Starting now @IMFNews the 20th #ARCPOLAK research conference on #debt. Full program and papers here:

imf.org/en/News/Semina…

imf.org/en/News/Semina…

First paper by Christoph Trebesch @kielinstitute (joint work with @carmenmreinhart and Sebastian Horn) with new insights and data on Chinese global lending. Data available here: sites.google.com/site/christoph…

Second presentation by @MarkLJWright on deception and self deception in sovereign debt statistics. Nice example of Italy debt reduction in 2002 by almost 2% of GDP, swapping low-face high-coupon with high-face/low-coupon debt @upanizza

Alberto Martin @ecb presenting on unions and fiscal policy. In a world with financial frictions the interest rate isn’t a good measure to decide how much to spend and this leads to an overspending externality in the union. The capacity to place debt abroad weakens the externality

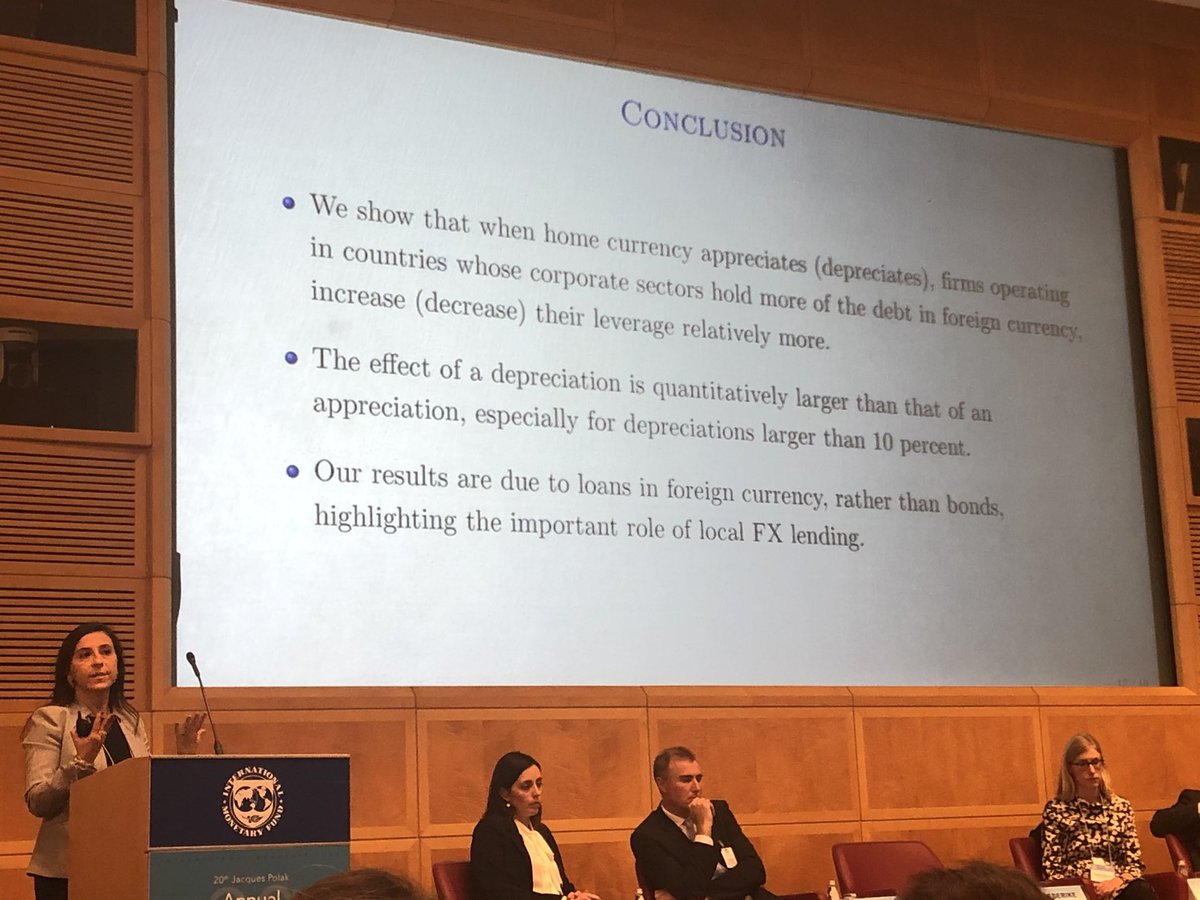

New evidence by @skalemliozcan on currency appreciations and rising firm leverage in emerging markets. Key message on the importance to monitor firms’ (and not only banks’) FX exposure

End of day 1 #ARCPolak with the Mundell Fleming lecture on credit cycles and the role for monetary policy and macroprudential regulation @IMFNews

Main message: as it is hard to believe that we are in a world where financial regulation cannot solve all problems alone, there is an active and important role for monetary policy. Key question (on which more research is needed) is on the magnitude of the effects of MP

Giancarlo Corsetti kicking off the second day of the #ARCPolak conference @IMFNews with a paper on official lending terms in the euro area and debt sustainability

Second paper of the day: Jing Zhou and @PaoloMauroEcon explore the evolution of r-g in 55 countries, arguing that even if negative r-g prevail, we cannot necessarily sleep more soundly

A key point is that while the effective rate does not increase in the run up of a sovereign default, marginal rates do increase, but this happens only a few months before the default

In his discussion, @ilzetzki makes the point that the fiscal space bought by negative r-g has recently been eroded and deficits have increased. He also stresses that r, g & debt are endogenous and can generate multiple equilibria, consistent with sharp increase in marginal rates

@ilzetzki This paper by Zhou and @PaoloMauroEcon and the discussion by @ilzetzki are a nice plug for this afternoon discussion #ARCpolak on public debt and fiscal policy, with @ojblanchard1 and @krogoff

• • •

Missing some Tweet in this thread? You can try to

force a refresh