A thread on understanding the basic concept of ROE for new investors

(1/n)

(1/n)

Simply put, ROE is a measure of profitability that calculates how many rupees of profit a company generates with each rupee of shareholders’ equity.

(2/n)

(2/n)

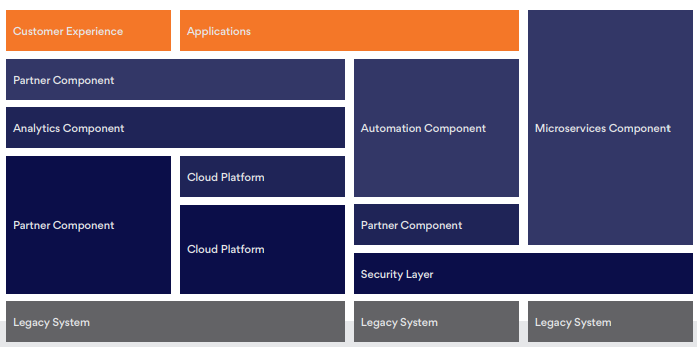

Dupont Framework breaks it to 3 aspects of a business:

1 Profitability

2 Asset Management

3 Financial Leverage

(3/n)

1 Profitability

2 Asset Management

3 Financial Leverage

(3/n)

Companies having a high PAT margin can charge higher prices compared to their competitors. This could most likely be a result of:

habitual use of the product,

the high cost of switching to the new product,

the high cost of searching for new products

(5/n)

habitual use of the product,

the high cost of switching to the new product,

the high cost of searching for new products

(5/n)

We put more weight on one’s ability to generate high margins, but often it is the high Asset Turnover rate that drives ROE. High asset turnover for the company means an asset-light model that requires little incremental capital to fund its growth.

(6/n)

(6/n)

Just as pricing power comes from advantage over consumers, high asset turnover is the result of production advantage. Efficiency in the operations helps the company to keep rotating the same amount of capital multiple times during the year to generate high asset turnover.

(7/n)

(7/n)

While the above two metrics (NP margin & Asset Turnover) look at the consumer and production angle, financial leverage is only concerned with the capital structure of the business.

(8/n)

(8/n)

Businesses that enjoy financial leverage will invariably have higher ROE, but we must try to decipher what type of financial leverage does the company enjoys and what are the costs associated with it.

(9/n)

(9/n)

Suppose a company manages a float in the nature of trade credits, deposit from distributors, and advance from customers or deferred tax liability, it effectively has temporary possession of Other People’s Money (OPM).

(10/n)

(10/n)

A float of this nature (OPM) is enduring, long term and cost-less. Thereby, the presence of this float allows the company to fund its assets without making a significant contribution in the form of equity or interest-bearing debts.

(11/n)

(11/n)

Financial leverage in this form (OPM) is advantageous for the company, as it levers ROA to produce a high return on capital employed.

(12/n)

(12/n)

But, if the company enjoys financial leverage in the form of high interest-bearing debt, after a certain point, the actual cost of the debt diminishes profit margins and decreases asset turns.

(13/n)

(13/n)

However, for a short period, a company can deliver extremely high ROE, as for that short period the equity requirements of the company go down due to the presence of huge debt.

(14/n)

(14/n)

Hence, in such a scenario, ROE can be misleading for a short period of time Calculate Return on Invested Capital (ROIC) for the same period; as ROIC negates the effects of leverage.

ROIC = Net Op PAT/ Total Cap invested

(15/n)

ROIC = Net Op PAT/ Total Cap invested

(15/n)

The goal of ROE is to understand how efficiently a company uses its equity. And we should just stick to that and leave aside the capital allocation matter. Excess cash on BS is a capital allocation matter, which should not affect the ROE.

(16/n)

(16/n)

Excess cash on the BS, hence, should be stripped from the asset side of the BS, & necessary downward revision in equity to be made to balance the asset side with the liability side.

(17/n)

(17/n)

M&A rules make it mandatory for companies to merge their accounts with the target company, so for any company which has just made an acquisition, the ROE just after the acquisition may be misleading as the goodwill amount on the BS has a bearing on the calculation of ROE

(19/n)

(19/n)

The best way to judge a company’s performance, while it is undertaking M&A activities, is to calculate:

a. ROE excluding goodwill (subtracting goodwill from equity)

b. ROE including goodwill.

(20/n)

a. ROE excluding goodwill (subtracting goodwill from equity)

b. ROE including goodwill.

(20/n)

If a co is going for more organic growth Vs inorganic, the ROE without goodwill is a better measure of performance. But if a co is going for more inorganic growth Vs organic, the better measure of performance for such a company would be ROE including goodwill.

(21/n)

(21/n)

Summing up:

1.ROE is undoubtedly the most effective measure of a company’s operational performance

2.Don’t take the blanket rate of ROE for the purpose of analysis.

3.Take into account the 3 levers of ROE & then judge how each lever is contributing to ROE.

…continued

(22/n)

1.ROE is undoubtedly the most effective measure of a company’s operational performance

2.Don’t take the blanket rate of ROE for the purpose of analysis.

3.Take into account the 3 levers of ROE & then judge how each lever is contributing to ROE.

…continued

(22/n)

4.ROE may be misleading due to high leverage, excess cash on the BS or involvement of M&A activities. However, by making suitable adjustments to the ROE formula in each case, we do arrive at a reasonably correct figure to gauge the performance of the company accurately.

(23/n)

(23/n)

We hope that clears the concept of ROE. If you have any doubts or queries regarding ROE, please write in the comments section, we will be happy to take that up.

End

(n/n)

End

(n/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh