…

... not necessarily in terms of rate cuts, but in terms of adding liquidity.”

are not for everyone. A lot can go wrong with the system’s immune system..."

Translation: They are not money.

Just in case you are really, really slow.

Remember all those oversubscribed TOMO's, anyone...?

(Since September, not January, BTW.)

…

"As banks hoard the highest form of liquidity – reserves – the periphery will come knocking for liquidity. Now’s not the time to end QE. It’s time to lean in… "

But they don't realise that the Fed SHOULD NOT, really, just monetise.

It's like saying "this stock is rising - you absolutely have to put together an offering immediately, because it's not working for me as a result of the gigantic short I have on".

Capitalism when I'm winning, Socialism when I'm not.

Know wot ah mean..?

All I am saying is all that I ever seem to have been saying.

Namely: only base money ("bank reserves" + "notes and coin") is [public] money. All else is [private credit". (With thanks for J.P.Morgan)

Seriously. Fuck right off.

You made it.

Deal with it.

FUCK OFF.

And you're certainly not doing it now as it's just catching on fire and you're demanding everyone else build a pipeline and divert all the water on earth to reverse your stupid mistake.

BURN.

Except. Get this. It won't get to that level, because these people WILL get what they want well before that.

(Apologies to all those who enjoy these outbursts.)

nyfed.org/2v5MGnk

Don't worry my lil pups, we will save you from this HUGE BONFIRE YOU BUILT! 😕

Yeah - coz it's only Corona init. It'll be over in a minit.

Pedals ready.

G…

#WeWatch…

But, hey. they can't be 100% right eh?

Oh, wait. It was.

Well, I don’t know about you but I’m shocked. And completely surprised.

No, number not go down.

bit.ly/2TL6jcI

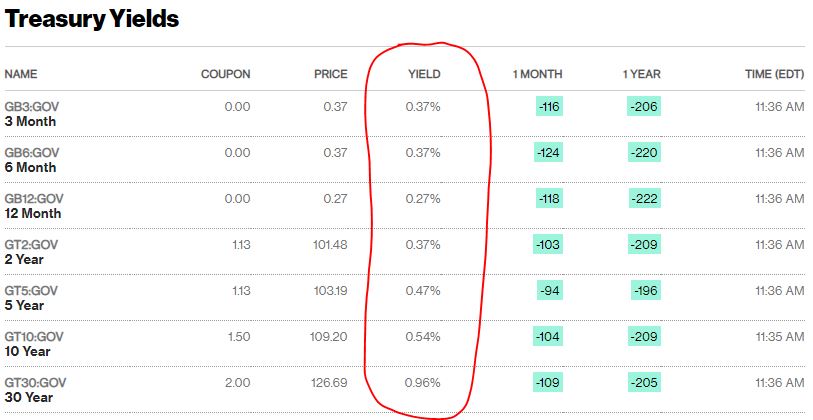

So let's go with the Bloomview instead I guess… [bloom.bg/2Q134wz]

bloom.bg/2TAlKp9

Not "gold". But PHYSICAL gold. 👌

"Foreign investors" are not stupid. They know "gold" is worthless -- after all… they create and sell it, right? So who would know better than them..? 😉

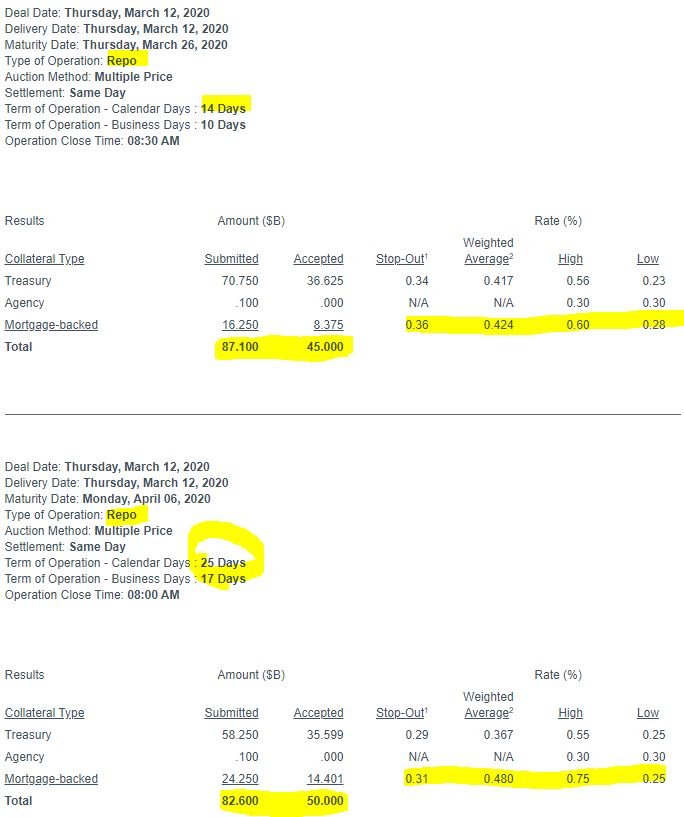

I can no longer get all of the RP/RRP operations for the day onto a single screenshot for you.

DON'T THESE PEOPLE EVER THINK OF ANYONE BUT THEMSELVES?!?

I'm a busy person (contrary to appearances I'm sure).

DON'T THEY REALISE I DON'T HAVE MORE TIME BECAUSE OF THIS CRISIS - LIKE THEM I HAVE LESS AS A RESULT OF IT?!?

#SoInconvenient #SoSelfish

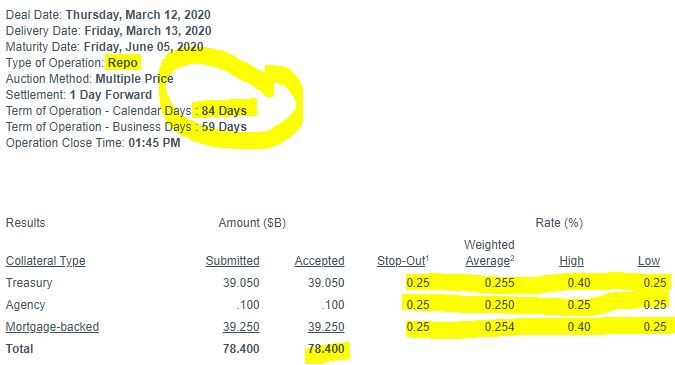

1) The rates on the longer term ops vs short.

2) Surprising (to me) there was not a much bigger number on the term ops.

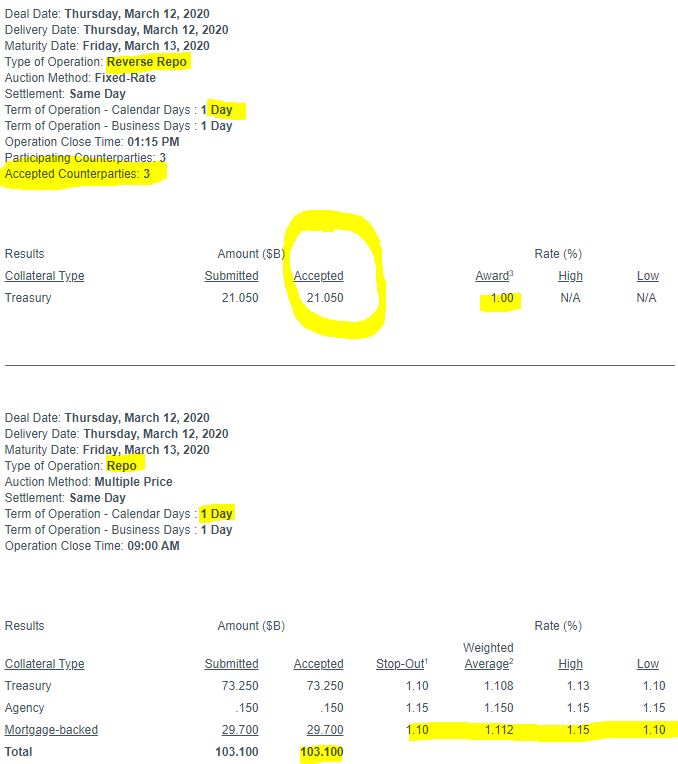

3) check that RRP size & number of participants.

#WeWatch…

Yeah. Shur.

IT'S ALL JUST THE VIRUS GOYZ! 😉👍

Oh, you betcha. How could they not hear the roar?

But they just are not omnipotent after all. Who knew....? 🤷♂️

For the US.

And "its" dollar.

bit.ly/2Upbuk5

And on the other we watch the market come to the Fed in increasing size for HQLA vs dawlarz they don't have a better use for.

YOU DECIDE!

😎👌

🥇

<over a fifth of a trillion dawleurs disappears, replacced with HQLA that is what's really needed and is busy stinkin up the Fed's balance sheet anyway 🙌>

Because nobody likes money, they only want Tbills. 👍

But then you remember…

Only a member bank has or can have base USD, aside from a stinkin vault full of illiquid green paper stacks that I'm too sophisticated for!!!!11

(Spoiler: they're not)

And the G-SIBs (many of whom also cannot hold base USDs at the Fed BTW) keep Tbills as their "100% HQLA" reserves.

#FedGoSleepyByebyeTimeNow

(a) that the Eurodollar banks are being satisfied now by their local Central Banks, so the problem is not showing up in the Fed programs, but is still there.

(b) that there is insufficient lending by Eurodollar G-SIBs, to satisfy the demand for "cash".

And …

#CapitalismFTW!!!!11

Because the US and global economy just can't tolerate that strong of a USD.

Everyone's a winner, right?

WRONG. Everyone is a loser really.

#FreemarketFTW???1111

The solution is for the imbalances to be cleared with real goods (eg: gold bullion -- as is tradition), which resolves Triffin's dilemma.

Money was always fiat and tokens of credit.

All the fixed exchange rate for gold did, was give the illusion that all savers of the tokens could have gold if they just asked for it.

But the tradition is alive and well all this time. Just without the commitment to exchange at a fixed price.

And the in-your-face obviousness.

But the consequences of not thinking, are on them.