Ex-neuroscientist | Python Maximalist | Swing HODLer | Data Scientist | Co-founder @glassnode

17 subscribers

How to get URL link on X (Twitter) App

2/ MVRV Pricing Bands are derived from the amount of days that MVRV has traded at extreme levels.

2/ MVRV Pricing Bands are derived from the amount of days that MVRV has traded at extreme levels.

2/ Transaction counts rose more than 2x compared to the 2022 baseline, which had remained in a stable range of ~250k txs per day throughout last year.

2/ Transaction counts rose more than 2x compared to the 2022 baseline, which had remained in a stable range of ~250k txs per day throughout last year.

1/ First, the average #Bitcoin block size has seen a massive increase, constantly reaching values well above 2 MB throughout the past week.

1/ First, the average #Bitcoin block size has seen a massive increase, constantly reaching values well above 2 MB throughout the past week.

2/ Creating a live version of @WClementeIII's #Bitcoin Delta Price / Realized Price (DPRP) Ratio

2/ Creating a live version of @WClementeIII's #Bitcoin Delta Price / Realized Price (DPRP) Ratio

2/ In fact, #Bitcoin mining difficulty increased by 5.8% last Friday – to a new ATH as well.

2/ In fact, #Bitcoin mining difficulty increased by 5.8% last Friday – to a new ATH as well.

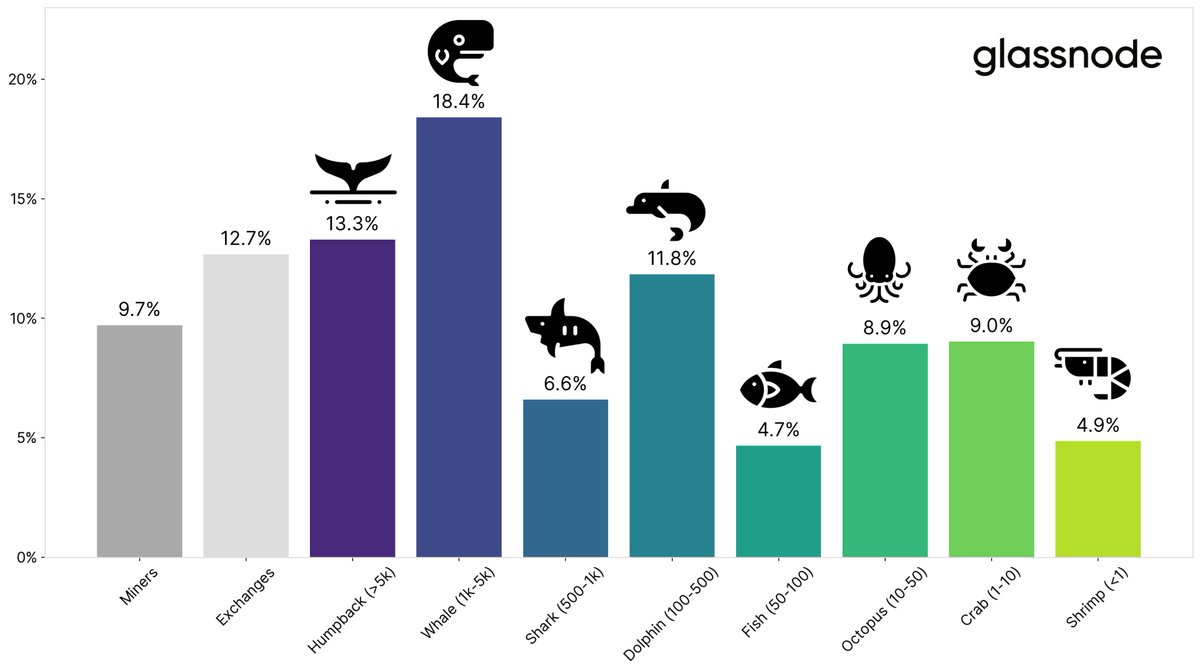

1/ We split the #Bitcoin supply into network participants of varying sizes, treating miners & exchanges separately.

1/ We split the #Bitcoin supply into network participants of varying sizes, treating miners & exchanges separately.

1/ Accumulation Balance

1/ Accumulation Balance

2/ MVRV Z-Score ($240,000)

2/ MVRV Z-Score ($240,000)

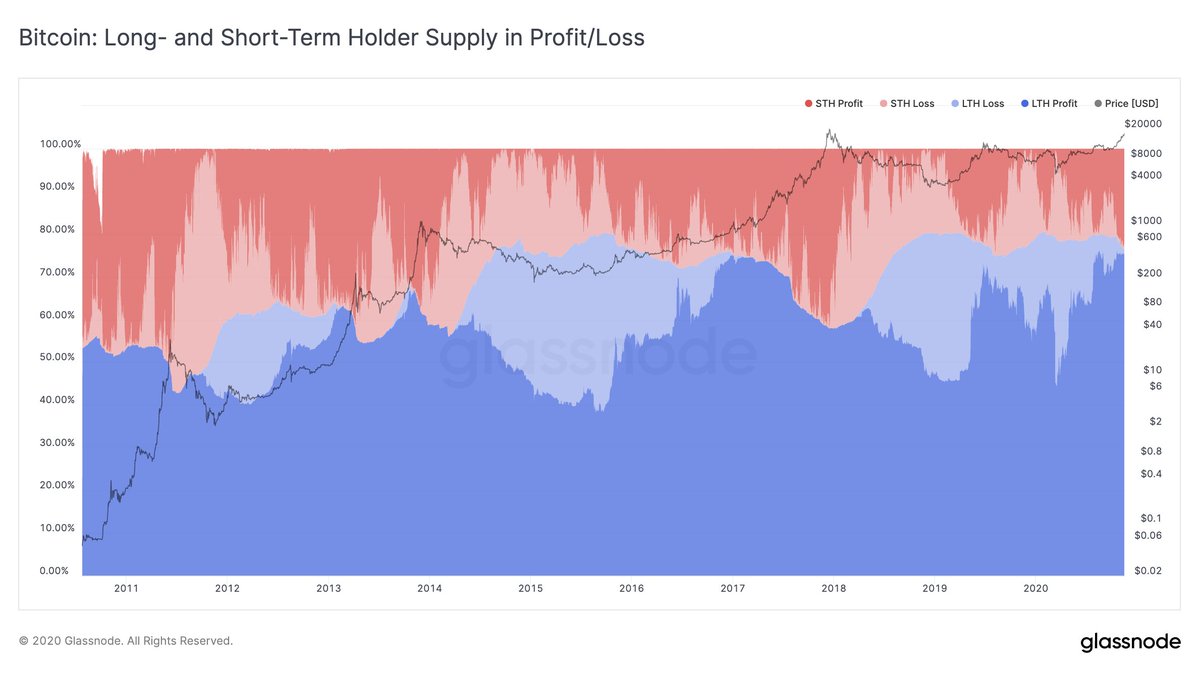

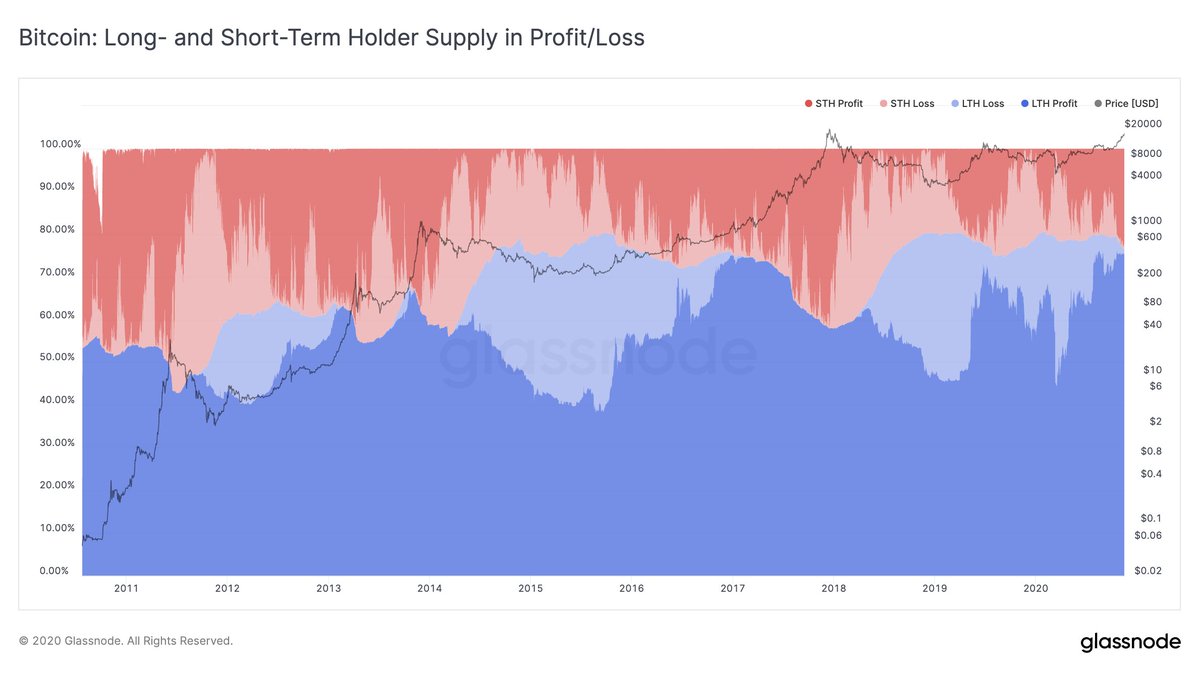

2/ After a monthslong increase, the total #Bitcoin supply held by long-term holders has recently started to decline – while $BTC appreciates.

2/ After a monthslong increase, the total #Bitcoin supply held by long-term holders has recently started to decline – while $BTC appreciates.

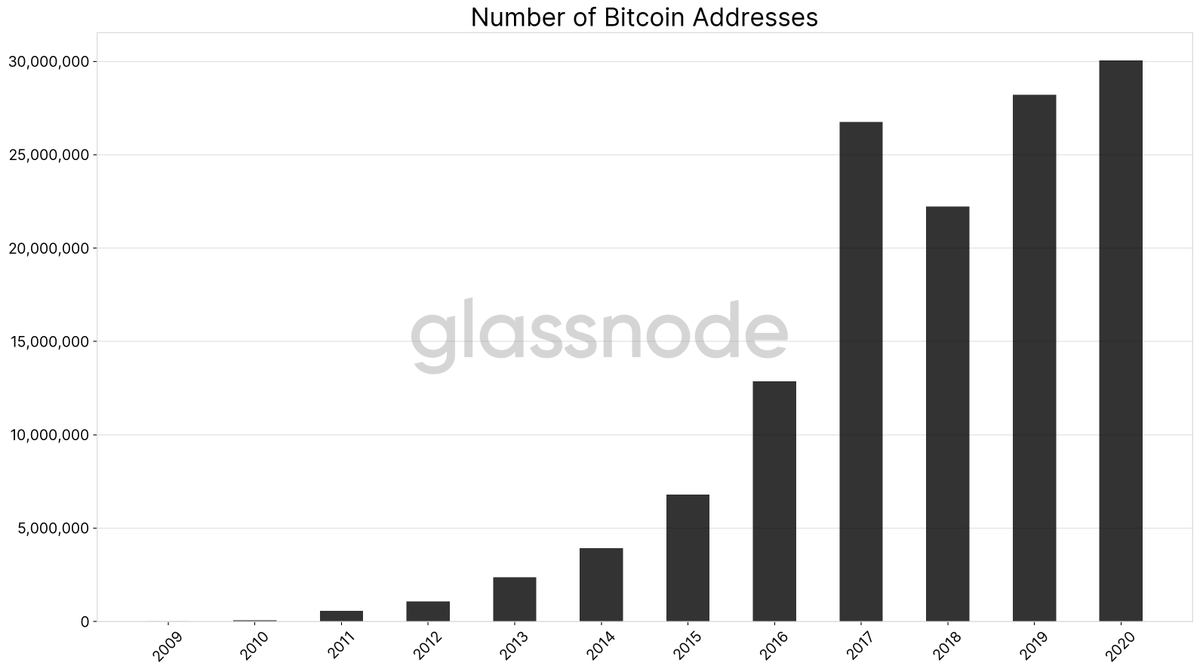

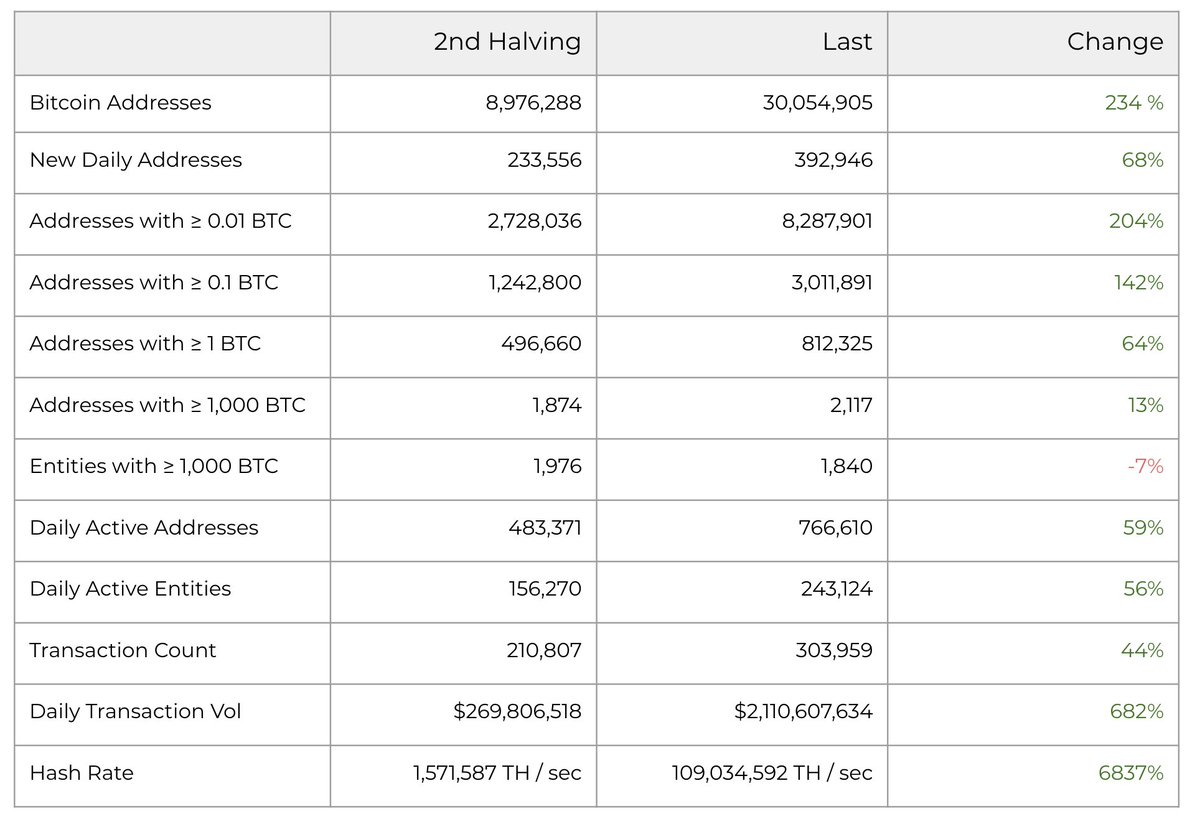

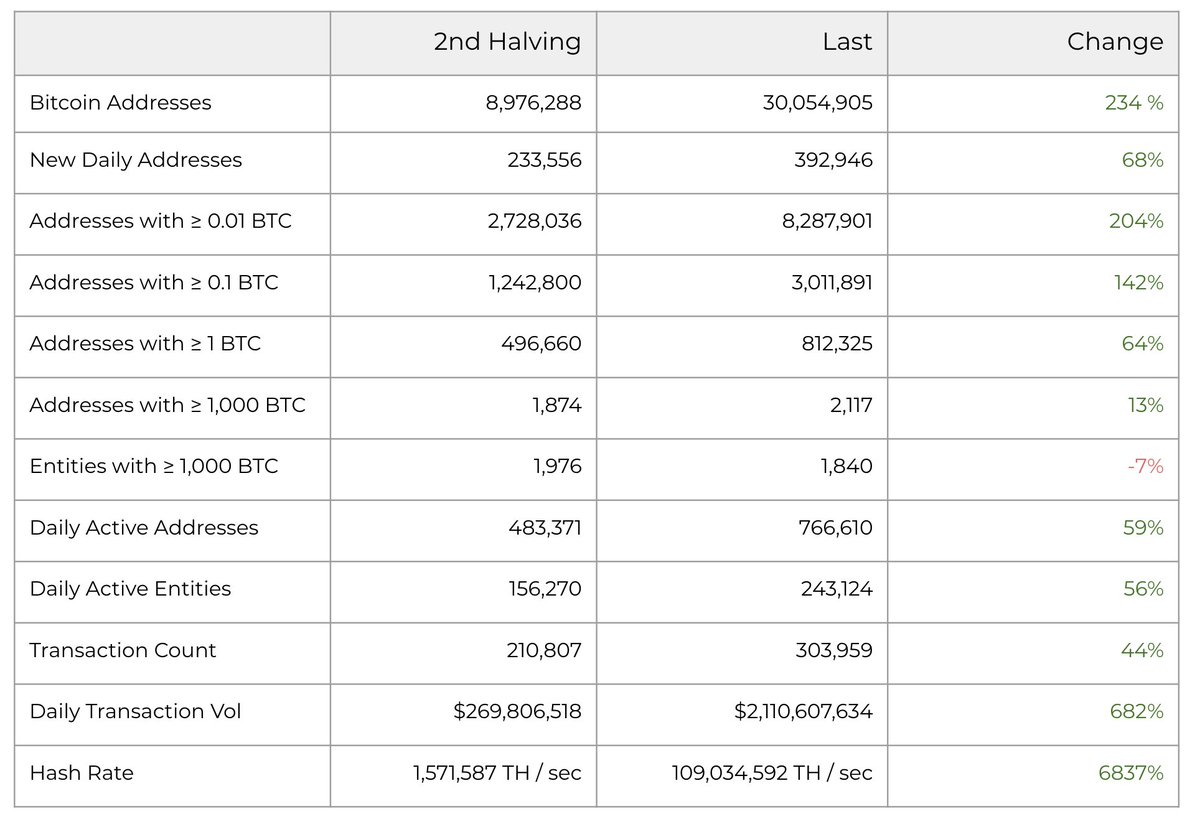

2/ NETWORK GROWTH

2/ NETWORK GROWTH