Economist @IMFNews, @JHU_BIPR and @cepr_org Research Fellow, former @SAISHopkins and @UnivPoliMarche. Views are my own, RT ≠ Endorsement

How to get URL link on X (Twitter) App

The largest US banks paid out $35 bn in rewards (cash backs, miles, points) in 2019 @CFPB. A popular view is that the poor foot much of the bill for credit card rewards. See, for instance, @Aarondklein brookings.edu/opinions/how-c… or vox.com/the-goods/2245… @voxdotcom @EmilyStewartM

The largest US banks paid out $35 bn in rewards (cash backs, miles, points) in 2019 @CFPB. A popular view is that the poor foot much of the bill for credit card rewards. See, for instance, @Aarondklein brookings.edu/opinions/how-c… or vox.com/the-goods/2245… @voxdotcom @EmilyStewartM

We document that negative interest rate policy (NIRP) has expansionary effects on credit supply and the real economy through a portfolio rebalancing channel, similar to QE, and different from conventional policy rate cuts just above the ZLB

We document that negative interest rate policy (NIRP) has expansionary effects on credit supply and the real economy through a portfolio rebalancing channel, similar to QE, and different from conventional policy rate cuts just above the ZLB

The Debt Service Suspension Initiative (DSSI) provides debt relief to poor countries by deferring debt service due in 2020 without affecting the NPV of public debt. Liquidity provision under the DSSI accounts for about 20% of the fiscal shortfall due to the Covid-19 shock. 2/8

The Debt Service Suspension Initiative (DSSI) provides debt relief to poor countries by deferring debt service due in 2020 without affecting the NPV of public debt. Liquidity provision under the DSSI accounts for about 20% of the fiscal shortfall due to the Covid-19 shock. 2/8

