I put this at low odds, but I believe it is possible.

Thanks to The Accountant for flagging this in his excellent post - teslamotorsclub.com/tmc/posts/4401…

Thread continued: -

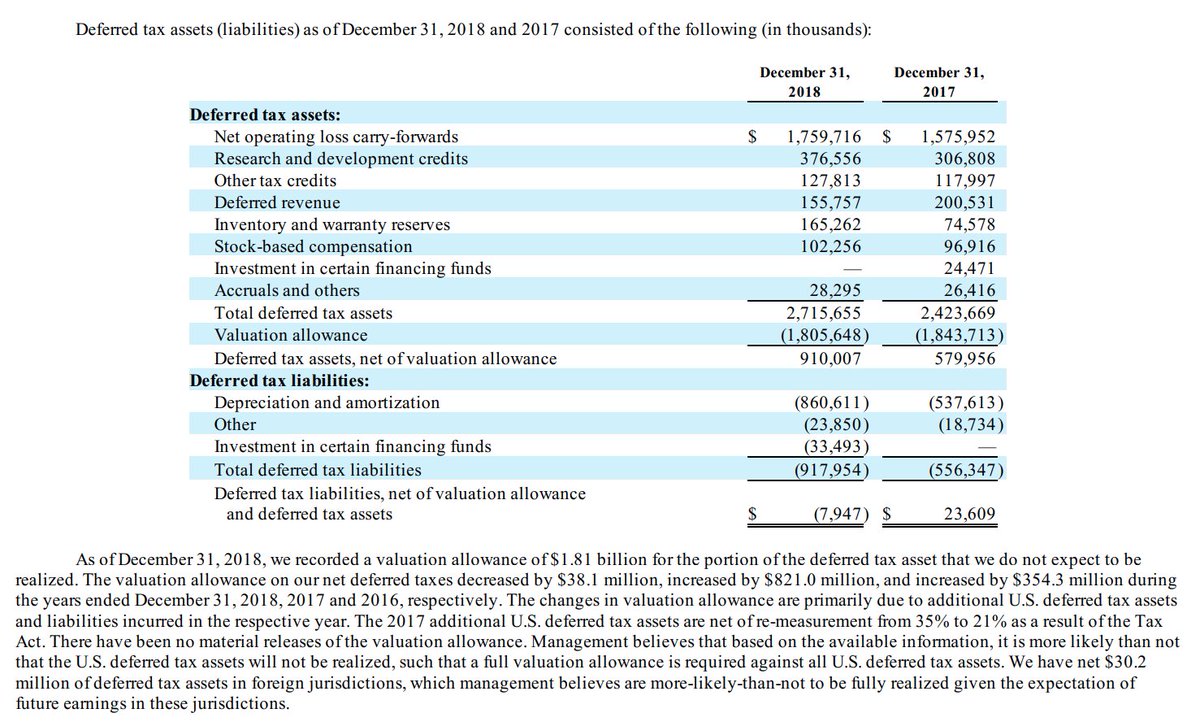

negative evidence and the anticipated ability to use the deferred tax assets, that it was more likely than not that the deferred tax assets could be realized."