There are four paths to becoming a millionaire, but most Nigerians only focus on one!

This CNBC article, outlines four very different ways to get to $1m. #Thread

cnbc.com/amp/2019/09/27…

This CNBC article, outlines four very different ways to get to $1m. #Thread

cnbc.com/amp/2019/09/27…

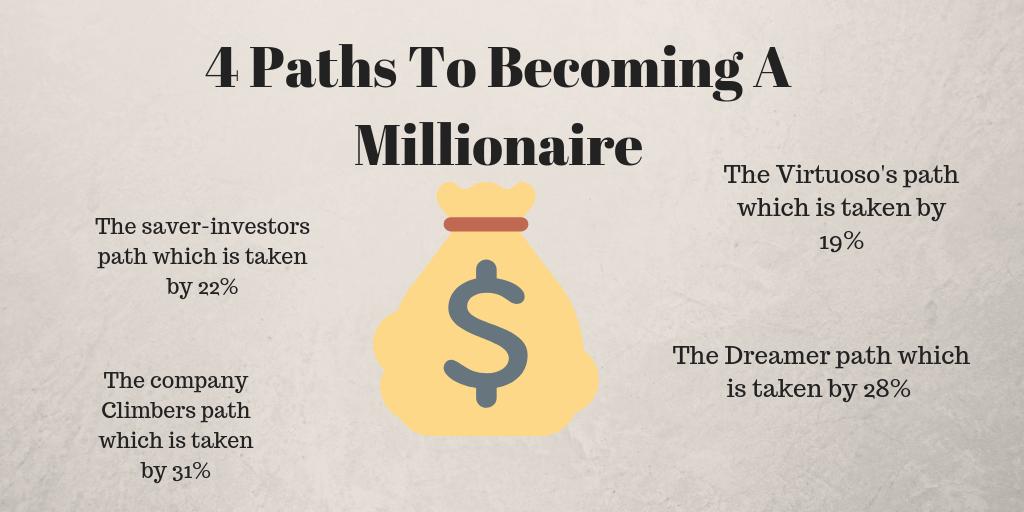

The saver investors path is actually the easiest way to become a millionaire according to the article.

This involves simply being disciplined, understanding financial instruments and saving your salary, then using your savings to invest.

This involves simply being disciplined, understanding financial instruments and saving your salary, then using your savings to invest.

You may not get to $1m but you can definately get a lot more comfortable financially by learning to be a saver -investor. This is practically guaranteed. @tayooye talks about this a lot.

The Dreamers path

This is perhaps the hardest path to building wealth because it requires the pursuit of a dream, such as starting a business, becoming a successful actor, musician or author.

This is perhaps the hardest path to building wealth because it requires the pursuit of a dream, such as starting a business, becoming a successful actor, musician or author.

This is very high risk, there are no guarantees. It will probably fail.

But surprisingly, this seems to be what Nigerians on twitter talk about the most.

But surprisingly, this seems to be what Nigerians on twitter talk about the most.

The Company Climbers path

Climbers are individuals who work for a big company and devote all of their energy into climbing the corporate ladder until they land a senior executive position.

Climbers are individuals who work for a big company and devote all of their energy into climbing the corporate ladder until they land a senior executive position.

This is the second-hardest path to becoming a millionaire,after entrepreneurship and comprises about 31% of rich people according to the article.

To be a climber, you must have strong relationship-building skills. Networking and making lasting connections with powerful people in your industry is essential.

Like Dreamers, however, climbers also have long work hours and travel a lot.

Like Dreamers, however, climbers also have long work hours and travel a lot.

Virtuosos are among the absolute best at what they do in their profession. They are paid a high premium for their knowledge and expertise, which sets them apart from the competition.

They must spend many years continuously studying and learning. Formal education, such as advanced degrees, is usually a requirement.

• • •

Missing some Tweet in this thread? You can try to

force a refresh