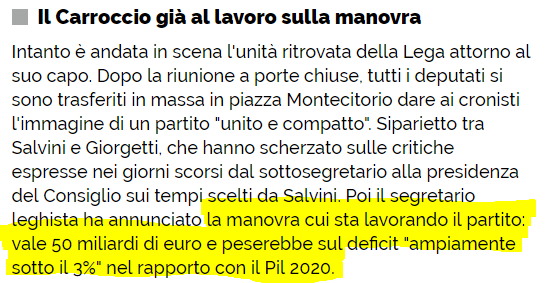

Salvini dice che la manovra sarà da 50 mld e sarebbe ampiamente sotto il 3% del PIL. Ma non è tutto oro quel che luccica (segue aritmetica)

agi.it/politica/crisi…

agi.it/politica/crisi…

Facciamo 2 conti:

Deficit tendenziale 2020 = 1.5-1.7%

- Reddito di Cittadinanza: 0.4% (draft budget 11/2018)

= 1.1%-1.3%

- 80 euro Renzi: 9.5 mld = 0.5%

= 0.6%-0.8%

ci avanzano: 3% - (0.7%-0.9%) = 2.3-2.1% = 41-38mld

- sterilizzazione IVA: 23mld (1.3%)

= 15-18 mld liberi

Deficit tendenziale 2020 = 1.5-1.7%

- Reddito di Cittadinanza: 0.4% (draft budget 11/2018)

= 1.1%-1.3%

- 80 euro Renzi: 9.5 mld = 0.5%

= 0.6%-0.8%

ci avanzano: 3% - (0.7%-0.9%) = 2.3-2.1% = 41-38mld

- sterilizzazione IVA: 23mld (1.3%)

= 15-18 mld liberi

Questo assumendo che vengano tagliati RdC e 80 euro. Se venisse tagliato solo RdC:

Deficit 2020 = 1.5-1.7%

- Reddito di Cittadinanza: 0.4% (draft budget 11/2018)

= 1.1%-1.3%

ci avanzano: 3% - (1.2%-1.4%) = 1.8-1.6% = 32-29mld

- sterilizzazione IVA: 23mld

= 9-6 mld liberi

Deficit 2020 = 1.5-1.7%

- Reddito di Cittadinanza: 0.4% (draft budget 11/2018)

= 1.1%-1.3%

ci avanzano: 3% - (1.2%-1.4%) = 1.8-1.6% = 32-29mld

- sterilizzazione IVA: 23mld

= 9-6 mld liberi

Quindi, se prendiamo Salvini in parola:

1) I 50mld diventano 15-18 una volta sterilizzata IVA. Flat tax per tutti molto lontana,

2) questo se tagliamo RdC e 80€, quindi grosso impatto redistributivo da poveri a ricchi

3) se tagliamo solo RdC, i mld liberi sono solo 7-9

1) I 50mld diventano 15-18 una volta sterilizzata IVA. Flat tax per tutti molto lontana,

2) questo se tagliamo RdC e 80€, quindi grosso impatto redistributivo da poveri a ricchi

3) se tagliamo solo RdC, i mld liberi sono solo 7-9

Se invece non prendiamo Salvini in parola ma assumiamo che i 50 mld siano tutti per la flat tax (che, ricordiamo, costa 50-70mld) allora anche togliendo RdC e 80 euro:

= 0.6%-0.8%

+ 50mld (2.8%)

= 3.6%

+ sterilizzazione IVA (1.3%)

= 4.9%

=> tanti auguri

= 0.6%-0.8%

+ 50mld (2.8%)

= 3.6%

+ sterilizzazione IVA (1.3%)

= 4.9%

=> tanti auguri

• • •

Missing some Tweet in this thread? You can try to

force a refresh