Books &year-end forgivable Jeremiad (a thing we should normally avoid):geo-political factors going worse in 2020, an economically normal year.Trump seems closer to reelection:the negative popularity gap closing; the majority favouring impeachment thinner; polls more favourable1/n

Lying and ignoring facts is now an established part of populist leaders’ “charisma”. Freud:“..masses have never known the thirst for truth.They demand illusions..”Populists were captured the anger of those left-behind by globalisation and the negligence of liberal elites 2/n

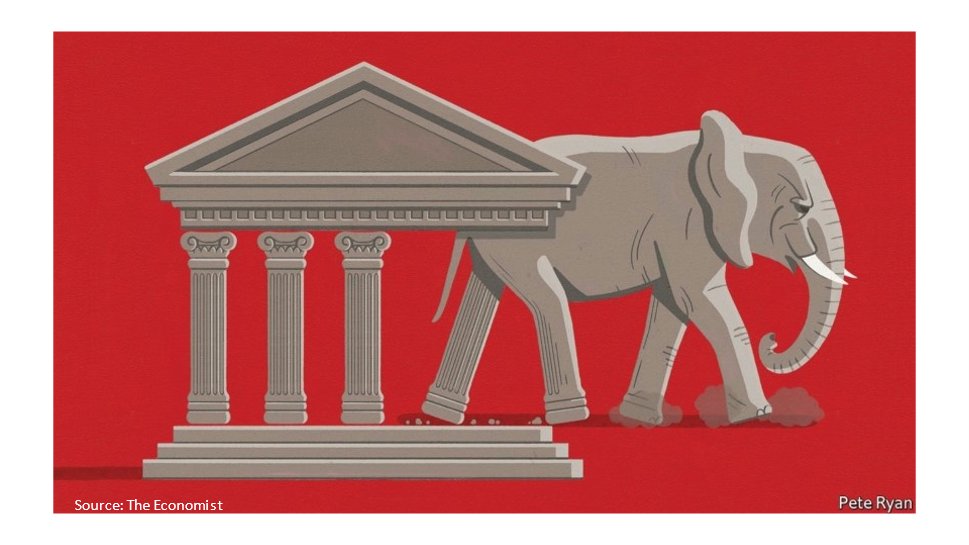

Authoritarian regimes are spreading. Putin is wining with the help of Trump and the GOP! Xi is Emperor for life.Modi started his ethnic fascism.There are little Trumps like Duterte or Bolsonaro. In Europe, the illiberal Hungary and Poland get billions from democratic EU. 3/n

On those issues read one of the books of the year: “The light that failed: a reckoning”(2019) by Ivan Krastev and Stephen Holmes, dealing with the illiberal developments in Eastern Europe, Russia, the US and China. See also “Capitalism alone” (2019) by B. Milanovic. 4/n

EU is in suspended mode.A new Commission with a bold programme but member countries paralysed by fragmented politics, looming nationalisms, threatening populists and fetishized conservatisms. No major reforms expected. Muddling-through to the next crisis? 5/n

For a balanced, forward-looking view of European institutions and governance read “The History of the European Union: Constructing Utopia” (2019) by Giuliano Amato (Author, Editor), Enzo Moavero-Milanesi (Editor), Gianfranco Pasquino (Editor), Lucrezia Reichlin (Editor). 6/n

Multilateralism collapsing.WTO in a coma, NATO brain dead (Macron).UN stripped of power.IMF hardly relevant.It does good economic research but has no influence on world affairs.Focusing outside the core mission:gender gap, climate change,corruption, the dark web.7/n

To think about international monetary problems read the 3d updated edition (Aug 2019) of “Globalizing Capital: A History of the International Monetary System - Third Edition” by B. Eicheingreen 8/n

Lots of talk about inequality but no advanced economy is trying to correct it, despite the recent recommendations by economists, sort of atoning for 30 years of unfettered markets’ sanctification and hyper-globalisation praise, despite Samuelson and Rodrik warnings 9/n

On sanctification read “The Economists' Hour:False Prophets Free Markets and the Fracture of Society”(2019) by Binyamin Appelbaum,light and full of nice vignettes.On inequality “The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay”by E Saez & G Zucman. 10/n

Besides climate change, the main risks are: the consolidation of a post-truth society and the consequent success of illiberal charlatans and demagogues; spread of nationalism and the decline of international cooperation, harming prosperity and peace 11/n

And yet..There is no past Golden Age.I’am no declinist à la Spengler,no moral pessimist MacIntyre’s style or cultural pessimist of pseudo-Nietzschian postmodern descent.Environmental awareness and improved vital conditions are civilisational bright spots: nytimes.com/2019/12/28/opi…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh