Yes,& the cyclical recovery we feel in financial markets will feel recessionary. While semiconductor, tech & trade related activities may bounce on low base, cheap rates, & cycle turning, consumers pinched by high debt, stagnant income & insecurity unlikely to boost discretionary

https://twitter.com/Convertbond/status/1219040793849188354

In Hong Kong, HSI has bounced back but few would say the worst is over & the best is to come. Rates aren’t even lower but higher on tight liquidity & hence strong HKD. If u think the unemployment is low, watch sectors related to tourism (hotels, suppliers to hotels, etc).

Of course, HSI is linked to mainland China & also the same story. Very unlikely to see a massive boost in discretionary spending just b/c trade starts to look good as households feel squeezed by debt, higher CPI (not just pork but other commodities moving up too), weak real wages

Higher food CPI is good for Chinese farmers (or Indian farmers or Vietnamese) BUT very bad for consumer purchasing power. They have less disposable income for discretionary if ESSENTIALS are higher. Some say this is temporary but key is that these are INELASTIC goods! Need to eat

I didn't get to talk about this in the bloomberg program as the question on North Asia outward investment & geopolitics threw me off guard. That said, the key pt here is that we're looking at central banks trying to suppress volatility but can't control everything. Weather is one

For me, climate change is not about believing in it or not but rather about the predictabiltiy/volatility of weather patterns & hence PRODUCTION of essentials like FOOD & obvs water is key in that.

In Asia, key. Markets focused on oil but food is under appreciated as a shock 👈🏻!

In Asia, key. Markets focused on oil but food is under appreciated as a shock 👈🏻!

As in the rapid change of weather in Asia to be much dryer & hotter means RICE PRODUCTION is impacted & not just that but everything else. Don't forget that contention over WATER'll get worse. Rivers are underappreciated & key to Asia. And guess what? Rivers are not doing well.👈🏻

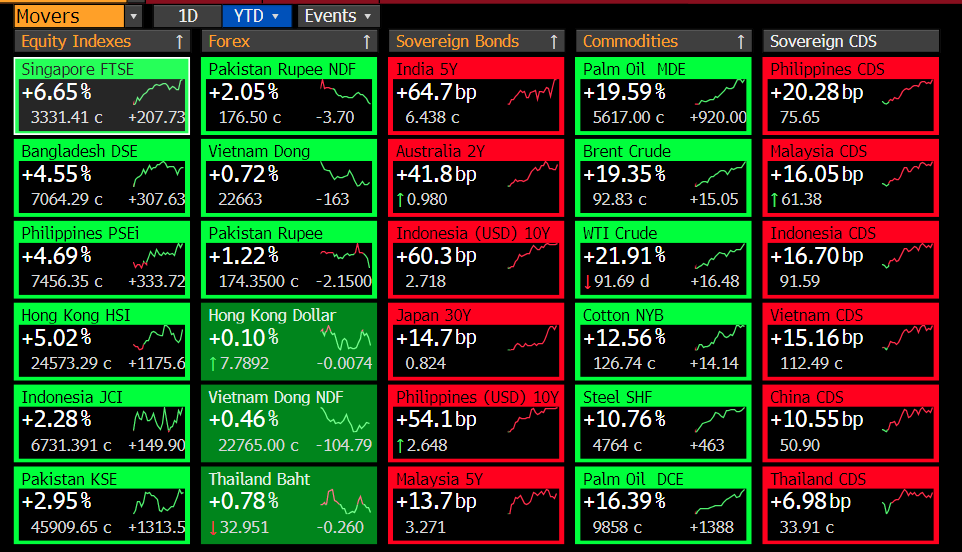

I mean, look at that commodity price chart since November 2019 (2 months only) & I'm worried that pork inflation is just the beginning to a hot year of food inflation.

HOT & DRY WEATHER = DROUGHT = HOT FOOD CPI!

📈📈📈🥵

HOT & DRY WEATHER = DROUGHT = HOT FOOD CPI!

📈📈📈🥵

As Thai rice prices rice, the Philippines is looking into Vietnam to buy. Indian broken rice also moving up as higher demand from African buyers (Nigeria is a huge buyer & likely to be second biggest soon).

agriculture.com/markets/newswi…

agriculture.com/markets/newswi…

Not just drought but also cold waves in India & Bangladesh. Anyway, very clear that high volatility of weather patterns is here to stay. Bad news is that Asia does not have the infrastructure to deal w/ this. It needs both soft & hard infra to cope w/ what is a regional issue.

Btw, China 1-yr primate rate UNCHANGED AT 4.15% in Jan vs expectations of 5bps cut. Latest report on food CPI shows higher commodity prices (not just pork). Low supply + high demand for lunar new year'll likely push up Jan 2020 # (seasonality impact here as LNY was Feb in 2019).

• • •

Missing some Tweet in this thread? You can try to

force a refresh