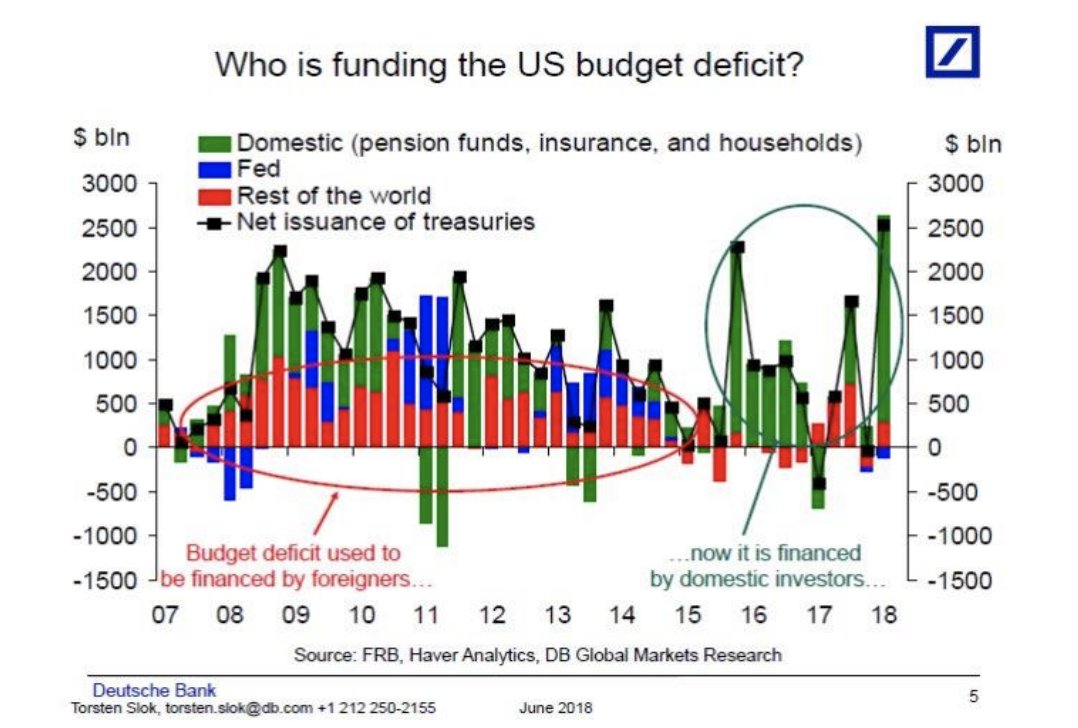

Simultaneously, the fed is rolling debt off the balance sheet, sucking money out of the economy. This will increase yields to compensate for the bump in demand

And, now for the reflexivity: a lower stock market will decrease tax receipts and increase deficit/yields further

This feeds on itself and higher yields again pulls the broader stock market / risk assets down even more, leading to even higher deficit

The Fed will need to reverse course, monetize debt and ease the debt burden. The private sector alone won't be able to support the borrowing needs

The president won't be able to reverse course on massive spending / welfare promises either

Structurally we are in a long term, secular dollar bear market

Markets can continue to be manipulated. But the casualty will be fiat currencies