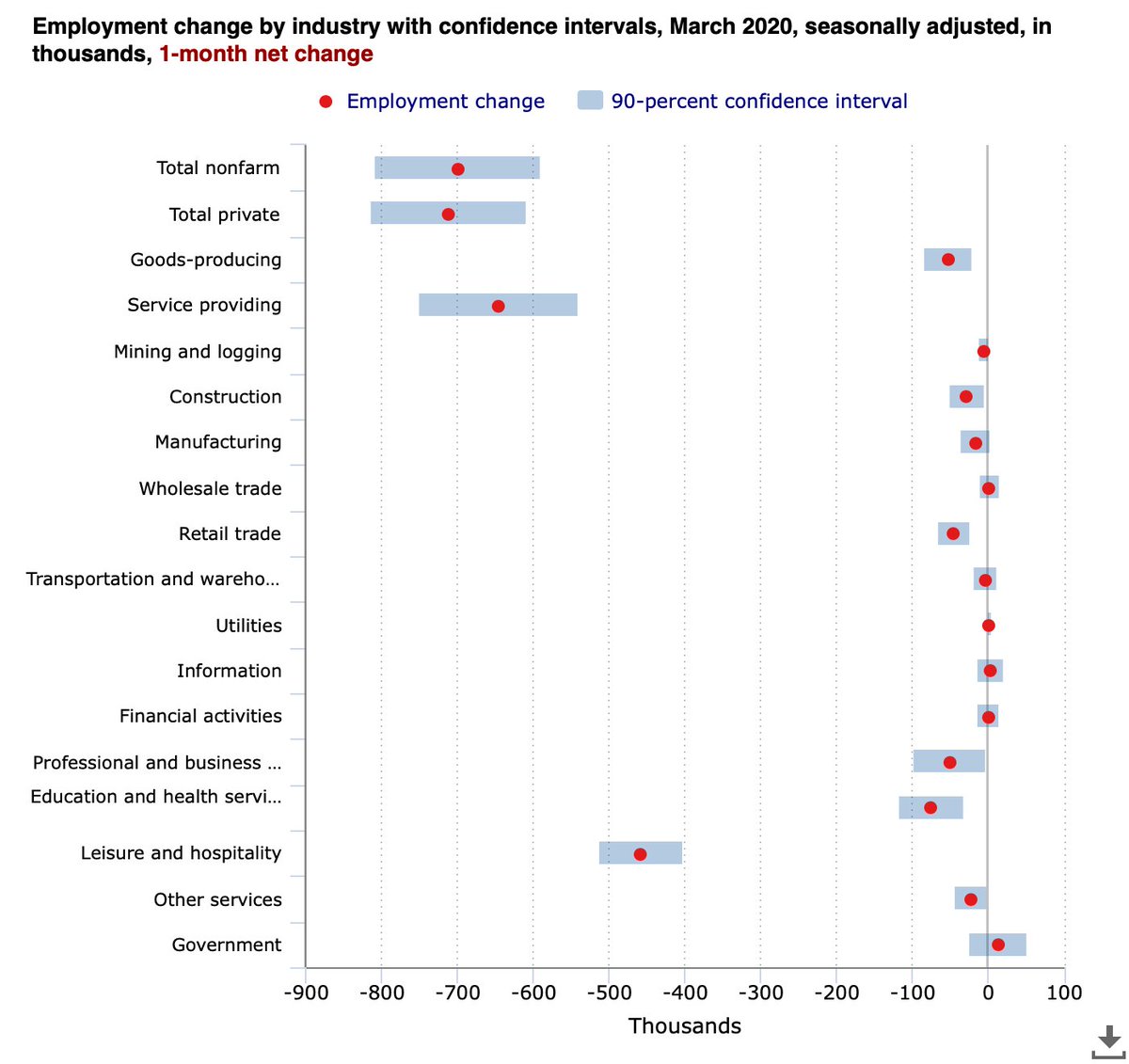

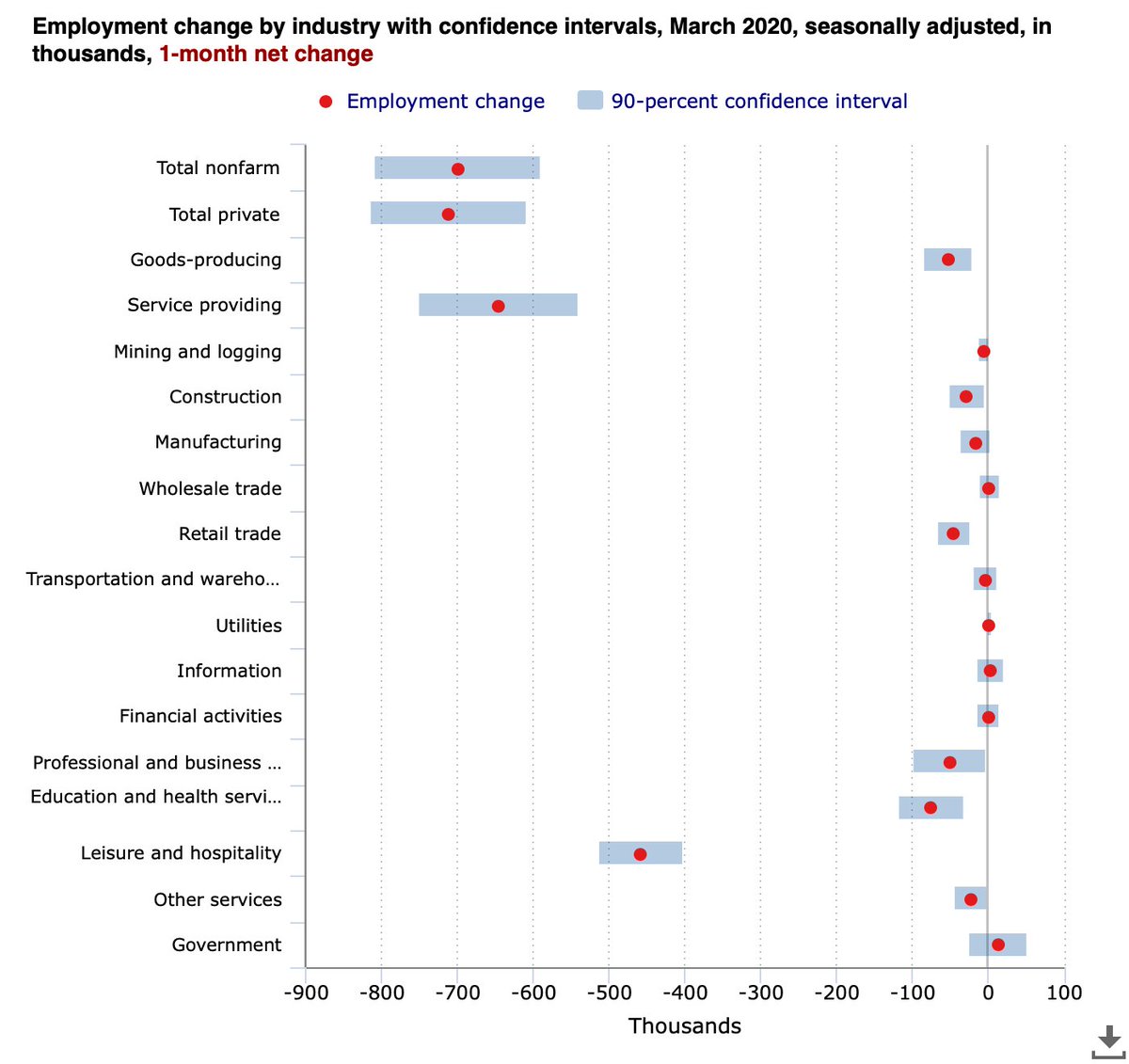

First, the sharp decline in electricity usage and the unique spike in unemployment insurance claims (~33 million as of today) highlight that the Great Lockdown is novel not only for its magnitude, but also for the speed at which the economy and the labor market are affected

First, the sharp decline in electricity usage and the unique spike in unemployment insurance claims (~33 million as of today) highlight that the Great Lockdown is novel not only for its magnitude, but also for the speed at which the economy and the labor market are affected

The decline in energy usage has been more sizeable in countries hit harder by the pandemic. However, the correlation becomes weaker as time passes, suggesting that the shock becoming less idiosyncratic as the virus spreads

The decline in energy usage has been more sizeable in countries hit harder by the pandemic. However, the correlation becomes weaker as time passes, suggesting that the shock becoming less idiosyncratic as the virus spreads

Distributing checks to almost all households is likely to miss the least vulnerable and partially waste money. On the contrary, targeting fiscal support measures should not be extremely difficult and costly, and it could achieve a better allocation. 2/7

Distributing checks to almost all households is likely to miss the least vulnerable and partially waste money. On the contrary, targeting fiscal support measures should not be extremely difficult and costly, and it could achieve a better allocation. 2/7

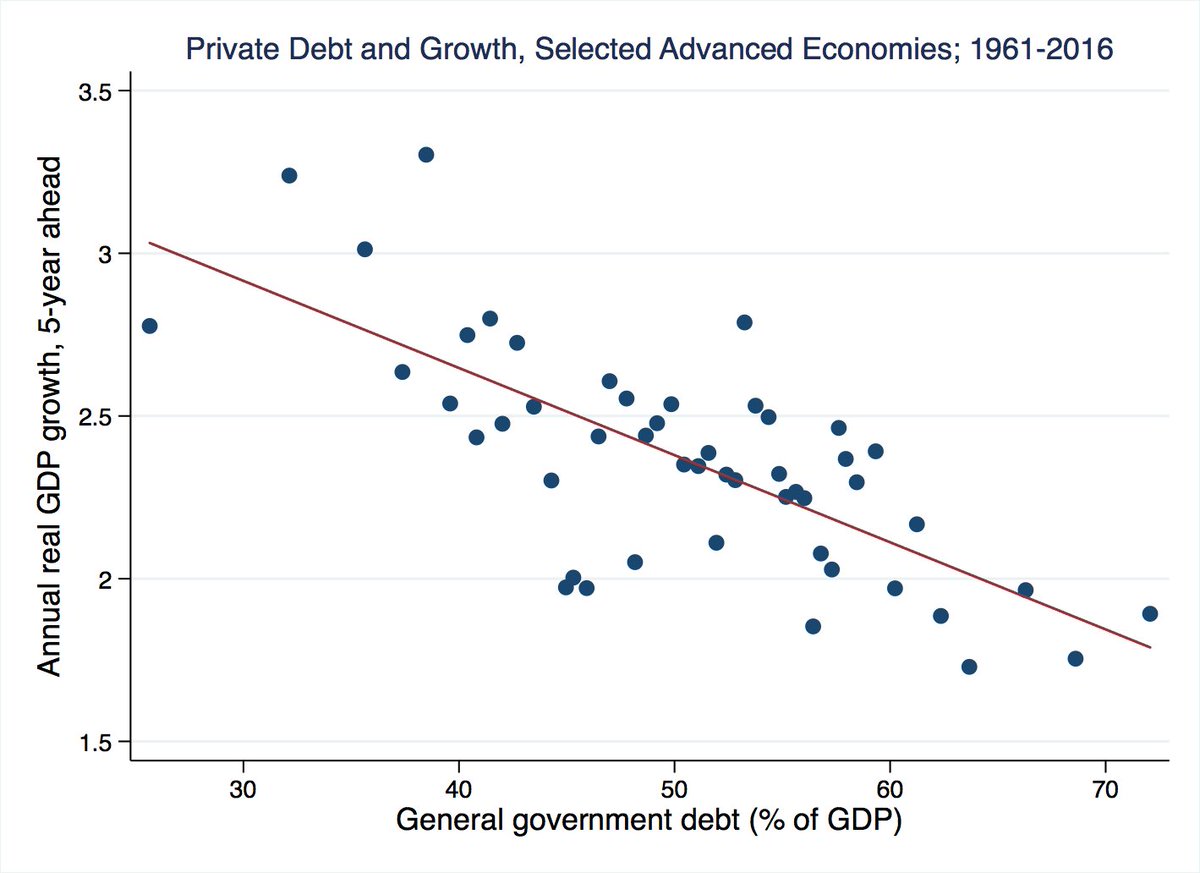

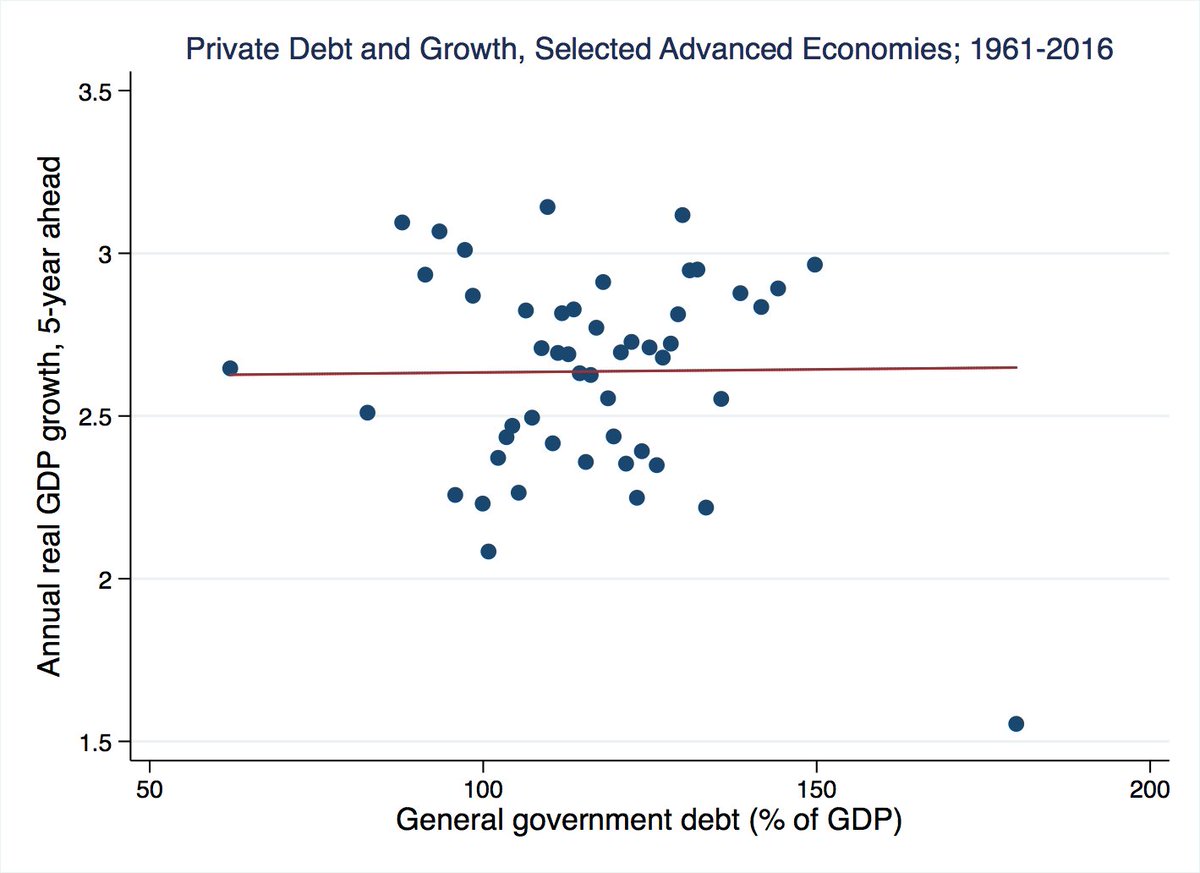

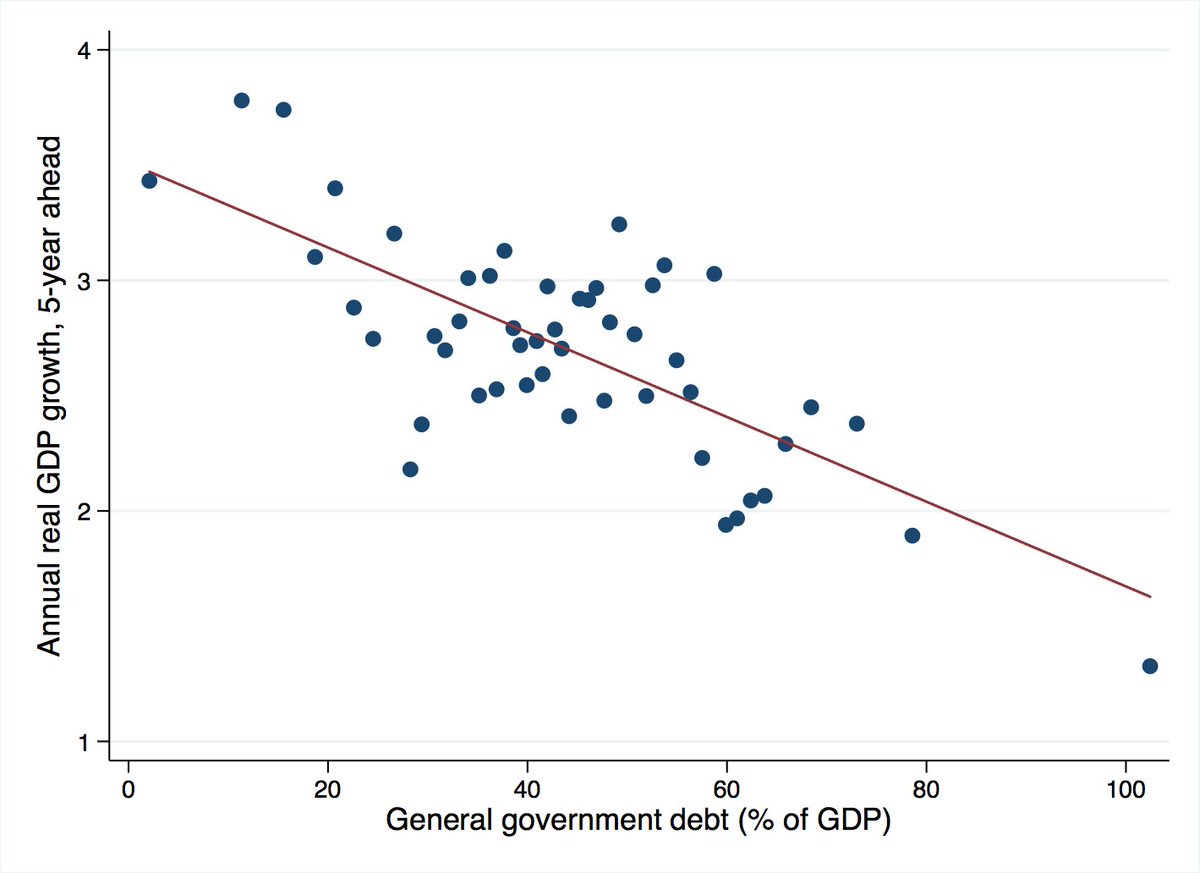

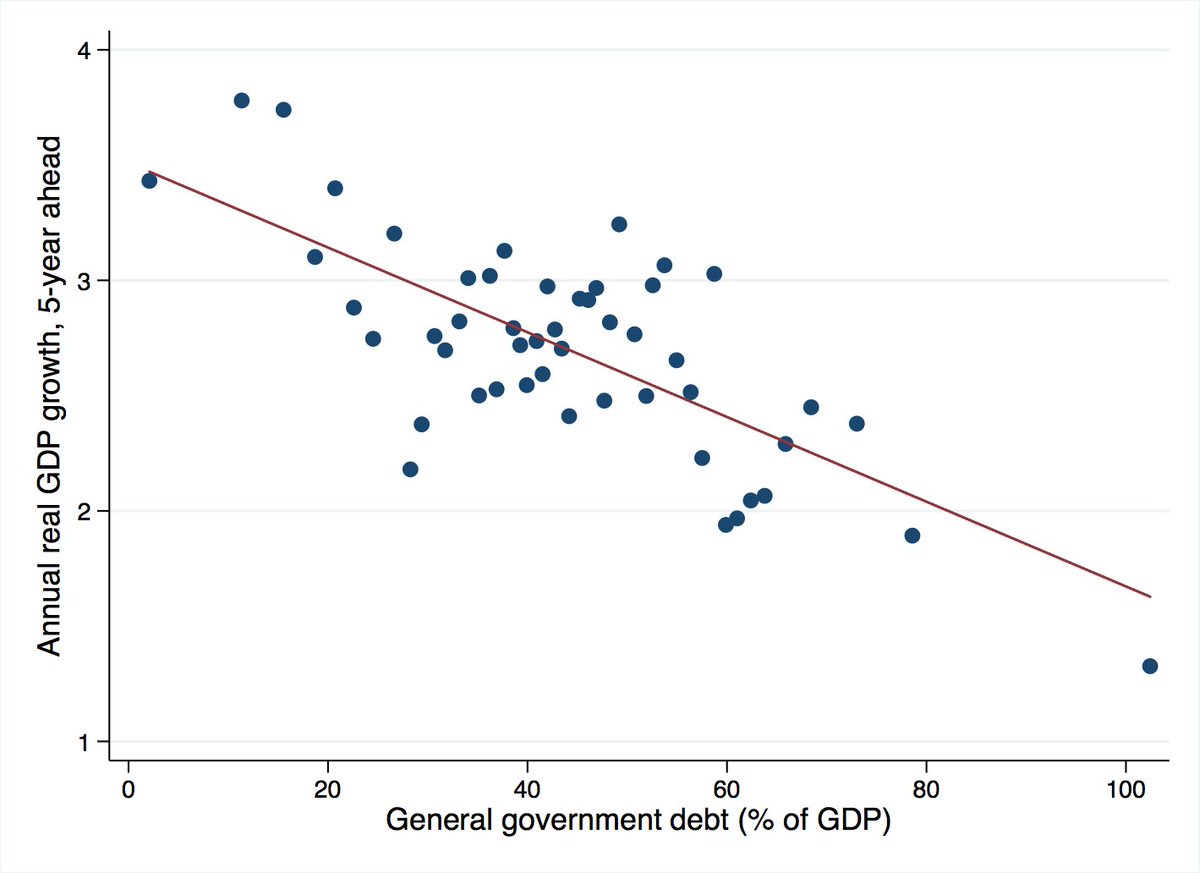

@Confindustria @GiampaoloGalli @upanizza @Leonardobecchet @SMerler @CottarelliCPI @MCroce_MacroFin @aaamigh @FGoria La prima lezione è che il rallentamento economico in corso non implica che sia ottimale espandere il debito pubblico. Un debito elevato ha costi economici e redistributivi e aumenta il rischio che un paese si trovi in un “equilibrio cattivo” 2/n

@Confindustria @GiampaoloGalli @upanizza @Leonardobecchet @SMerler @CottarelliCPI @MCroce_MacroFin @aaamigh @FGoria La prima lezione è