Today I cover the Government Securities (G-Secs) market. G-Secs, in short, are debt instruments through which Government borrows from the public (banks, financial institutions etc.). This post covers the size, type of lenders, and other broad contours of G-Sec market. Thread 1/8

The total size of the G-Sec market is approx. 92.86 lakh crore. In comparison, the size of the listed equity market (total market capitalisation of all listed stocks) was 141.47 lakh crore in July, 2019. (2/8)

Out of the total borrowing of Rs. 92.86 lakh crore, ~ Rs. 64.49 lakh crore borrowing is from Central Govt and the remaining Rs. 28.37 lakh crore borrowing is from State Govts i.e. of the the total borrowings 69.45 % is from Central Govt and 30.55 % is from State Govts. (3/8)

Bank and Insurance companies are the largest lenders to the Government. Banks own ~40% while Insurance companies own ~30% of all the Central and State Govt debt. Rest is owned by FPI, RBI, PFs etc in that order. (4/8)

The following comprises the central government securities

> Dated Securities - 55.19 lakh crore

> T-Bills - 5.33 lakh crore

> Special Securities - 1.99 lakh crore

> Floating rate bonds - 1.97 lakh crore. (5/8)

> Dated Securities - 55.19 lakh crore

> T-Bills - 5.33 lakh crore

> Special Securities - 1.99 lakh crore

> Floating rate bonds - 1.97 lakh crore. (5/8)

The following constitutes the state government securities

> State Development Loans (SDL) - 26.40 lakh crore

> Uday Bonds - 1.97 lakh crore

* Data for central and state government securities updated till June 2019. (6/8)

> State Development Loans (SDL) - 26.40 lakh crore

> Uday Bonds - 1.97 lakh crore

* Data for central and state government securities updated till June 2019. (6/8)

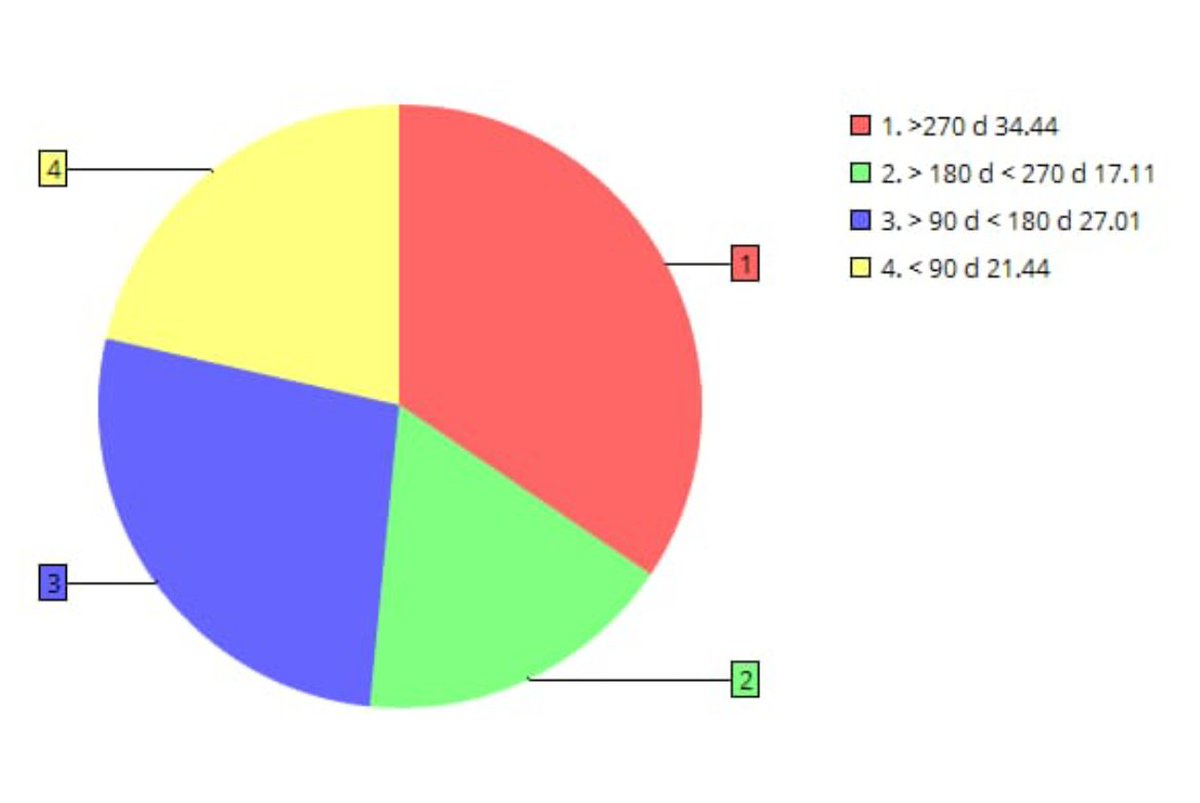

The borrowings have increased manifolds in the past 10 years. The value of total G-Secs at various points in time:

June 2009 - 23.79 lakh crore

June 2012 - 40.16 lakh crore

June 2014 - 53.15 lak crore

June 2017 - 76.82 lakh crore

June 2019 - 92.86 lakh crore. (7/8)

June 2009 - 23.79 lakh crore

June 2012 - 40.16 lakh crore

June 2014 - 53.15 lak crore

June 2017 - 76.82 lakh crore

June 2019 - 92.86 lakh crore. (7/8)

As a percentage to GDP, the total outstanding borrowing through central and state government securities is ~48%. These levels of debt are quite high - so much so that 25-30% of budget is eaten up in laying interests. (8/8)

@kayezad @ActusDei @_soniashenoy @andymukherjee70 @invest_mutual @BMTheEquityDesk @dmuthuk @rohitchauhan @contrarianEPS @shyamsek @chokhani_manish @pvsubramanyam @BalakrishnanR @Sanjay__Bakshi @TamalBandyo @CafeEconomics @menakadoshi @latha_venkatesh @AmolPlanRupee

@deepakshenoy @dugalira @Iamsamirarora @SunilBSinghania @mrinagarwal @IamMisterBond @NagpalManoj @SalariedTaxpay1 @YashwantSinha @ayushmitt

#GSec #govermentsecurities #SDL #GDP #debt #borrowing #debttogdg #outstandingdebt #bondmarket #bonds

• • •

Missing some Tweet in this thread? You can try to

force a refresh