Head of Economic Policy Research, Algebris Investments. Non-Resident Fellow @Bruegel_org. Adjunct Lecturer @SAISHopkins. Fellow @iep_bu.

2 subscribers

How to get URL link on X (Twitter) App

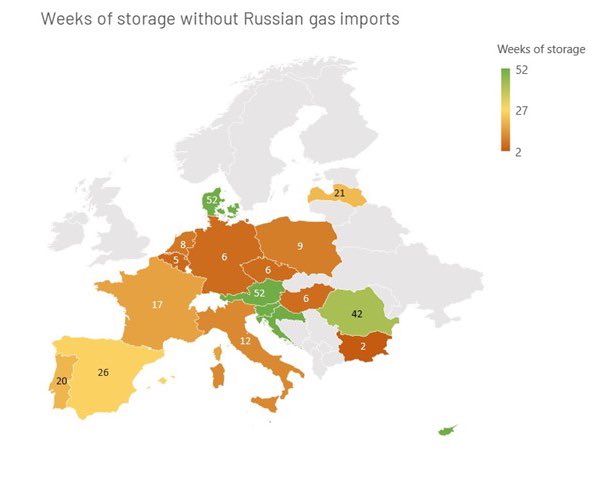

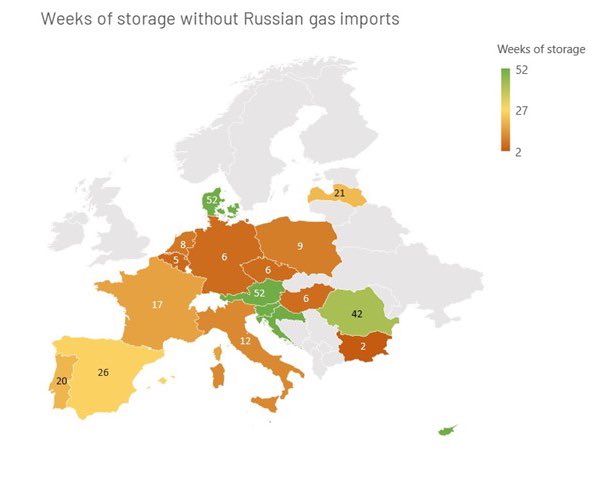

https://twitter.com/SMerler/status/1564898157137379329Some have pointed out that Italy has signed contracts for extra flows (compared to 2022) from North Africa in 2023/24. In my baseline scenarios (see here with data updated through end-August) I am not considering those future flows for two reasons (continues below).

In Italy, gas consumption has declined by just 2% on average over the first 6 months of 2022 wrt 2021. At this rate, Italy will run out of gas by the spring even if Russia keeps sending 10% of the flows. Italy needs to more than double its energy savings to weather the storm. 2/

In Italy, gas consumption has declined by just 2% on average over the first 6 months of 2022 wrt 2021. At this rate, Italy will run out of gas by the spring even if Russia keeps sending 10% of the flows. Italy needs to more than double its energy savings to weather the storm. 2/

#UkraineRussiaWar is disrupting physical, logistical & market dynamics in the Black Sea - a key hub for wheat, feed grains & sunflower seed to world markets. 🇺🇦 ports are all closed or blockaded by 🇷🇺 Navy. 🇺🇦 suspended port operations for commercial activities since 24/02. 2/

#UkraineRussiaWar is disrupting physical, logistical & market dynamics in the Black Sea - a key hub for wheat, feed grains & sunflower seed to world markets. 🇺🇦 ports are all closed or blockaded by 🇷🇺 Navy. 🇺🇦 suspended port operations for commercial activities since 24/02. 2/

https://twitter.com/SMerler/status/1497732415745404928

A similar picture if we look at currency composition of reserves: out of EUR/USD (down from a combined 87% in 03/2014 to 49% in 06/2021, which is the latest figure available) and into gold and Yuan (up from 9% in 2014 to 25% in 2021). 2/

A similar picture if we look at currency composition of reserves: out of EUR/USD (down from a combined 87% in 03/2014 to 49% in 06/2021, which is the latest figure available) and into gold and Yuan (up from 9% in 2014 to 25% in 2021). 2/

https://twitter.com/DadoneFabiana/status/14043695087861350411) I salari in Italia praticamente non crescono da 20 anni, MA anche così sono cresciuti più della produttività (sia produttività del lavoro che TFP). È una situazione che nel lungo erode la competitività esterna, non è sostenibile, ed è il risultato di un circolo vizioso

What are countries prioritising? Looking at some of the #NRRPs published so far, spending areas are largely driven by the targets on green and digital, but priorities (the largest single spending items) vary. Italy stands out for prioritising infrastructure investment ⬇️

What are countries prioritising? Looking at some of the #NRRPs published so far, spending areas are largely driven by the targets on green and digital, but priorities (the largest single spending items) vary. Italy stands out for prioritising infrastructure investment ⬇️

https://twitter.com/SFischer_EU/status/13283396783958507531) First, if no agreement is found on ORD, we fall back on the previous MFF, which obviously didn't include RRF. BUT the new RoL mechanism will apply to all EU spending, hence also to the carried over MFF. Cohesion & CAP money for 🇭🇺 🇵🇱 will now be scrutinised on RoL grounds.

Biden's lead is stronger in swing states (notably Pennsylvania and Michigan) that are unlikely to be called tonight because they do little pre-processing of postal ballots. Swing states Trump could win (Florida and NC above all) have long pre-processing and will be called. 2/

Biden's lead is stronger in swing states (notably Pennsylvania and Michigan) that are unlikely to be called tonight because they do little pre-processing of postal ballots. Swing states Trump could win (Florida and NC above all) have long pre-processing and will be called. 2/

As we wrote in this ⬇️piece last year, the NI Protocol negotiated by Johnson achieved the remarkable combination of leaving the Prime Minister in a better political position at home, while putting the country in a worse economic position vis-à-vis 🇪🇺2/ algebris.com/policy-researc…

As we wrote in this ⬇️piece last year, the NI Protocol negotiated by Johnson achieved the remarkable combination of leaving the Prime Minister in a better political position at home, while putting the country in a worse economic position vis-à-vis 🇪🇺2/ algebris.com/policy-researc…

🇮🇹 storicamente ha una bassa % di popolazione con istruzione terziaria, e in particolare sotto-produce capitale umano nelle aree che guideranno crescita e sviluppo in futuro (e.g. STEMs ICT). Ciononostante spendiamo solo ~0.3% PIL su istruzione terziaria

🇮🇹 storicamente ha una bassa % di popolazione con istruzione terziaria, e in particolare sotto-produce capitale umano nelle aree che guideranno crescita e sviluppo in futuro (e.g. STEMs ICT). Ciononostante spendiamo solo ~0.3% PIL su istruzione terziaria

