Marcel Pechman

#Bitcoin avid learner since block 470,235

Analyst & writer @ Cointelegraph

It's about sending a message

How to get URL link on X (Twitter) App

The year was 1972, and Portland Trailblazers had the 1st draft pick. Their choice? LaRue Martin, a 6'11'' center from Loyola (Illinois). His team did 4W-20L in 1970-71, and 8W-14L on his senior year, scoring 19.6 points per game & 16 rebounds. Maybe not a bad pick, but....

The year was 1972, and Portland Trailblazers had the 1st draft pick. Their choice? LaRue Martin, a 6'11'' center from Loyola (Illinois). His team did 4W-20L in 1970-71, and 8W-14L on his senior year, scoring 19.6 points per game & 16 rebounds. Maybe not a bad pick, but....

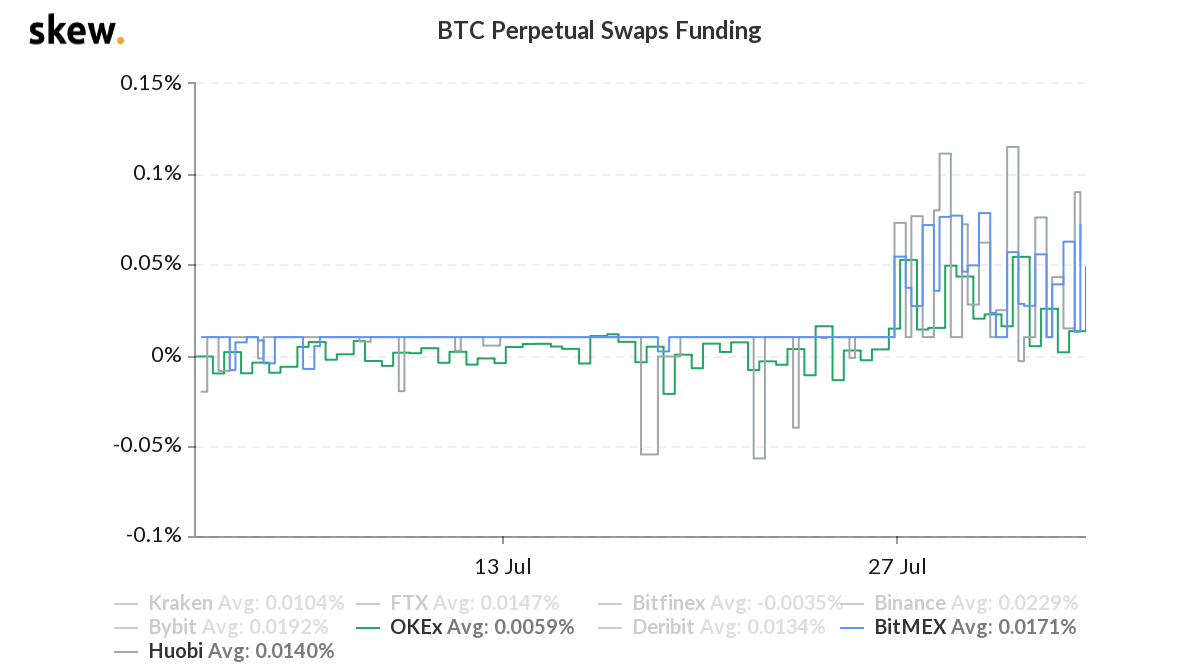

2/ Perpetual funding rate holding below 5% monthly fee also show no sign of buyers giving up. They've built such position below $10,400, so why worry? Options market remains rather calm as well...

2/ Perpetual funding rate holding below 5% monthly fee also show no sign of buyers giving up. They've built such position below $10,400, so why worry? Options market remains rather calm as well...

2/ This gives us a Net Asset Value (NAV) of $9800 x 0.00096112 = $9.42, while GBTC US closed at $11.73. That' a hefty 24% premium, which used to be a lot higher as you can see @ ycharts.com/companies/GBTC… Keep in mind only accredited investors can buy directly from @grayscaleinvest

2/ This gives us a Net Asset Value (NAV) of $9800 x 0.00096112 = $9.42, while GBTC US closed at $11.73. That' a hefty 24% premium, which used to be a lot higher as you can see @ ycharts.com/companies/GBTC… Keep in mind only accredited investors can buy directly from @grayscaleinvest

bitinfocharts.com/bitcoin/wallet…

bitinfocharts.com/bitcoin/wallet…

Ethereum

Ethereum