With Aston Villa and Derby County facing each other in today’s Championship play-off final for promotion to the Premier League, let’s take a closer look at what has been described as the most lucrative match in world football. Some thoughts in the following thread #AVFC #DCFC

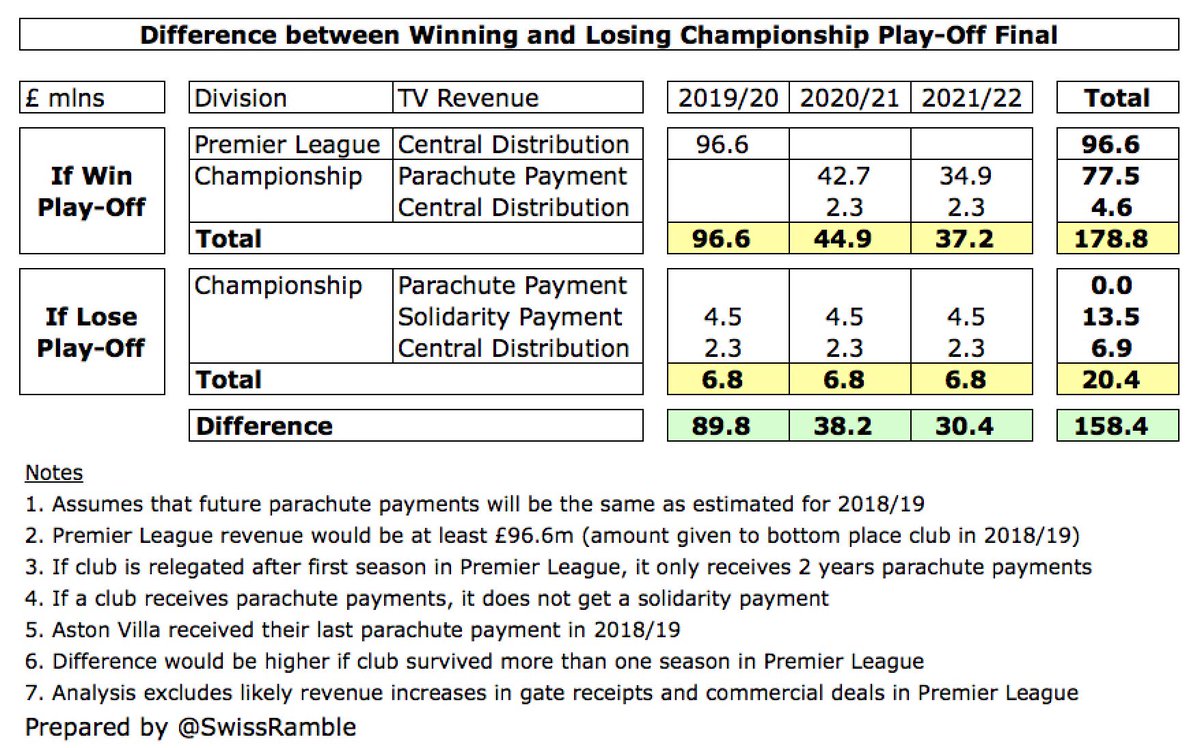

The Championship play-off winners will receive nearly £180m TV money over the next 3 seasons: at least £97m from the Premier League in 2019/20 (based on 20th place), then £78m parachute payments (2 years if relegated after one season in the PL) plus £5m EFL distribution.

The losers of the Championship play-off will receive around £20m over next 3 seasons: £13.5m Premier League solidarity payments (£4.5m a year) plus £6.9m EFL central distribution (£2.3m a year). So the difference between winning and losing this match is £160m (£180m less £20m).

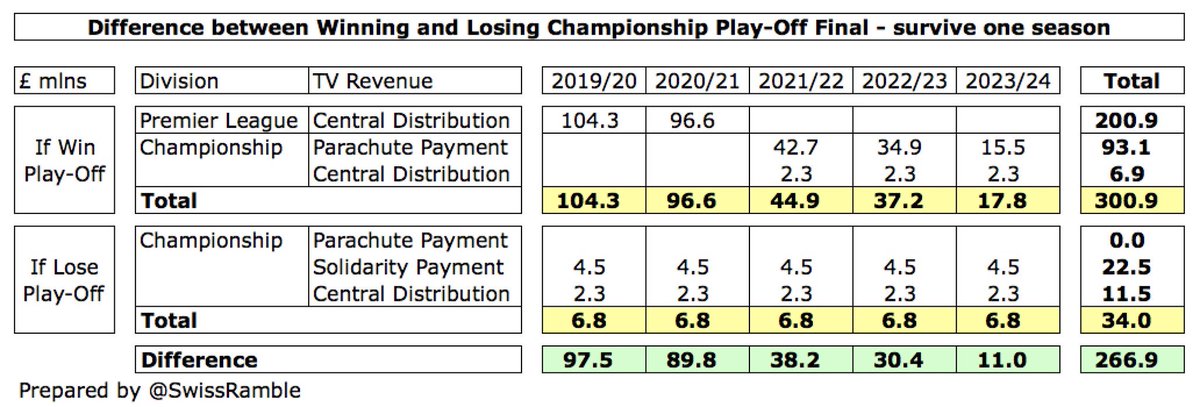

If the winners of the play-off final avoid relegation in their first season, they will get at least £300m TV money over 5 years, including £93m parachute payments (3 years in this case). This is around £266m more than £34m earned over the same period in the Championship.

