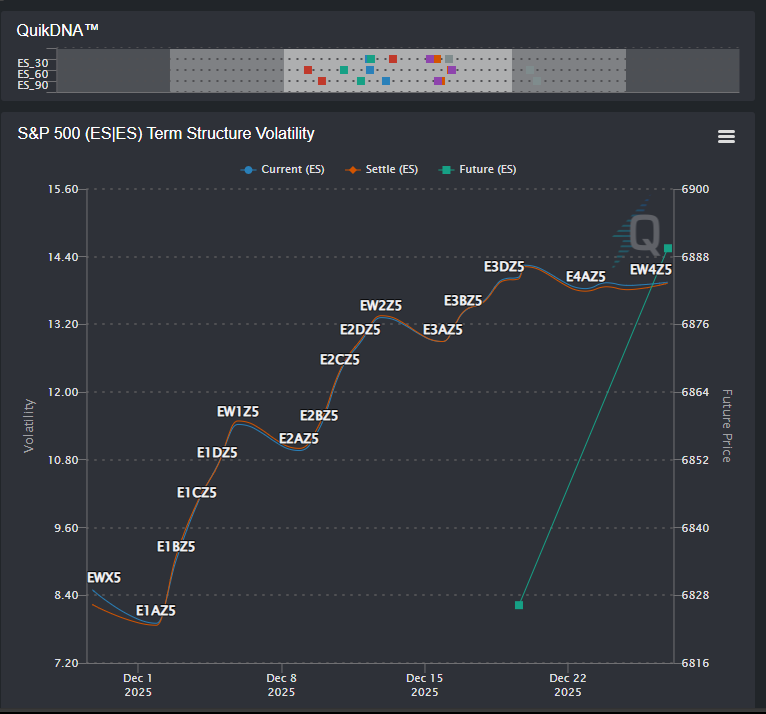

Navigating Year-End Volatility: S&P 500 (ES) Futures Outlook to 7,000 -- November 27, 2025 -- 22 DTE

Navigating Year-End Volatility: S&P 500 (ES) Futures Outlook to 7,000 -- November 27, 2025 -- 22 DTE

https://twitter.com/CathieDWood/status/1538508967437279232

This means Central Banks are going to sell their equities and park cash at fed along with everybody else.

This means Central Banks are going to sell their equities and park cash at fed along with everybody else.