Stranger: So @Trinhnomics , what do you do for a living?

A: Analyze & forecast the price of $$ 💪🏻

Q: So what's going on w/ the price of $

A: Interest rates are going down 📉

Let's talk about the price of $ today, & we're going BEYOND LIBOR to discuss the new reference rates.

A: Analyze & forecast the price of $$ 💪🏻

Q: So what's going on w/ the price of $

A: Interest rates are going down 📉

Let's talk about the price of $ today, & we're going BEYOND LIBOR to discuss the new reference rates.

To understand the price of $, we need to go back to the genesis of it all - how the central bank create $ & influence the supply & demand of $.

Central banks do it through banks & 3 ways in which they do it:

a) Setting the price via rates (policy rate)

b) Quantity

c) Regulation

Central banks do it through banks & 3 ways in which they do it:

a) Setting the price via rates (policy rate)

b) Quantity

c) Regulation

Let's focus on A b/c we're going to talk about LIBOR & beyond LIBOR. A central bank meets & decides a rate, say the Fed. The upper bound is 2.5% & lower is 2.25%. The mistake people make is that it THINKS the Fed sets the market rate but no, it influences. Effective rate is 2.4%

CBs influence in a CORRIDOR (some don't). Say economy is going strong, meaning there's a lot of demand for $ to invest/spend & that pushes rates 📈 Banks would need more $. The CB influences by lending at the upper bound (2.5%) so banks' effective overnight wouldn't exceed 2.5%.

The inverse is true if there's too much liquidity in the interbank, the CB influences how low rate can go but absorbing this at 2.25% (lower bound) so rates don't fall below this. This corridor is narrow at 25bps. Some have wider corridors

So that's b/n the banks & central bank.

So that's b/n the banks & central bank.

Let's talk about how this affects YOU. To talk about this, we must introduce RISK, specifically counter-party risks. A CB is RISK-FREE (so is a sound gov like the US) but banks have risks b/c their ability to manage their balance sheets differ. Firms have risks. Households do too

So this is how the price of $ works:

CB sets a policy rate ➡ influences costs of banks' funding ➡ banks pass it on to customers (firms, households, govs)

Fed upper bound 2.5% ➡ 2.68% 6-m LIBOR➡4.6% mortgage rate.

Okay, let's talk about LIBOR part & why that matters for u

CB sets a policy rate ➡ influences costs of banks' funding ➡ banks pass it on to customers (firms, households, govs)

Fed upper bound 2.5% ➡ 2.68% 6-m LIBOR➡4.6% mortgage rate.

Okay, let's talk about LIBOR part & why that matters for u

LIBOR is London Interbank Offered Rates, which is a rate that banks charge each others so it has counter-party risks. It has many cousins like the HK HIBOR, Singapore SIBOR, Australia BBSW, to name a few.

USD400trn of financial contracts bench-marked on LIBOR (19 times US GDP🤑)

USD400trn of financial contracts bench-marked on LIBOR (19 times US GDP🤑)

So now u're convinced that LIBOR is key & esp to every bankers' life b/c we're living dangerously tethered to the rise & fall of interest rates.

LIBOR is 🇬🇧British born & a child of the 1960s. The rate is formed from a collected interbank quotes from a panel of banks before 11am

LIBOR is 🇬🇧British born & a child of the 1960s. The rate is formed from a collected interbank quotes from a panel of banks before 11am

Obvs the controversy w/ LIBOR is that it is what a panel of banks would report, and hence led to a few cases of LIBOR misconduct & so got regulated from 2012.

And so there is a campaign to move from IBORs to overnight risk-free rates (RFRs) for each of the LIBOR currencies.

And so there is a campaign to move from IBORs to overnight risk-free rates (RFRs) for each of the LIBOR currencies.

Table of RFRs for USD, GBP, EUR, CHF, JPY.

Wut's an ideal reference rate:

a) Accurate representation of rates in core money markets & not susceptible to manipulation

b) Offer a reference rate for financial contracts beyond money market

c) Benchmark for term lending & funding

Wut's an ideal reference rate:

a) Accurate representation of rates in core money markets & not susceptible to manipulation

b) Offer a reference rate for financial contracts beyond money market

c) Benchmark for term lending & funding

So LIBOR is good for B & C but not A.

Wut about RFRs?

Suited for many purposes of market needs. Future, cash & derivatives are expected to migrate to RFRs but most challenging for cash markets due to tighter links to interbank offered rates. RFRs not good for credit-sensitive

Wut about RFRs?