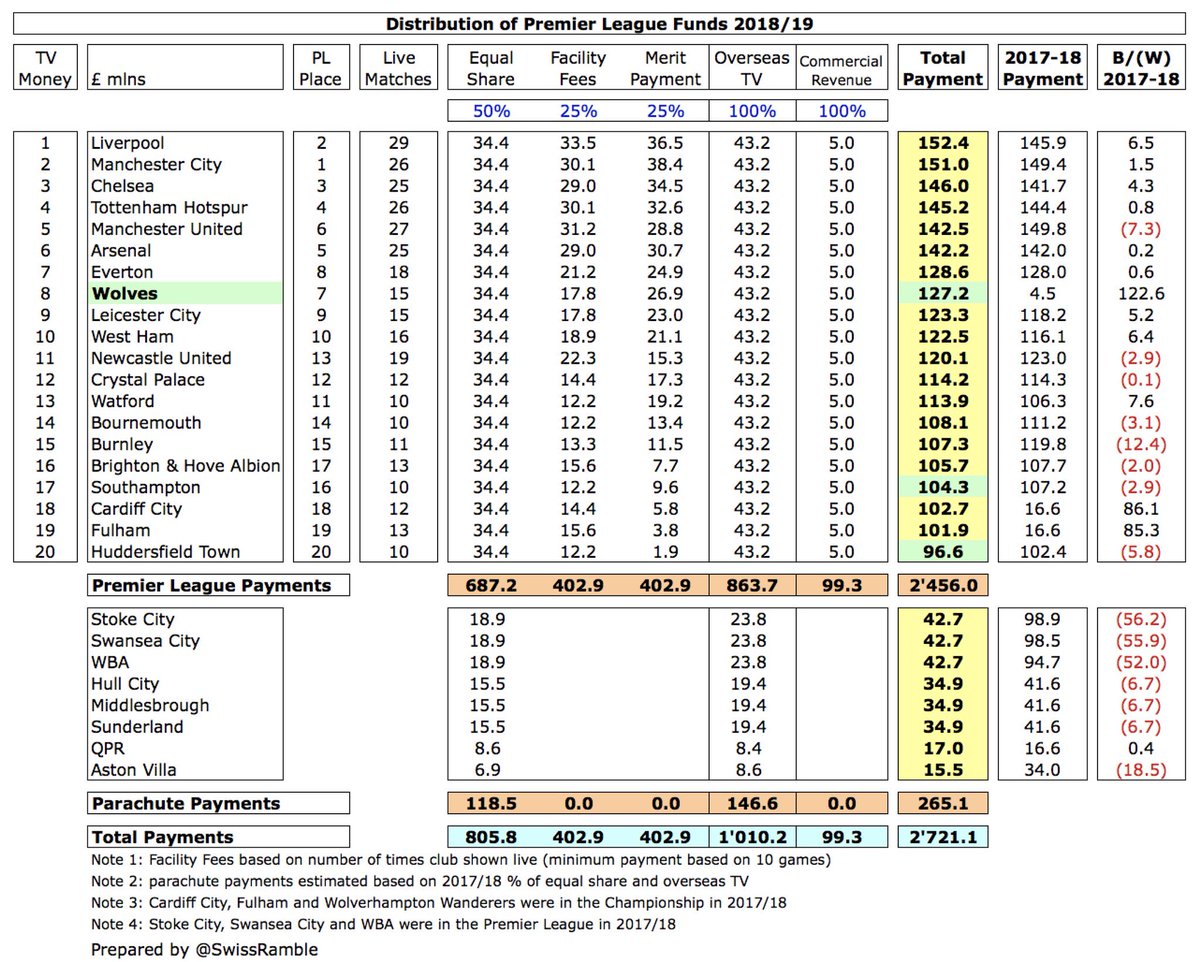

It is worth noting that these estimates are based on the promoted club finishing either bottom or just outside the relegation zone, but they could earn a lot more if they finish higher in the league table, e.g. #WWFC received £127m TV money for finishing 7th in 2018/19.