che il rallentamento economico in corso non implica che sia ottimale espandere il debito pubblico. Un debito elevato ha costi economici e redistributivi e aumenta il rischio che un paese si trovi in un “equilibrio cattivo” 2/n

First paper by Christoph Trebesch @kielinstitute (joint work with @carmenmreinhart and Sebastian Horn) with new insights and data on Chinese global lending. Data available here: sites.google.com/site/christoph…

First paper by Christoph Trebesch @kielinstitute (joint work with @carmenmreinhart and Sebastian Horn) with new insights and data on Chinese global lending. Data available here: sites.google.com/site/christoph…

1. #MDBs’ participation is associated with higher

1. #MDBs’ participation is associated with higher

Developing countries are vulnerable to terms-of-trade shocks, with severe impact on output growth and macroeconomic and political stability (see @blattman). We extend this literature documenting a transmission channel via bank lending 2/7

Developing countries are vulnerable to terms-of-trade shocks, with severe impact on output growth and macroeconomic and political stability (see @blattman). We extend this literature documenting a transmission channel via bank lending 2/7

A cut in policy rates expands aggregate demand, but:

A cut in policy rates expands aggregate demand, but:

Ora capisco meglio (cc @albertobisin)

Ora capisco meglio (cc @albertobisin)

@Kumar_EconIneq @krogoff @IMFNews @MEDevEcon @upanizza @JustinSandefur @AtifRMian @BaldwinRE @ryanavent @davidmwessel @arindube @ThomasHerndon1 @michaelstepner Same charts for total private debt (loans and debt securities) is flat, but if limited to hh debt the relationship is again negative

@Kumar_EconIneq @krogoff @IMFNews @MEDevEcon @upanizza @JustinSandefur @AtifRMian @BaldwinRE @ryanavent @davidmwessel @arindube @ThomasHerndon1 @michaelstepner Same charts for total private debt (loans and debt securities) is flat, but if limited to hh debt the relationship is again negative