Guys!!!! Good morning!!! Go buy the print version of the @FT today 🤗🤷🏻♀️! Somebody u know is in it 🙋🏻♀️🙋🏻♀️🙋🏻♀️🙈🤓😎🧐 📰 🗞 👇🏻👇🏻👇🏻👇🏻

https://twitter.com/bmclannahan/status/1239580134547623938

And leaders are starting to drop the F bomb - FISCAL 👇🏻:

New Zealand announces virus package worth 4% of GDP 🇳🇿🐏🐮🐄🥛.

New Zealand announces virus package worth 4% of GDP 🇳🇿🐏🐮🐄🥛.

During GFC, China spent 9.7% of GDP and so the equivalent of that today would have to be USD1.4trn.

Yep, the F bomb is going to be dropped everywhere, starting w/ New Zealand (other economies did tiny lil ones, as terms of share of GDP)🇳🇿🐄🐮🐏🥛💥💥💥

Yep, the F bomb is going to be dropped everywhere, starting w/ New Zealand (other economies did tiny lil ones, as terms of share of GDP)🇳🇿🐄🐮🐏🥛💥💥💥

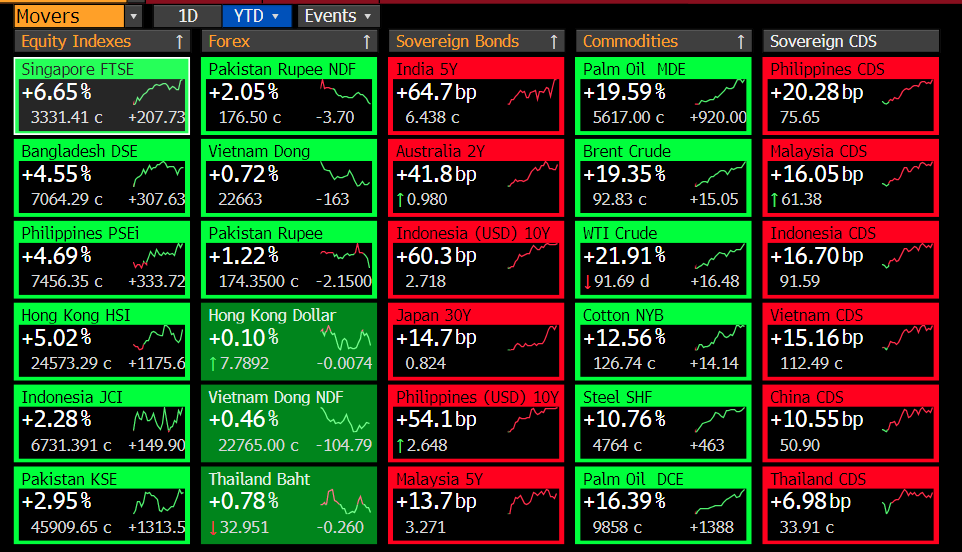

The Philippines not only closes its stock market but also now suspends FX trading from today.

That's one way to deal w/ the liquidity issue 😬👌🏻.

That's one way to deal w/ the liquidity issue 😬👌🏻.

Got dollars??? The fed may have supplied markets w/ cheap USD & also extended swap lines to developed markets but emerging markets need more access to the dollar!!!

"The supply of liquidity by CBs is beneficial only to those who can access it," said @Trinhnomics in the @FT 👌🏻😬

"The supply of liquidity by CBs is beneficial only to those who can access it," said @Trinhnomics in the @FT 👌🏻😬

Credit squeeze is getting to the IDR (Indonesian rupiah) as it got plenty of dollar debt & funds itself via portfolio investment. This is an opportunity for Jokowi to implement deep reforms!!! It needs stick flows. No way to fund a national development strategy w/ volatile flows!

The great rebalancing - Australians living more within their means. As the AUD weakens (most in Asia & will squeeze imports & help exports), the current account is turning from a negative to positive one.

So FX is a great absorber, well, unless u committed the original sin 😬😬

So FX is a great absorber, well, unless u committed the original sin 😬😬

• • •

Missing some Tweet in this thread? You can try to

force a refresh