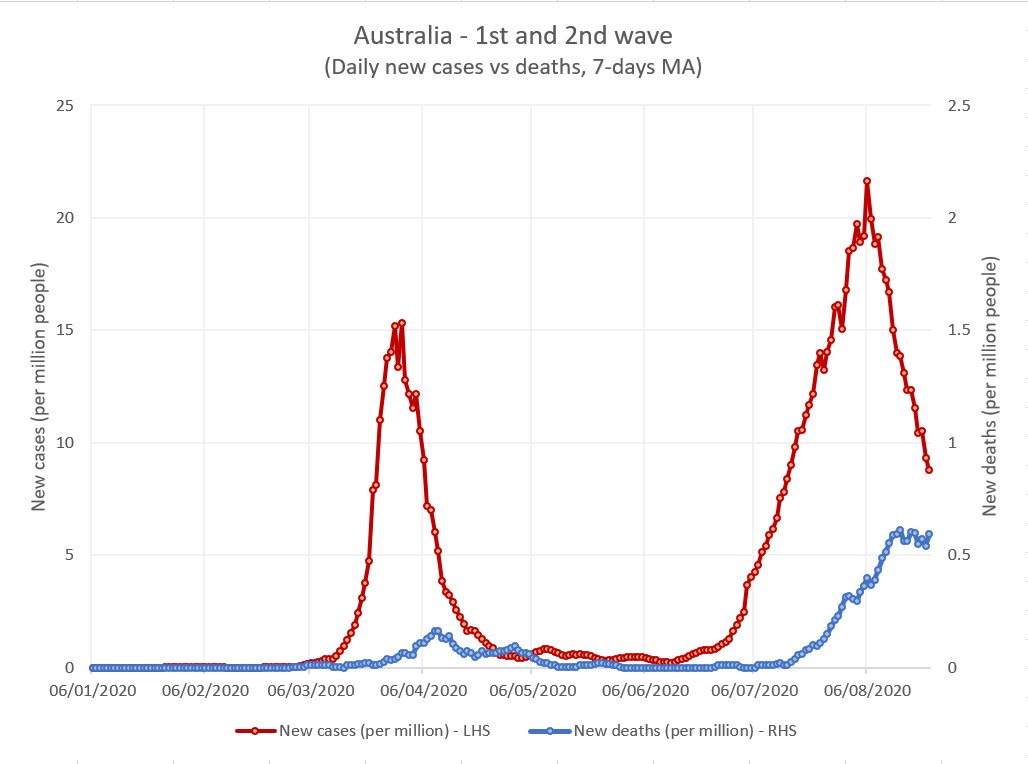

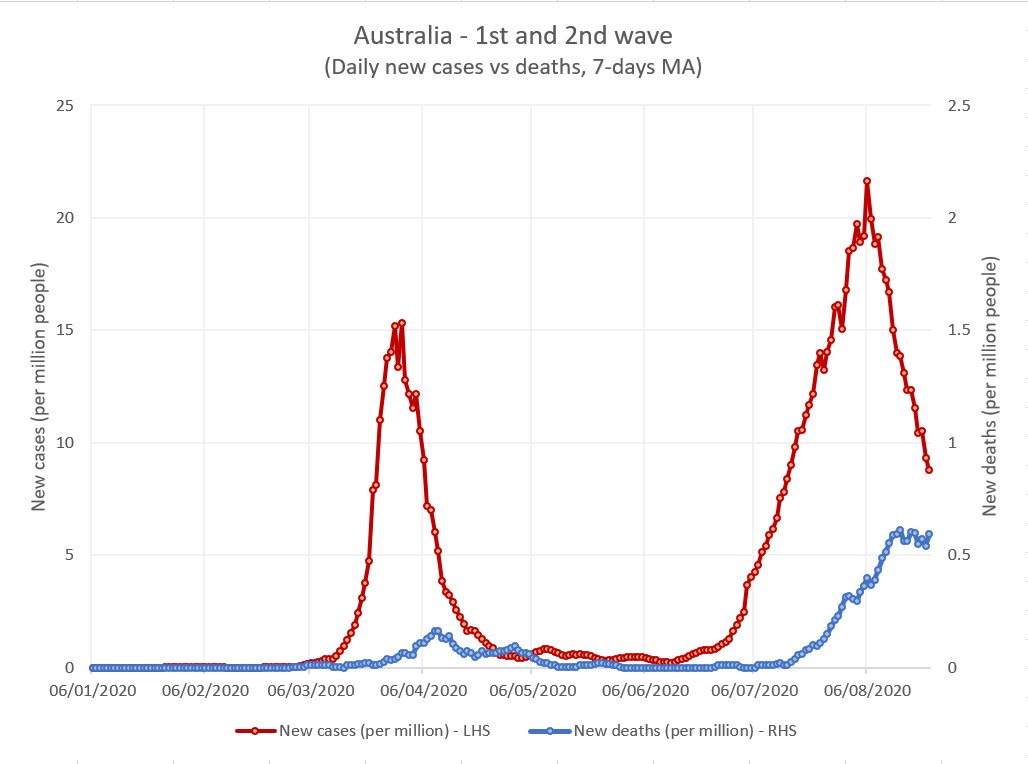

What we are seeing in European summer 2nd waves is a big increase in cases with (for now) stable deaths numbers. This is unlike what we had in March/April and there are a lot of factors contributing to it that have been explained by experts (age profile, better knowledge etc). 2/

What we are seeing in European summer 2nd waves is a big increase in cases with (for now) stable deaths numbers. This is unlike what we had in March/April and there are a lot of factors contributing to it that have been explained by experts (age profile, better knowledge etc). 2/

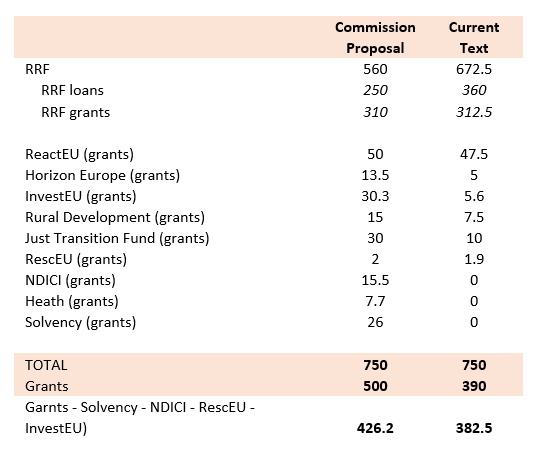

https://twitter.com/SMerler/status/12624206373117992961) Molti lamentano la dimensione (500mld vs 1000mld prospettati da Von der Leyen), ma non guardano alla composizione. I 1000mld di Von der Leyen erano pensati a leva come misto di loans e grants, in cui la grande incognita era la misura della componente grants.

Tra i settori più colpiti ci sono ovviamente ristorazione e alberghiero - e già da inizio anno (complici il disastro di Venezia da un lato, e i minori arrivi dalla Cina dall'altro). Queste le nostre stime di impatto sull'attività economica in questo settore a Marzo 2020. 2/

Tra i settori più colpiti ci sono ovviamente ristorazione e alberghiero - e già da inizio anno (complici il disastro di Venezia da un lato, e i minori arrivi dalla Cina dall'altro). Queste le nostre stime di impatto sull'attività economica in questo settore a Marzo 2020. 2/

https://twitter.com/SMerler/status/1237492257458204673First, this is NOT a forecast. I took the actual data on COVID-19 by country, normalised per 10k inhabitants, and mapped against the Italian curve to see at which point of that curve each country stands today. No degree of forecasting involved. 2/