Following other BIS papers Kristin Forbes published an empirical research showing that in times of globalisarion there are many drivers of inflation besides monetary policy and domestic slack in the economy. bis.org/publ/work791.p… CB must heed the evidence

Other drivers: “exchange rates, oil prices, other commodity prices, slack in major economies (not just at home) and international pricing competition”. It is time to shed some myths created by Milton Friedman like the one that says “Inflation is always a monetary phenomenon”. 2/n

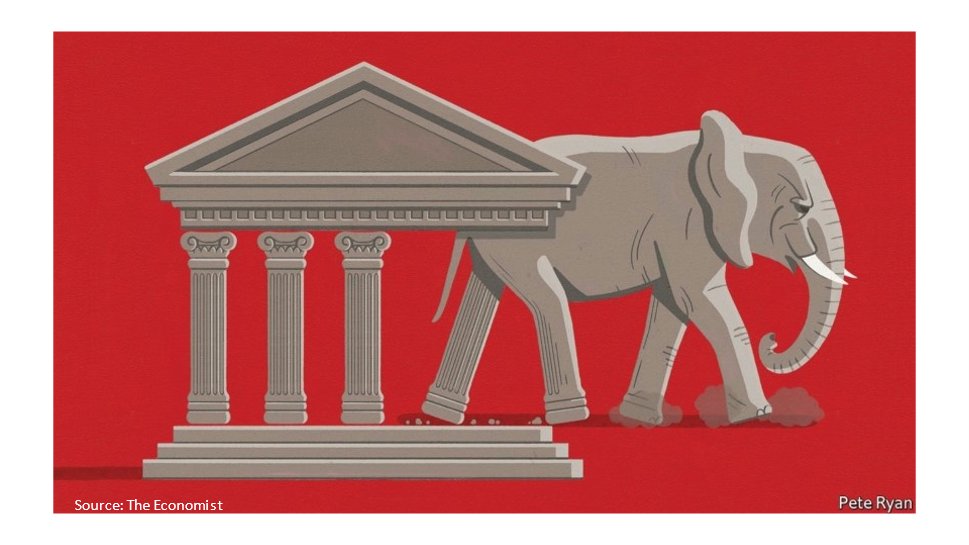

This was predicated on the role of monetary aggregates that has since then collapsed. It was also referring vaguely to the long the long term but it created the myth of the all too powerful Central Bank with full control over inflation and capable of fine tuning its evolution.3/n

In 2000 asked about Japan, Friedman said that it was simple to solve the deflation risk:BoJ should keep on buying sovereign bonds, increasing the monetary and normalizing inflation. Much later BoJ did that on a big scale (100% of GDP) without great success.4/n

Outside the extreme monetarist view, it was always recognised by theory that monetary policy effects are asymmetric: better in restricting to control inflation than in generating recoveries after recessions. Globalisation further reduced the role of domestic demand management 5/n

The other myth created by M. Friedman was that floating exchange rates would ensure external balance and insulate the economy from the outside world, putting monetary policy in full control. Evidence has also overwhelmingly disproved that myth. 6/n

For CBs it has been in a way, self-serving and self-congratulatory to embark into that hubristic position of potential power. It is now time to admit that monetary policy is undoubtedly quite powerful regarding inflation but that in present circumstances it has limits. 7/n

The ideas of Kimball, Rogoff and Goodfriend to embark into ever more negative interest rates ( in order to avoid fiscal policy..) should be resisted and debunked. In the present situation,if the downturn becomes serious, a more active fiscal policy will be indispensable 8/8

@threadreaderapp unroll

It was bound to happen. 3 prominent ex-central-bankers (Fisher, Hildebrand, Boivin) just published a report proposing direct monetary financing by CB of fiscal stimulus packages, going one up on Bernanke’s helicopter money 2004 proposal for Japan.

blackrock.com/us/individual/….

blackrock.com/us/individual/….

As I wrote in July, we need to recognise the limits of monetary policy after 10 years of many experiments. Ever lower negative rates are not a solution. Monetary and fiscal policies collaboration is the way forward, exiting when the inflation goal is attained.

As the authors say, their proposal is different from MMT. Only goal is normalizing inflation, it’s temporary, does not include a permanent job guarantee program or fighting high inflation with fiscal policy. However, it shows why an ill-defined MMT hit the zeitgeist

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh