Sovereign Credit Risk is on the rise, where are the opportunities?

We’re hosting a call with @ACGAnalytics at 2pm ET, inquiries here

thebeartrapsreport.com

We’re hosting a call with @ACGAnalytics at 2pm ET, inquiries here

thebeartrapsreport.com

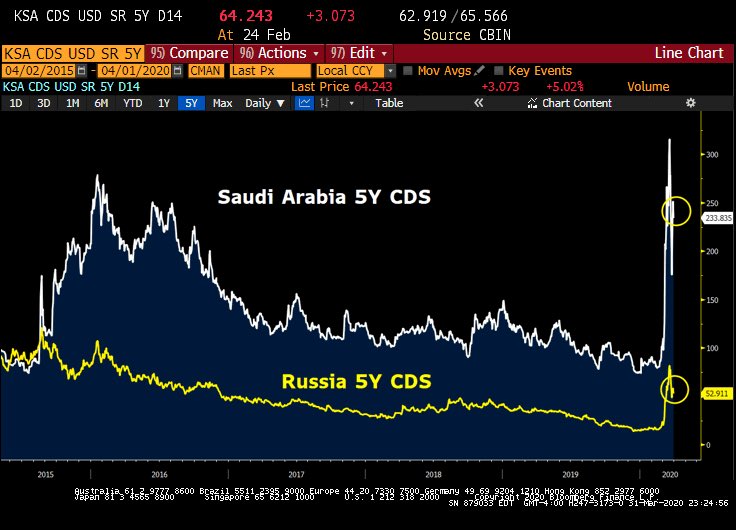

Hosted a solid client call, meaningful takeaways covering political implications for oil prices, Saudi / Russia EM Credit risk and the IMF's heavy load.

*IEA SAYS OPEC+ 10M B/D CUT NOT ENOUGH TO STABILIZE OIL MARKET

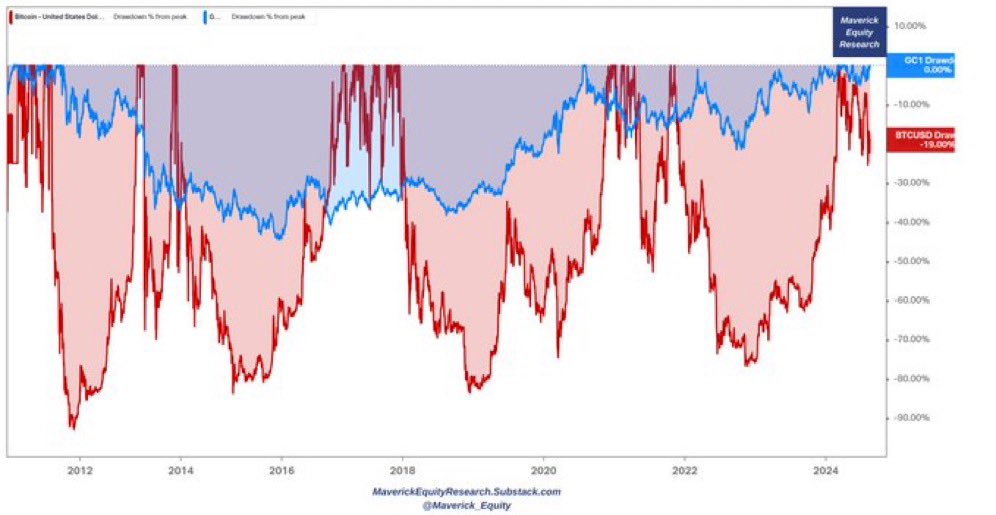

Two sides to every story, one large reason why KSA and Russia have had enough. Bottom line, there are lots of debts and leverage on all sides - coupons to be paid. So far, pumping has been the only solution to fend off a large default cycle.

#SaudiArabia

#MBS

#Oil

#Shale

#SaudiArabia

#MBS

#Oil

#Shale

*RUSSIA IS READY TO CUT PRODUCTION BY 1.6M/BBL A DAY: TASS

• • •

Missing some Tweet in this thread? You can try to

force a refresh