Despite the CBN’s best intentions, the liquidity ratio of #Skyebank didn't improve. It fell short of the regulatory standard. The bank found it difficult to do normal banking business as it was shut out of the lucrative FX market + it had to deal with loads of litigation.

In Sept, The CBN finally took the decision to revoke the license of #Skyebank and create a bridge bank to take over its assets and liabilities. The irony of the matter is that a bank that once bought a bridge bank is itself in need of a bridge to turn around its fortunes.

1. What led to the takeover of the bank?

2. What role did the regulator play in leading up to this decision?

I will now attempt to answer the question:

3. What role did insider related loans play to bring the bank down?

#Skyebank

1. Tunde Ayeni: (Former Board Chairman)

- N89.4B Loan used to acquire Ibadan Disco, Yola Disco & Nitel

- N29.5B Discovered in suspense a/c & directly linked to him

2. Festus Fadeyi (Father of Dr Jason Fadeyi Non-Exec Director)

- $616m (N191B): For Pan Oceanic Grp

3. Jide Omokere Grp

-N110B: For AEDC (N56B), Cedar Oil/Gas (N22b), Real Banc Ltd (N31B) #SkyeBank

- N11.6 Billion: Alleged illegal conversion of 46.4million shares in Forte Oil Plc, paid for by Afribank. Case is in court.

- N12.8 Billion: Owed by AP to Afribank

#SkyeBank

This is what has happened and it brings me to the last question.

4. What is the end game?

There are many reasons why we must ask this question.

#SkyeBank

cbn.gov.ng/Out/2018/RSD/C…

cbn.gov.ng/out/2015/bsd/1…

proshareng.com/admin/upload/r…

nairametrics.com/cbn-the-three-…

nairametrics.com/meaning-of-cap…

proshareng.com/admin/upload/r…

proshareng.com/news/Monetary%…

proshareng.com/news/Mergers%2…

guardian.ng/politics/reps-…

nigeriannewsdirect.com/eight-cbns-imp…

"Clearly at the time of the bid, the bank did not meet regulatory standards to qualify as the preferred bidder."

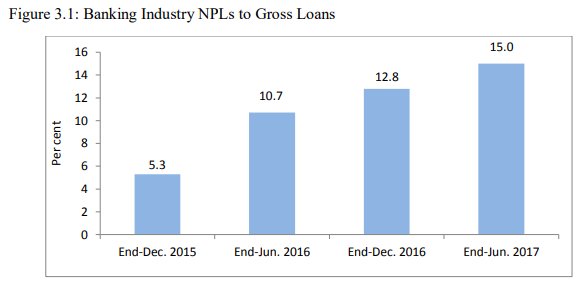

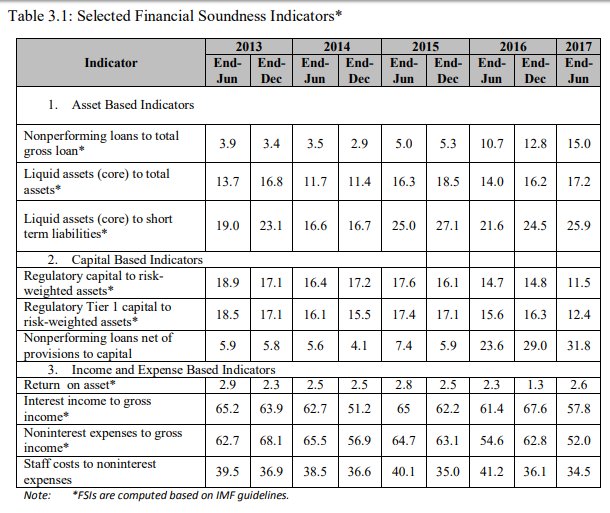

The NPL rose from 3.9% to 15% not declined.