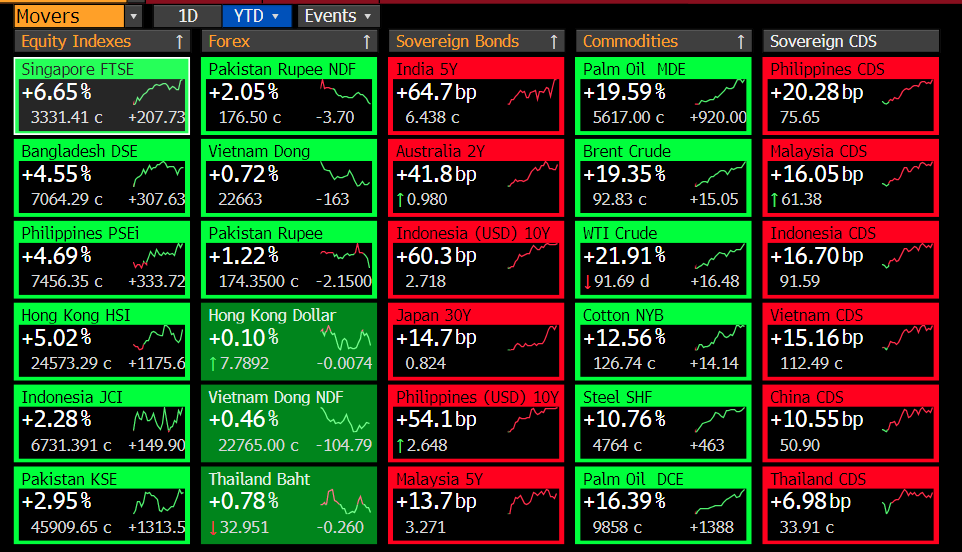

Ready? Thread on the corona virus & what trade and investment has got to do with it. This is similar to trade-war but going to be WORSE b/c we're adding a component LABOR, by that LACK of labor supply as well as the demand hit too.

Here we go. All about economic impact of virus!

Here we go. All about economic impact of virus!

Part 1. China

Before we talk about the impact of China, we must discuss the role of China in global TRADE & INVESTMENT:

*1/5 manufactured items are exported out of China - that share higher for some electronics, textile and household goods. So China is the manufacturing center.

Before we talk about the impact of China, we must discuss the role of China in global TRADE & INVESTMENT:

*1/5 manufactured items are exported out of China - that share higher for some electronics, textile and household goods. So China is the manufacturing center.

*As a manu center for the world & the center of the Asian supply chain, esp for electronics, textile, footwear & household goods, what China does or doesn't produce matter as few subsitutes

*But not just massive in gross exports, China has exported more & more intermediates

*But not just massive in gross exports, China has exported more & more intermediates

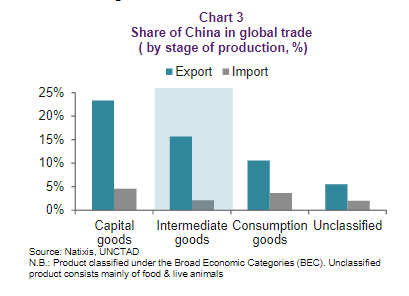

Let's look at this through China trade - exports & imports by global market share by STAGE OF PRODUCTION.

What do u see? a) China global market share of exports are massive for capital goods & intermediate goods & increasingly consumption goods. Share of its imports is much less

What do u see? a) China global market share of exports are massive for capital goods & intermediate goods & increasingly consumption goods. Share of its imports is much less

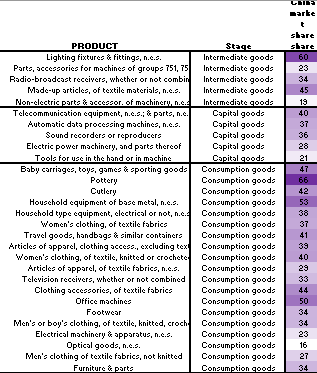

If u must see this by items, let me show u some Chinese manufactured goods by global market share & USDbn in value. What do you see? Well, high concentration risks for:

ELECTRONICS, MACHINERY, TEXTILE & HOUSEHOLD GOODS.

ELECTRONICS, MACHINERY, TEXTILE & HOUSEHOLD GOODS.

So key takeaways from this are: a) China has 19% manu global market share; b) Esp key for electronics, textile, household and machinery.

Exposure is through SUPPLY CHAIN (intermediate goods - as in if u don't get parts, can't make it) and also through IMPORTS of FINAL GOODS.

Exposure is through SUPPLY CHAIN (intermediate goods - as in if u don't get parts, can't make it) and also through IMPORTS of FINAL GOODS.

Btw, while China's exports are about 90% manufactured goods, its imports are dominated by commodities & its import of commodities have large global market share. See chart below on Chinese imports of food, oil & gas. Most of Asia is. So what they don't buy matter too.

So that should cover basic China trade issues. Btw, about 40% of Chinese exports are by foreign invested entities so it's not just Chinese firms but also a lot of foreign firms involved in the manufacturing trade in China.

What has happened w/ the virus? How does that matter?

What has happened w/ the virus? How does that matter?

On 23 January (note that just before Lunar New Year where people about to take 1 wk off), China locked down Wuhan. Soon enough, partial lock-down rest of China. People gripped w/ fear avoided public places & so not only that province stopped working, the rest operated sub-optimal

How sub-optimal u ask? Well, an entire Hubei Province was shutdown. The rest as a whole remained rather shut. Some data to indicate: autos down ~-90%; railway passenger ~-80; real estate sales ~-80, air traffic etc.

Since the infection has slowed ex Hubei, normalization BUT...

Since the infection has slowed ex Hubei, normalization BUT...

By some measure, labor is only about 70% of normal rate so we're talking about after a month of low production, the resumption of activities is slow. Apple reports -40-50% down sales. Foxconn is reportedly giving a USD1k bonus to start work in Zhengzhou.

scmp.com/tech/big-tech/…

scmp.com/tech/big-tech/…

So u can see here is that the manufacturing center of the world is missing workers to PRODUCE work. That's the labor component & that is a hard one to solve. If Foxconn is offering 1k & it has deep pockets, then China being still lacking labor will see OTHER PARTS MISSING WORKERS

We're having SUPPLY CHAIN CONCENTRATION RISKS in China for key sectors: electronics, textiles, machinery. If the highest value item (eg Iphone) gets made b/c they manage to somehow gets ALL parts to make the phone, & somehow pay a premium to get labor, still got labor shortage...

Because u have to understand, the issue here is that the contingency plans firms made for LNY shutdown is only 1 week & we got 3 more weeks of very low resumption & then current resumption is still around 70% of normal (using CICC estimate), then WE GOT A LABOR SHORTAGE PROBLEM..

Btw, supply chain is a very complex topic. But even at the macro level, u can see that the concentration risk is MASSIVE. And so at the firm level, some firms have LIMITED DIVERSIFICATION PLANS. If they want to get LABOR, they must pay more. And if they got labor, SOMEONE DOESN'T

No matter how u slice & dice the math, does not WARRANT A ROUNDING ERROR OF SUPPLY CHAIN RISKS.

A massive risk. And that risk is more concentrated for some & can be mitigated by deep pockets but on a macro basis, that RISK DOESN'T GO AWAY.

That's just China supply chain.

A massive risk. And that risk is more concentrated for some & can be mitigated by deep pockets but on a macro basis, that RISK DOESN'T GO AWAY.

That's just China supply chain.

So hopefully u're still w/ me on the importance of China & the concentration risks of China by key sectors (electronics, textile, household goods).

And u know that what happens in China matters for the REST OF ASIA. That's where we'll go next.

And u know that what happens in China matters for the REST OF ASIA. That's where we'll go next.

Part 2. The rest of Asia

As I told u already that this concentration risks well understood by Asia neighbors, esp the North Asians such as Japanese, Taiwanese, and South Korea. They deployed capital to China to take advantage of CHEAP LABOR & big MARKETS but then both got tough.

As I told u already that this concentration risks well understood by Asia neighbors, esp the North Asians such as Japanese, Taiwanese, and South Korea. They deployed capital to China to take advantage of CHEAP LABOR & big MARKETS but then both got tough.

As labor costs rise in China & policy less favorable as China moves up the value chain & China flexes its SOFT power via geopolitical conflicts (think past incidences), these firms DEPLOYED MORE CAPITAL TO SOUTHEAST ASIA, esp Vietnam.

So below is the stock of FDI 👇🏻👇🏻👇🏻

So below is the stock of FDI 👇🏻👇🏻👇🏻

So this strategy captures 3 components: cheaper labor, diversification from China concentration risks (think geopolitics & trade-war), & access to growing markets.

So what? Good for Vietnam et al but the virus reveals cracks in the model: TOO MUCH DEPENDENCY ON CHINESE INPUTS

So what? Good for Vietnam et al but the virus reveals cracks in the model: TOO MUCH DEPENDENCY ON CHINESE INPUTS

You can see that b/c in China there is a LABOR SHORTAGE & so there is a PRODUCTION SHORTAGE & so there is a SUPPLY CHAIN DISRUPTION for those that needs the imported parts from China.

Okay, who are these people & HOW LARGE AS A SHARE OF GDP? 👇🏻👇🏻👇🏻 Massive for Vietnam & Malaysia

Okay, who are these people & HOW LARGE AS A SHARE OF GDP? 👇🏻👇🏻👇🏻 Massive for Vietnam & Malaysia

But if u think that it is only the Southeast Asian affected by supply chain (as a share of GDP may be large for Vietnam but Japan GDP is massive so on a LEVEL BASIS the impact is higher for Japan).

Okay, but who owns these Southeast Asian electronic & textile production firms???

Okay, but who owns these Southeast Asian electronic & textile production firms???

Well, well, well the North Asia firms (Japanese, Taiwanese, and South Korea). Okay, what do they do? Some make parts & some ASSEMBLE final products for MAJOR ELECTRONIC BRANDS.

OK, think Samsung Electronics, Apple, etc. So the disruption from China goes regional & then GLOBAL.

OK, think Samsung Electronics, Apple, etc. So the disruption from China goes regional & then GLOBAL.

So that's how supply chain works. U look at the trade & investment & ownership. Note that I have only talked about supply chain. Haven't NOT TOUCHED DEMAND. Btw, I'm staring at beautiful clear blue sky in Hong Kong (unprecedented) & so proxy for lower production in the Mainland.

Here is the podcast by @natixis & I quote myself:

"If you think trade-war made global supply chain sexy, then well the corona virus is gonna make it SEXIER 😉."

"If you think trade-war made global supply chain sexy, then well the corona virus is gonna make it SEXIER 😉."

https://twitter.com/natixis/status/1230432682699624450?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh