"throw out all of the matrices and formulas that existed before the Web....they can't make money for you anymore, and that is all that matters. If we use any of what Graham and Dodd teach us, we wouldn't have a dime under management.”

Null hypothesis should be that the status quo is unchanged: assets are worth discounted future cash flows

Errors with tech valuation weren't because of a lack of tools but bc of errors predicting cash flow and new biz models

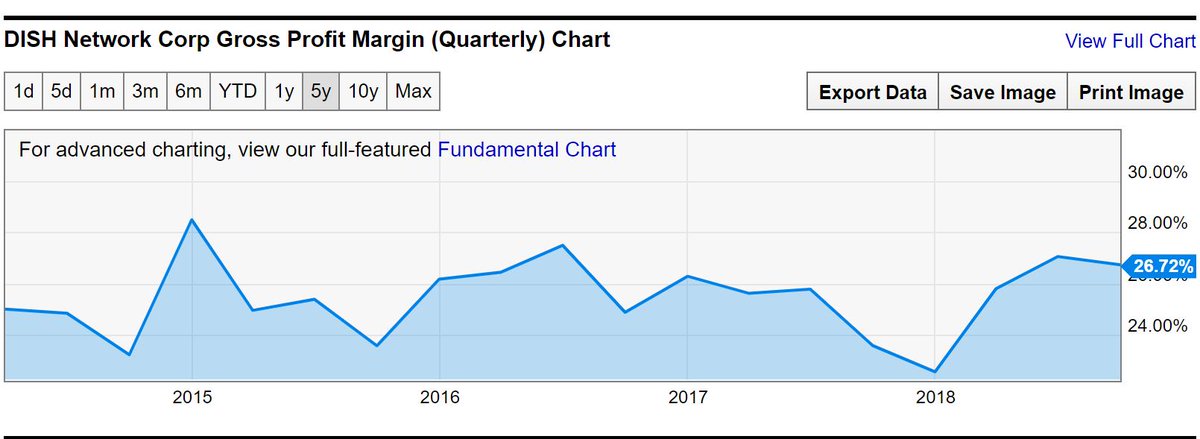

But my base case assumption is that other than which ONE ASSET wins as the primary money, the only way others can accrue value will be through cash flow

The burden of proof is on the approach that's contra lindy, not on the status quo

And there hasn't been anything that indicates yet "graham & dodd" should be jettisoned in favor of MV = PQ or xyz new valuation model