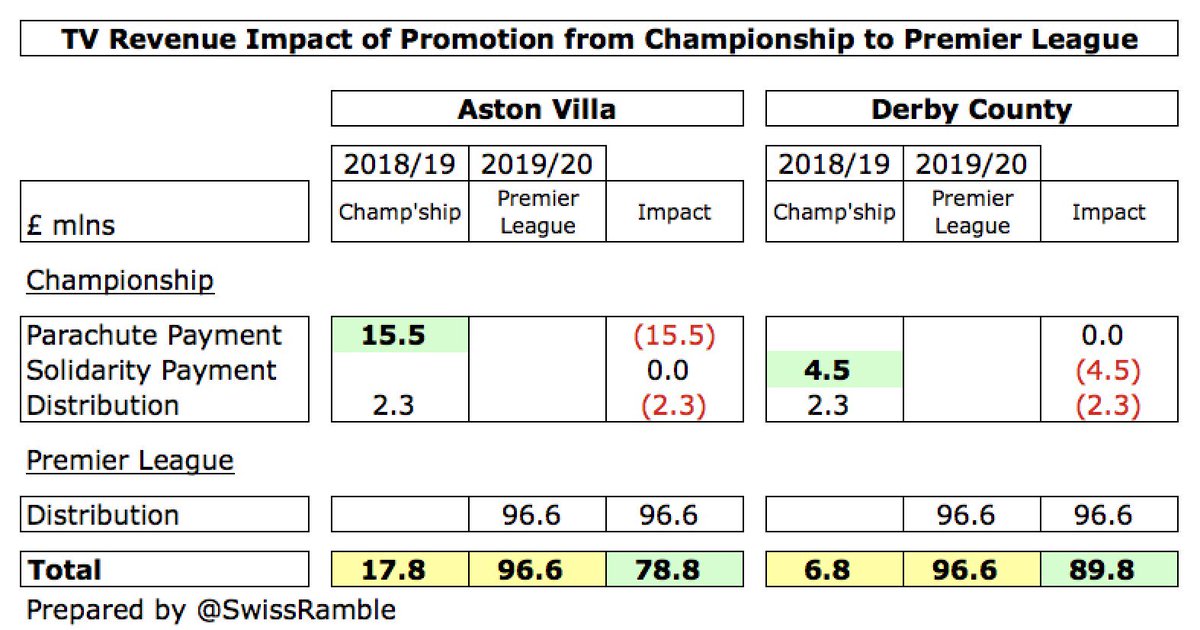

The increase in TV money compared to this season is different for the two play-off clubs, as #AVFC had a (final) parachute payment of £15.5m in 2018/19, while #DCFC only had a £4.5m solidarity payment. Therefore, the #DCFC YoY increase of £90m would be higher than #AVFC £79m.

So the size of the increase following promotion is dependent on whether a club has a parachute payment – and which year. If a club is promoted in the first season after relegation from the Premier League, the YoY increase would “only” be £52m (£97m less £43m parachute & £2m EFL).

Of course, it is this enormous disparity in TV money that helps explains why so many Championship clubs “go for it” and then post substantial losses. It is perhaps understandable that some owners get a little giddy at the prospect of going from £8m TV money to £100-150m.

There is less focus on promotion impact on the bottom line, but it is evident that wages also explode in the top flight. That said, all 3 clubs promoted in 2016/17 swung from large losses to solid profits, showing significant improvements: #NUFC £70m, #BHAFC £51m & #HTAFC £49m.

Furthermore, even though losses are increasing in the Championship, the improvements after promotion appear to be on the rise. In 2016/17 operating profits improved by an average of £38m, while this was up to £67m in 2017/18 (£47m even excluding #NUFC huge £108m gain).

The size of the revenue increase after promotion for individual clubs largely depends on whether they have benefited from parachute payments in the Championship, but the average in 2017/18 was around £104m (nearly 250%) with the highest increase of £110m coming from #BHAFC.

Obviously, TV money is the main driver of growth following promotion, but there are also increases in the other revenue streams. In 2017/18 #NUFC and #HTAFC growth of £14m and £7m respectively was almost all commercial, while #BHAFC £8m was split between commercial and match day.

The need to compete means that wages also take off after promotion. In 2016/17 all 3 clubs doubled wage bills with an average increase of £33m. This was even higher in 2017/18 at #BHAFC £46m & #HTAFC £41m, while NUFC low growth was due to the highest ever Championship wage bill.

So, there we have it, the description of the “£170m match” is a little simplistic, but it is still true that there is a huge amount of money at stake in the Championship Play-Off final. Of course, it is then up to the winner to spend it wisely – and there’s no guarantee of that.

The other way to look at this is that both clubs *really* need promotion. #AVFC parachute payments have finished, while #DCFC had to sell (and lease back) their stadium to meet the EFL’s Profitability and Sustainability targets. May the best team win.

• • •

Missing some Tweet in this thread? You can try to

force a refresh