Suited for many purposes of market needs. Future, cash & derivatives are expected to migrate to RFRs but most challenging for cash markets due to tighter links to interbank offered rates. RFRs not good for credit-sensitive

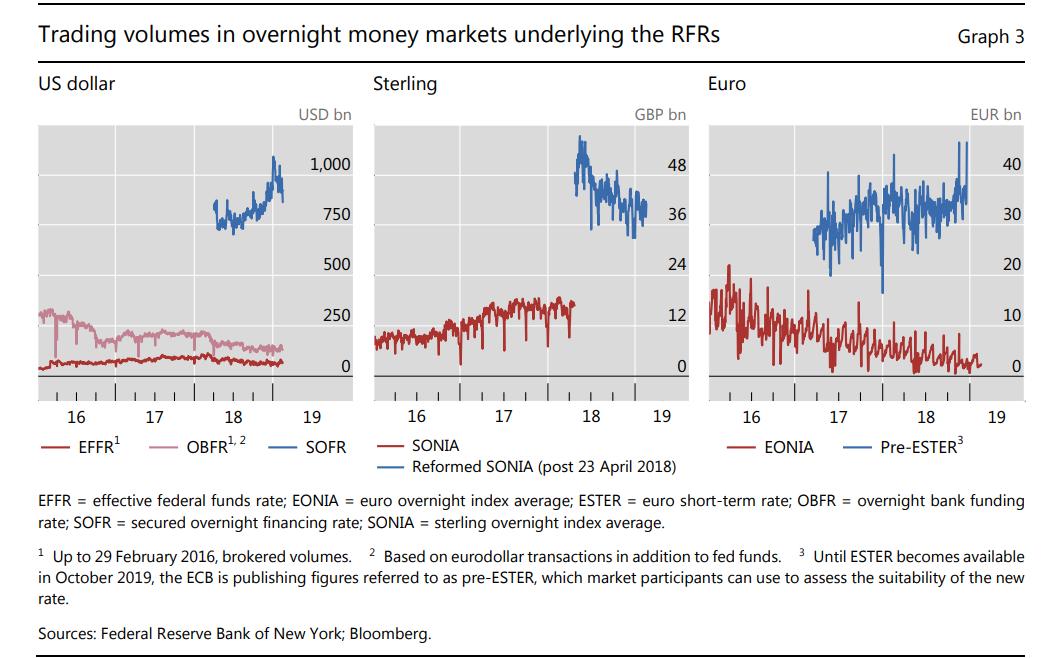

Wut are RFRs? Considered more robust b/c they are anchored in active, underlying markets (see the trading volumes below) & this is in contracts to the scracity of underlying transactions of wholesale unsecured funding markets of IBOR.

Summary:

RFRs: a ✅b✅c❎

LIBOR: a ❎b✅c✅

Summary:

RFRs: a ✅b✅c❎

LIBOR: a ❎b✅c✅

In short, LIBOR hard to replace as great for B & C. RFRs good for A but need a companion to do B & C properly. Now when u read the news, u know. And no worries, u're welcome😎

Sincerely,

💜

@Trinhnomics

Readings:

a) Fed paper fsb.org/wp-content/upl…

b) bis.org/publ/qtrpdf/r_…

Sincerely,

💜

@Trinhnomics

Readings:

a) Fed paper fsb.org/wp-content/upl…

b) bis.org/publ/qtrpdf/r_…

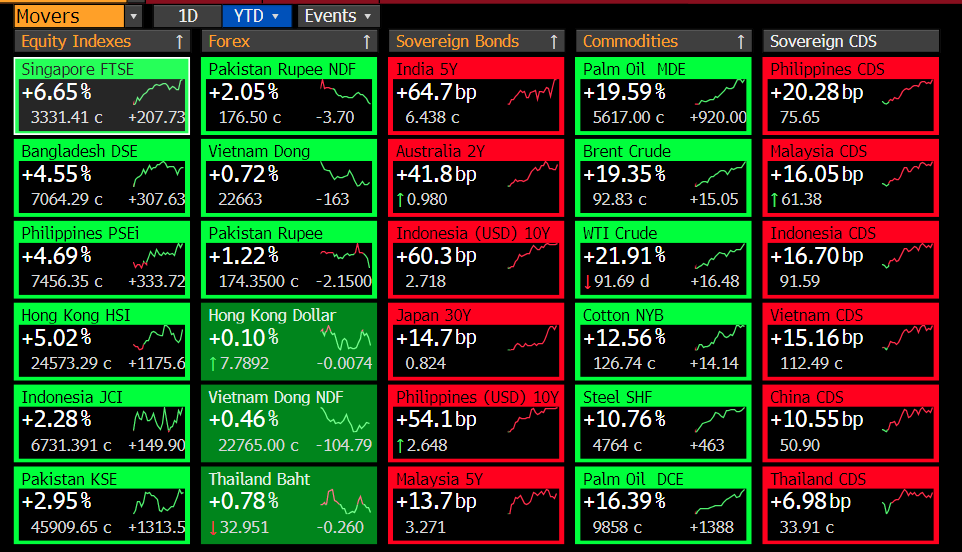

Btw, @Trinhnomics will be on the @BBCBusiness Monday to discuss week ahead for Asia; you bet I will loop together weak global demand, contracting regional trade and its spilling over to services & wut that means for, wait for it:

The price of $ in Asia 🌏 &why it's gonna go 📉🤓

The price of $ in Asia 🌏 &why it's gonna go 📉🤓

• • •

Missing some Tweet in this thread? You can try to

force a refresh