Investigative journalist @FinUncovered. DM me here, or email simon@financeuncovered.org.

Formerly @ICIJorg, formerly @guardian

🦡 🦡 🦡

How to get URL link on X (Twitter) App

#FinCENFiles showed 3,267 UK shell companies🇬🇧🐚 linked to suspicious bank transactions🕵️💰 — far more than companies from better known secrecy havens

#FinCENFiles showed 3,267 UK shell companies🇬🇧🐚 linked to suspicious bank transactions🕵️💰 — far more than companies from better known secrecy havens

This thread gives some highlights from our #FinCENFiles reporting on shell-company formation agencies, their close ties to Baltic banks & the role they play in money laundering schemes.

This thread gives some highlights from our #FinCENFiles reporting on shell-company formation agencies, their close ties to Baltic banks & the role they play in money laundering schemes. https://twitter.com/ICIJorg/status/1307364121986334721

https://twitter.com/i/status/1307377543843115011

The 133-page decision is a HUGE victory for whistleblowing. 😇🍾🎺🎉

The 133-page decision is a HUGE victory for whistleblowing. 😇🍾🎺🎉

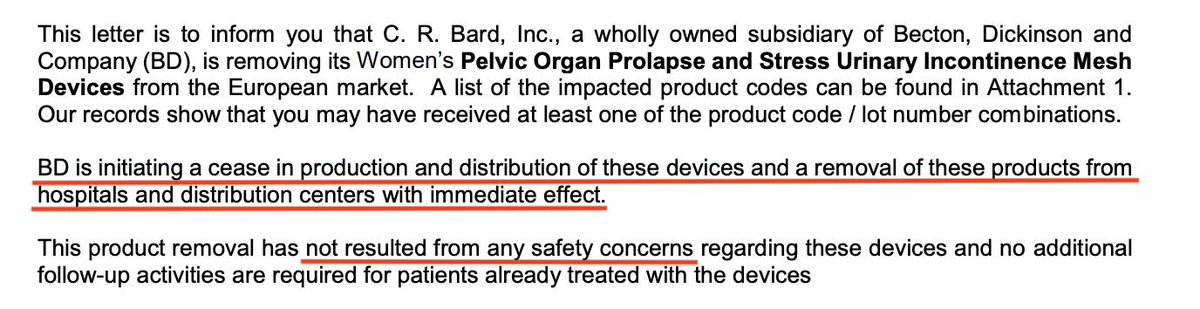

In its statement, Bard (now part of @BDandCo) refers to a “product removal”. Says it's “initiating a cease in production & distribution …with immediate effect”. Does not use the word “recall”. 👇

In its statement, Bard (now part of @BDandCo) refers to a “product removal”. Says it's “initiating a cease in production & distribution …with immediate effect”. Does not use the word “recall”. 👇

Well, what about UK Crown Dependencies (Jersey/Guernsey/Isle of Man)? Somehow they lobbied not to be caught by the same transparency rules as Overseas Ts.

Well, what about UK Crown Dependencies (Jersey/Guernsey/Isle of Man)? Somehow they lobbied not to be caught by the same transparency rules as Overseas Ts.

2/ TCJA has resulted in a towering U.S. deficit that is now poised to invert the Treasury yield curve — a heavy signal of impending recession.

2/ TCJA has resulted in a towering U.S. deficit that is now poised to invert the Treasury yield curve — a heavy signal of impending recession.

This is shocking news. Eight years ago the FDA commissioned the Institute of Medicine to carry out a detailed review of 510(k). The IoM reported back that 510(k) was “fatally flawed” and should be scrapped. (2/10)

This is shocking news. Eight years ago the FDA commissioned the Institute of Medicine to carry out a detailed review of 510(k). The IoM reported back that 510(k) was “fatally flawed” and should be scrapped. (2/10)

Apple's balance sheet already contains provisions of $36bn for deferred tax liabilities that will now be subject to HUGE windfall write-backs —underlining the fact that this IS a retroactive govt giveaway (to the world's most profitable corporation) /2 sec.gov/Archives/edgar…

Apple's balance sheet already contains provisions of $36bn for deferred tax liabilities that will now be subject to HUGE windfall write-backs —underlining the fact that this IS a retroactive govt giveaway (to the world's most profitable corporation) /2 sec.gov/Archives/edgar…